Sanofi's (SNY) Dupixent Meets Goal in Pivotal COPD Study

Sanofi SNY and partner Regeneron REGN announced positive data from the pivotal phase III BOREAS study, which evaluated their blockbuster drug, Dupixent (dupilumab), for treating chronic obstructive pulmonary disease (COPD) in adults aged 40 through 80 years.

The study achieved both its primary and secondary endpoints. Data from the BOREAS study showed that Dupixent, when added to maximal standard-of-care inhaled therapy, achieved a 30% reduction in moderate or severe acute COPD exacerbations — the primary endpoint — over a 52-week treatment period, against placebo. Treatment with the drug also led to improved lung function, quality of life and reduction in disease symptoms.

Dupixent is currently approved in the United States and EU for five type II inflammatory diseases, namely severe chronic rhinosinusitis with nasal polyposis, severe asthma, moderate-to-severe atopic dermatitis, eosinophilic esophagitis and prurigo nodularis.

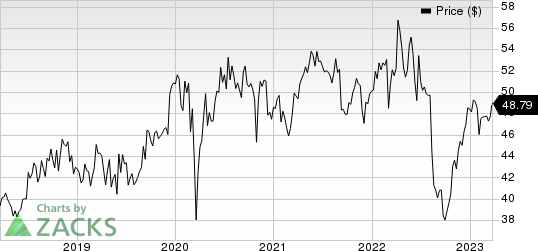

Shares of Sanofi have gained 0.7% in the year so far against the industry’s 7.6% fall.

Image Source: Zacks Investment Research

Dupixent is being jointly marketed by Regeneron and Sanofi under a global collaboration agreement. Sanofi records global net product sales of Dupixent, while Regeneron records its share of profits/losses in connection with the global sales of the drug.

COPD is a life-threatening respiratory disease that damages the lungs and causes progressive lung function decline. Smoking is also a key risk factor for COPD. The disease is the third leading cause of death worldwide. Management estimates that around 300,000 people are living with uncontrolled COPD with type II inflammation in the United States. Currently, there are limited treatment options for COPD patients. In fact, no novel treatments have been approved targeting this indication in more than a decade.

An approval for Dupixent in COPD indication will drive the drug’s sales higher.

Apart from the BOREAS study, Sanofi and Regeneron are also evaluating the drug in COPD indication in an ongoing second replicate phase III study (NOTUS). Data from the same is expected next year.

Dupixent has become the key driver of the top line for Sanofi. Dupixent generated global product sales of $8.3 billion in 2022, which were recorded by Sanofi, representing growth of 43.8% at a constant exchange rate. With outside U.S. revenues accelerating and multiple approvals for new indications and expansion in younger patient populations expected, its sales are likely to be higher.

Dupixent is now annualizing at close to €9.0 billion in sales after around five years on the market. Sanofi expects Dupixent to achieve more than €13 billion in peak sales and €10 billion in 2023.

Sanofi and Regeneron are also studying dupilumab in late-stage studies in a broad range of diseases driven by type II inflammation, like bullous pemphigoid and chronic spontaneous urticaria.

Sanofi Price

Sanofi price | Sanofi Quote

Zacks Rank & Stocks to Consider

Sanofi currently carries a Zacks Rank #3 (Hold).A couple of better-ranked stocks in the overall healthcare sector are Adaptive Biotechnologies Corporation ADPT and Atara Biotherapeutics ATRA, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Estimates for Adaptive Biotechnologies’ 2023 loss per share narrowed from $1.20 to $1.15 in the past 30 days. During the same period, the loss per share estimates for 2024narrowed from 99 cents to 94 cents. Shares of Adaptive Biotechnologies have risen 3.8% year-to-date.

Earnings of Adaptive Biotechnologies beat estimates in three of the last four quarters and missed the mark on one occasion, the average surprise being 10.75%. In the last reported quarter, ADPT delivered an earnings surprise of 24.32%.

In the past 30 days, estimates for Atara Biotherapeutics’ 2023 loss per share have narrowed from $2.28 to $2.17. During the same period, the loss per share estimates for 2024 narrowed from $1.81 to $1.62. Shares of Atara Biotherapeutics have declined 12.5% in the year-to-date period.

Earnings of Atara Biotherapeutics beat estimates in two of the last four quarters while missing the mark on the other two occasions, witnessing an earnings surprise of 13.50%, on average. In the last reported quarter, Atara Biotherapeutics’ earnings missed estimates by 18.03%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Regeneron Pharmaceuticals, Inc. (REGN) : Free Stock Analysis Report

Sanofi (SNY) : Free Stock Analysis Report

Adaptive Biotechnologies Corporation (ADPT) : Free Stock Analysis Report

Atara Biotherapeutics, Inc. (ATRA) : Free Stock Analysis Report