Can You Imagine How Jubilant Limbach Holdings' (NASDAQ:LMB) Shareholders Feel About Its 144% Share Price Gain?

When you buy shares in a company, there is always a risk that the price drops to zero. But if you pick the right business to buy shares in, you can make more than you can lose. For example, the Limbach Holdings, Inc. (NASDAQ:LMB) share price had more than doubled in just one year - up 144%. We note the stock price is up 3.9% in the last seven days. On the other hand, longer term shareholders have had a tougher run, with the stock falling 18% in three years.

Check out our latest analysis for Limbach Holdings

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Limbach Holdings went from making a loss to reporting a profit, in the last year.

When a company has just transitioned to profitability, earnings per share growth is not always the best way to look at the share price action.

Revenue was pretty flat year on year, but maybe a closer look at the data can explain the market optimism.

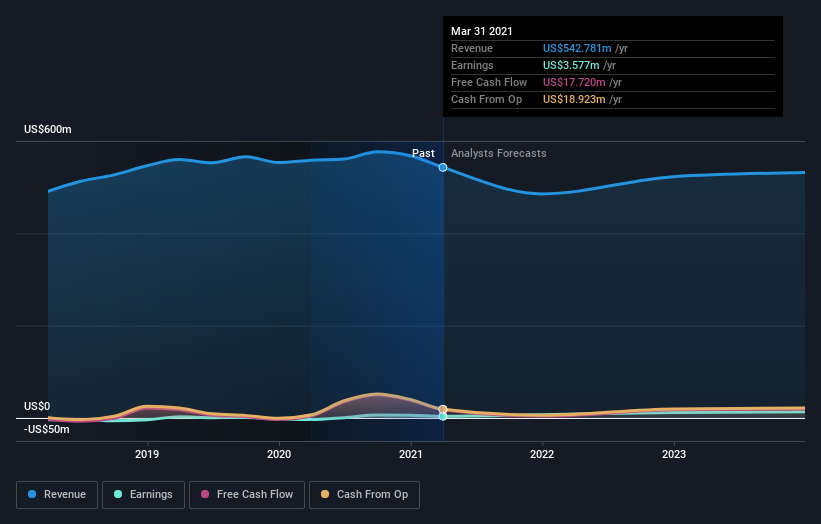

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. You can see what analysts are predicting for Limbach Holdings in this interactive graph of future profit estimates.

A Different Perspective

It's good to see that Limbach Holdings has rewarded shareholders with a total shareholder return of 144% in the last twelve months. That's better than the annualised return of 3% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Limbach Holdings better, we need to consider many other factors. Take risks, for example - Limbach Holdings has 4 warning signs we think you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.