Ciena (CIEN) Expands Portfolio With Tibit & Benu Acquisitions

Ciena Corporation CIEN has announced an agreement to acquire California-based Tibit Communications. Also, the company announced that it has acquired Benu Networks.

The buyouts will increase the company's capacity to support clients' metro and edge strategies and cope with increased investments made by service providers to update and boost network connectivity.

Tibit integrates Passive Optical Network (PON)-specific hardware and OS into a micro pluggable transceiver, which is then integrated into a carrier-grade Ethernet switch. The company’s microplug OLT technology allows faster deployment of PON in any environment

Ciena Corporation Price and Consensus

Ciena Corporation price-consensus-chart | Ciena Corporation Quote

Per a report from ReseachAndMarkets, the global PON market was estimated at $13.1 billion in 2020 and is expected to reach $45.9 billion by 2027 at a CAGR of 19.6% over 2020-2027.

Ciena will target the international PON market and support residential, commercial, and mobile use cases, including 10G XGS-PON with delivery channels for 25G and higher PON going ahead.

Ciena is Tibit’s largest shareholder and will pay $210 million in cash to acquire the remaining shares of the company. The acquisition, subject to customary conditions, is expected to close in the first quarter of fiscal 2023. Also, the company has entered into an employee retention arrangement with Tibit.

Further, the acquisition of Benu will complement Ciena’s current portfolio of solutions for broadband access use cases, such as residential broadband, enterprise business services, and fixed-wireless access. Benu specializes in cloud-native software solutions, including a virtual Broadband Network Gateway. The company’s acquisition of Benu was completed in the first quarter of fiscal 2023.

Benu will enable Ciena to offer a single solution that combines routing, OLT, subscriber management and network services, which will lower capital and operational costs and enhance sustainability for clients.

CIEN is a leading provider of optical networking equipment, software and services. The increasing cloud adoption, rising demand for higher capacity and bandwidth and proliferation of edge applications drive demand for its diversified product portfolio.

Owing to the prevailing supply-chain woes and global macroeconomic uncertainty, the company provided muted revenue outlook for the fiscal fourth quarter. For the quarter, the company expects revenues of $800-$880 million. The Zacks Consensus Estimate for revenues is pegged at $851.5 million, down 18.2% year over year.

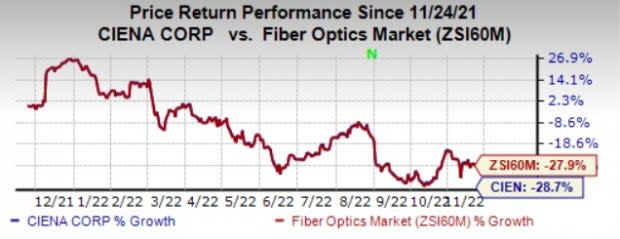

CIEN currently carries a Zacks Rank #4 (Sell). Shares of the company have lost 28.7% compared with the sub-industry’s decline of 27.9% in the past year.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the broader technology space are Arista Networks ANET, Plexus PLXS and Jabil JBL, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Arista Networks 2022 earnings is pegged at $4.35 per share, up 7.7% in the past 60 days. The long-term earnings growth rate is anticipated to be 17.5%.

Arista Networks’ earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 12.7%. Shares of ANET have increased 5.1% in the past year.

The Zacks Consensus Estimate for Plexus 2023 earnings is pegged at $5.98 per share, rising 8.9% in the past 60 days.

Plexus’ earnings beat the Zacks Consensus Estimate in three of the last four quarters, the average being 17.5%. Shares of PLXS have increased 18.4% in the past year.

The Zacks Consensus Estimate for Jabil’s fiscal 2023 earnings is pegged at $8.18 per share, rising 4.1 in the past 60 days. The long-term earnings growth rate is anticipated to be 12%.

Jabil’s earnings beat the Zacks Consensus Estimate in three of the last four quarters, the average being 9.3%. Shares of JBL have increased 11.2% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ciena Corporation (CIEN) : Free Stock Analysis Report

Plexus Corp. (PLXS) : Free Stock Analysis Report

Jabil, Inc. (JBL) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report