REAL TIME PRICE

EXTENDED HOURS

| Day’s Range | - |

| 52 Week Range | - |

| Industrial and Commercial... | |

Donaldson (DCI) Price Target Increased by 10.09% to 73.44

The average one-year price target for Donaldson (NYSE:DCI) has been revised to 73.44 / share. This is an increase of 10.09% from the prior estimate of 66.71 dated February 21, 2024.

The price target is an average of many targets provided by analysts. The latest targets range from a low of 59.59 to a high of 80.85 / share. The average price target represents an increase of 1.25% from the latest reported closing price of 72.53 / share.

Donaldson Declares $0.25 Dividend

On January 25, 2024 the company declared a regular quarterly dividend of $0.25 per share ($1.00 annualized). Shareholders of record as of February 12, 2024 received the payment on February 28, 2024. Previously, the company paid $0.25 per share.

At the current share price of $72.53 / share, the stock's dividend yield is 1.38%.

Looking back five years and taking a sample every week, the average dividend yield has been 1.59%, the lowest has been 1.27%, and the highest has been 2.53%. The standard deviation of yields is 0.18 (n=232).

The current dividend yield is 1.20 standard deviations below the historical average.

Additionally, the company's dividend payout ratio is 0.32. The payout ratio tells us how much of a company's income is paid out in dividends. A payout ratio of one (1.0) means 100% of the company's income is paid in a dividend. A payout ratio greater than one means the company is dipping into savings in order to maintain its dividend - not a healthy situation. Companies with few growth prospects are expected to pay out most of their income in dividends, which typically means a payout ratio between 0.5 and 1.0. Companies with good growth prospects are expected to retain some earnings in order to invest in those growth prospects, which translates to a payout ratio of zero to 0.5.

The company's 3-Year dividend growth rate is 0.19%, demonstrating that it has increased its dividend over time.

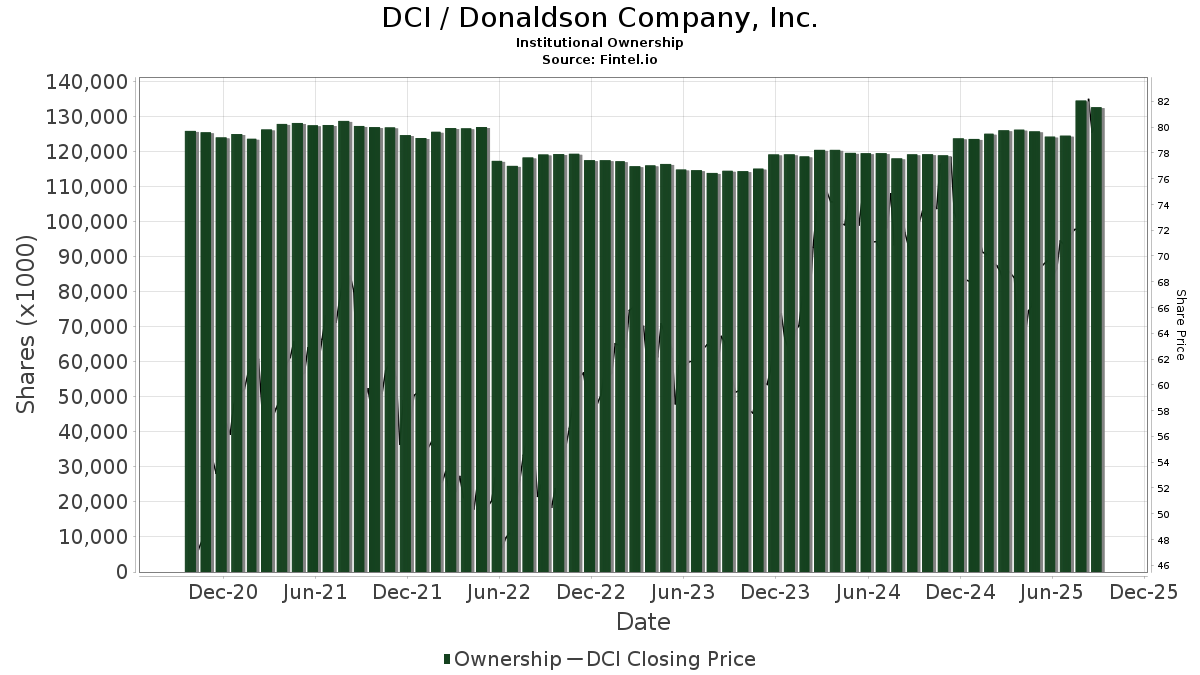

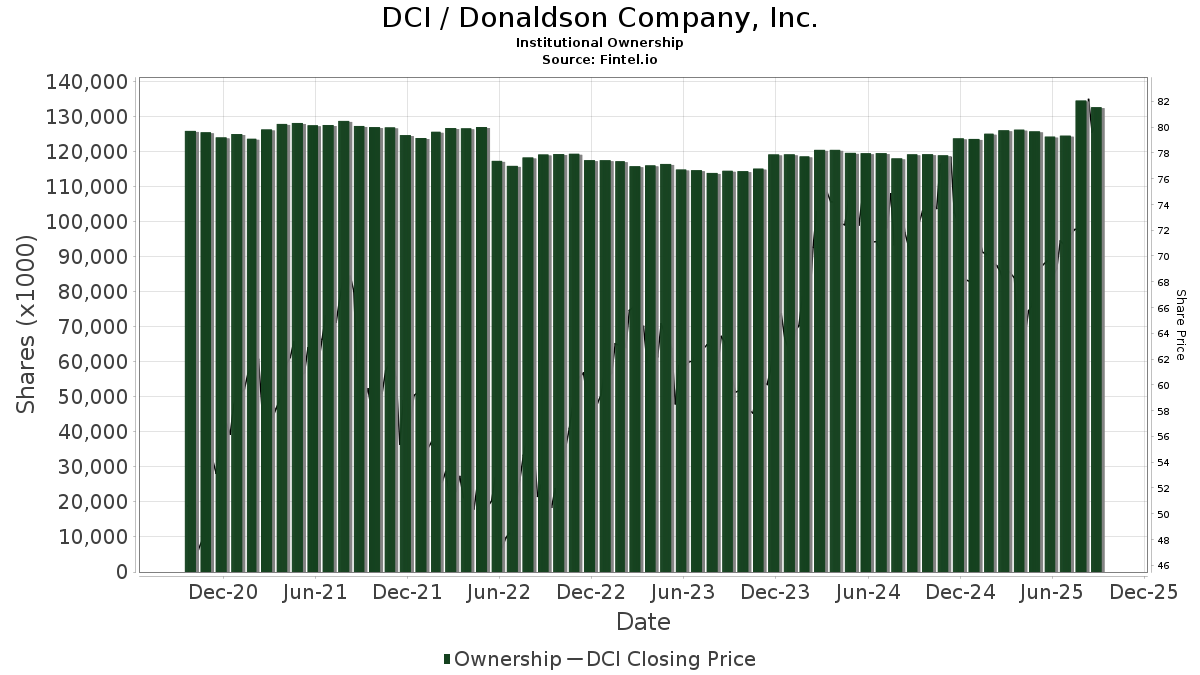

What is the Fund Sentiment?

There are 924 funds or institutions reporting positions in Donaldson.

This is an increase

of

28

owner(s) or 3.12% in the last quarter.

Average portfolio weight of all funds dedicated to DCI is 0.18%,

an increase

of 0.47%.

Total shares owned by institutions increased

in the last three months by 1.13% to 120,478K shares.

The put/call ratio of DCI is 1.44, indicating a

bearish

outlook.

The put/call ratio of DCI is 1.44, indicating a

bearish

outlook.

What are Other Shareholders Doing?

State Farm Mutual Automobile Insurance holds 9,564K shares representing 7.95% ownership of the company. In it's prior filing, the firm reported owning 10,089K shares, representing a decrease of 5.49%. The firm decreased its portfolio allocation in DCI by 0.69% over the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 3,800K shares representing 3.16% ownership of the company. In it's prior filing, the firm reported owning 3,801K shares, representing a decrease of 0.03%. The firm decreased its portfolio allocation in DCI by 2.12% over the last quarter.

IJH - iShares Core S&P Mid-Cap ETF holds 3,664K shares representing 3.04% ownership of the company. In it's prior filing, the firm reported owning 3,789K shares, representing a decrease of 3.43%. The firm decreased its portfolio allocation in DCI by 2.10% over the last quarter.

NAESX - Vanguard Small-Cap Index Fund Investor Shares holds 3,070K shares representing 2.55% ownership of the company. In it's prior filing, the firm reported owning 3,120K shares, representing a decrease of 1.62%. The firm decreased its portfolio allocation in DCI by 5.28% over the last quarter.

Franklin Resources holds 2,844K shares representing 2.36% ownership of the company. In it's prior filing, the firm reported owning 2,848K shares, representing a decrease of 0.15%. The firm decreased its portfolio allocation in DCI by 77.32% over the last quarter.

Donaldson Background Information

(This description is provided by the company.)

ounded in 1915, Donaldson is a global leader in technology-led filtration products and solutions, serving a broad range of industries and advanced markets. Our diverse, skilled employees at over 140 locations on six continents partner with customers-from small business owners to the world's biggest OE brands-to solve complex filtration challenges.

Stories by George Maybach

Scotiabank Initiates Coverage of Qualys (QLYS) with Sector Perform Recommendation

Fintel reports that on April 26, 2024, Scotiabank initiated coverage of Qualys (NasdaqGS:QLYS) with a Sector Perform recommendation.

Wells Fargo Upgrades Visteon (VC)

Fintel reports that on April 26, 2024, Wells Fargo upgraded their outlook for Visteon (NasdaqGS:VC) from Underweight to Equal-Weight.

Deutsche Bank Downgrades Boyd Gaming (BYD)

Fintel reports that on April 26, 2024, Deutsche Bank downgraded their outlook for Boyd Gaming (NYSE:BYD) from Buy to Hold.

Morgan Stanley Downgrades Mobileye Global (MBLY)

Fintel reports that on April 26, 2024, Morgan Stanley downgraded their outlook for Mobileye Global (NasdaqGS:MBLY) from Equal-Weight to Underweight.

JP Morgan Upgrades Dow (DOW)

Fintel reports that on April 26, 2024, JP Morgan upgraded their outlook for Dow (NYSE:DOW) from Neutral to Overweight.

Stifel Upgrades LeMaitre Vascular (LMAT)

Fintel reports that on April 26, 2024, Stifel upgraded their outlook for LeMaitre Vascular (NasdaqGM:LMAT) from Hold to Buy.

B of A Securities Downgrades Teledyne Technologies (TDY)

Fintel reports that on April 26, 2024, B of A Securities downgraded their outlook for Teledyne Technologies (NYSE:TDY) from Buy to Neutral.

DA Davidson Initiates Coverage of Napco Security Technologies (NSSC) with Buy Recommendation

Fintel reports that on April 26, 2024, DA Davidson initiated coverage of Napco Security Technologies (NasdaqGS:NSSC) with a Buy recommendation.

Morgan Stanley Downgrades Envista Holdings (NVST)

Fintel reports that on April 26, 2024, Morgan Stanley downgraded their outlook for Envista Holdings (NYSE:NVST) from Overweight to Equal-Weight.

B of A Securities Downgrades Hertz Global Holdings (HTZ)

Fintel reports that on April 26, 2024, B of A Securities downgraded their outlook for Hertz Global Holdings (NasdaqGS:HTZ) from Neutral to Underperform.