REAL TIME PRICE

EXTENDED HOURS

| Day’s Range | - |

| 52 Week Range | - |

SoftBank (SFBQF) Price Target Increased by 16.55% to 12.68

The average one-year price target for SoftBank (OTC:SFBQF) has been revised to 12.68 / share. This is an increase of 16.55% from the prior estimate of 10.88 dated August 31, 2023.

The price target is an average of many targets provided by analysts. The latest targets range from a low of 10.80 to a high of 17.21 / share. The average price target represents an increase of 1.74% from the latest reported closing price of 12.46 / share.

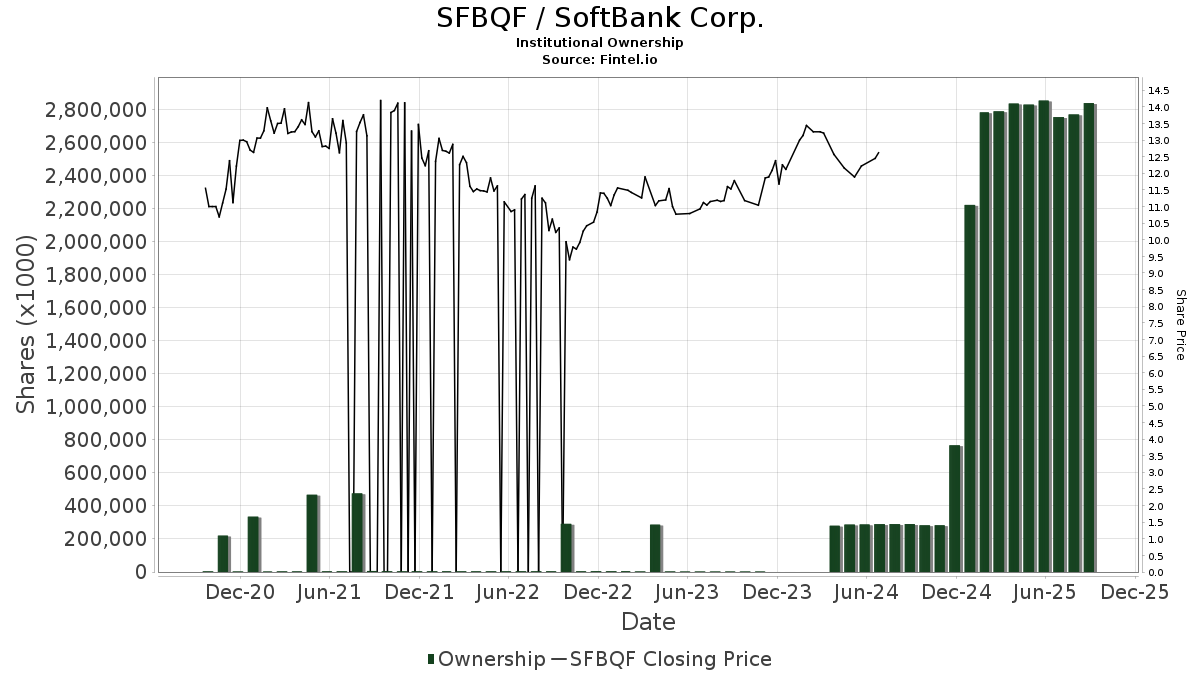

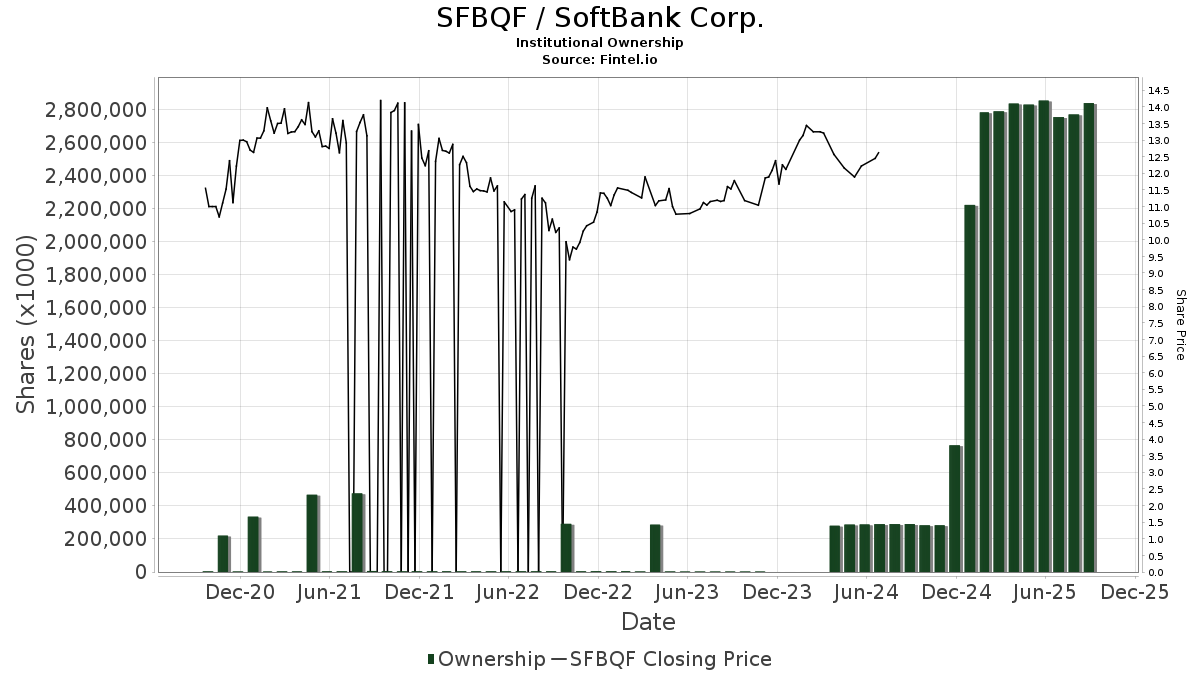

What is the Fund Sentiment?

There are 9 funds or institutions reporting positions in SoftBank. This is unchanged over the last quarter. Average portfolio weight of all funds dedicated to SFBQF is 0.00%, a decrease of 93.35%. Total shares owned by institutions decreased in the last three months by 98.29% to 51K shares.

What are Other Shareholders Doing?

Rhumbline Advisers holds 20K shares. In it's prior filing, the firm reported owning 19K shares, representing an increase of 1.76%. The firm increased its portfolio allocation in SFBQF by 12.72% over the last quarter.

Boston Private Wealth holds 13K shares. In it's prior filing, the firm reported owning 11K shares, representing an increase of 17.35%. The firm increased its portfolio allocation in SFBQF by 56.87% over the last quarter.

RMEAX - Aspiriant Risk-Managed Equity Allocation Fund Advisor Shares holds 6K shares.

Pnc Financial Services Group holds 4K shares. In it's prior filing, the firm reported owning 3K shares, representing an increase of 33.10%. The firm decreased its portfolio allocation in SFBQF by 67.14% over the last quarter.

Russell Investments Group holds 4K shares. In it's prior filing, the firm reported owning 1K shares, representing an increase of 77.31%. The firm decreased its portfolio allocation in SFBQF by 24.08% over the last quarter.

Stories by George Maybach

Goldman Sachs Upgrades CG Oncology (CGON)

Fintel reports that on May 14, 2024, Goldman Sachs upgraded their outlook for CG Oncology (NasdaqGS:CGON) from Neutral to Buy.

Stephens & Co. Initiates Coverage of Delcath Systems (DCTH) with Overweight Recommendation

Fintel reports that on May 14, 2024, Stephens & Co.

Jefferies Upgrades Boston Beer (SAM)

Fintel reports that on May 14, 2024, Jefferies upgraded their outlook for Boston Beer (NYSE:SAM) from Hold to Buy.

Stephens & Co. Initiates Coverage of Elevation Oncology (ELEV) with Overweight Recommendation

Fintel reports that on May 14, 2024, Stephens & Co.