Conformis (CFMS) to Post Q3 Earnings: What's in the Offing?

Conformis, Inc. CFMS is scheduled to release third-quarter 2021 results on Nov 3, after the market closes. In the last reported quarter, the company delivered an earnings surprise of 162.5%. It beat estimates in three of the trailing four quarters and missed once, the average surprise being 50.6%.

Q3 Estimates

Currently, the Zacks Consensus Estimate for third-quarter revenues is pegged at $14.1 million, suggesting a decline of 12.7% from the year-ago reported figure. The consensus mark for the bottom line stands at a loss of 7 cents.

Factors to Note

Conformis is likely to have witnessed revenue growth in the third quarter backed by improved procedural levels.

Apart from this, the company saw sequential improvement in its core products (beneficial for its expanded product portfolio) in the second quarter of 2021 and this momentum is likely to have continued in the to-be-reported quarter as well.

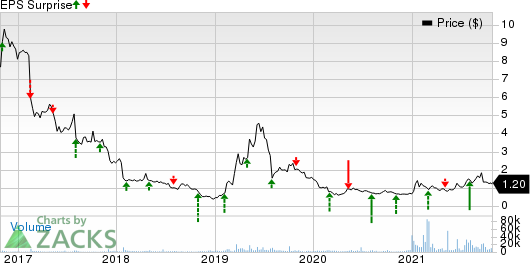

ConforMIS, Inc. Price and EPS Surprise

ConforMIS, Inc. price-eps-surprise | ConforMIS, Inc. Quote

In the second quarter, Conformis Hip System revenues witnessed significant growth, with sustained interest from current and new surgeons for its Cordera Match Hip System. The new system has been built to offer flexibility to surgeons by allowing both anterior and posterior surgical approach. Hence, Conformis Hip System third-quarter revenues are likely to reflect gains from the improving trend and new system.

In September, the company announced solid and encouraging results of a published retrospective study of procedures utilizing Conformis’ patient-specific iTotal CR (cruciate-retaining) knee replacement implant that assessed implant survivorship, patient satisfaction, and functional outcomes.

In August, Conformis announced the first procedure that was performed utilizing the Identity Imprint knee replacement system (received regulatory clearance in May).

These developments are likely to have positively impacted the company’s performance in the third quarter.

What Our Quantitative Model Suggests

Per our proven model, a combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. This is not the case here as you will see.

Earnings ESP: Conformis has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: The company carries a Zacks Rank #3.

Stocks Worth a Look

Here are some medical stocks worth considering as these have the right combination of elements to post an earnings beat this quarter.

Insulet Corporation PODD has an Earnings ESP of +15.79% and a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Canopy Growth Corporation CGC has an Earnings ESP of +26.83% and a Zacks Rank of 3.

Cardiovascular Systems, Inc. CSII has an Earnings ESP of +24.59% and a Zacks Rank of 3.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Insulet Corporation (PODD) : Free Stock Analysis Report

Cardiovascular Systems, Inc. (CSII) : Free Stock Analysis Report

ConforMIS, Inc. (CFMS) : Free Stock Analysis Report

Canopy Growth Corporation (CGC) : Free Stock Analysis Report

To read this article on Zacks.com click here.