Phillips 66 (PSX) to Report Q2 Earnings: What's in Store?

Phillips 66 PSX is set to report second-quarter 2021 earnings before the opening bell on Aug 3.

In the previous quarter, the company reported an adjusted loss of 1.16 cents per share, narrower than the Zacks Consensus Estimate of a loss of 1.41 cents due to lower costs and expenses, and improved base oil and finished lubricant margins. Higher refining margin from Atlantic Basin/Europe also boosted the results. This was partially offset by low demand for refined products caused by the pandemic and the severe impacts of winter storms in the Gulf Coast and Central regions.

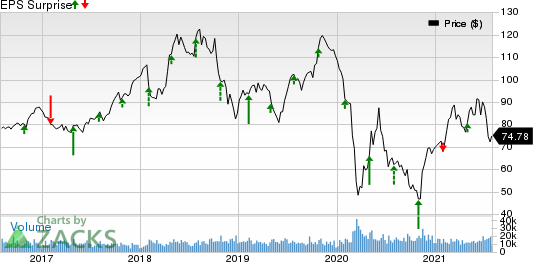

Notably, the diversified energy manufacturing and logistics company beat the Zacks Consensus Estimate in three of the previous four quarters and missed once, the average surprise being 33.8%, as shown in the chart below.

Phillips 66 Price and EPS Surprise

Phillips 66 price-eps-surprise | Phillips 66 Quote

Let’s delve into the factors that are expected to have influenced the company’s performance in the June-ended quarter.

Estimate Trend

The Zacks Consensus Estimate for the to-be-reported quarter’s earnings per share of 71 cents has witnessed four downward revisions and no upward movement in the past 30 days. The estimate suggests an increase of 196% from the year-ago reported figure.

The Zacks Consensus Estimate for second-quarter revenues of $20.6 billion indicates an increase of 84.7% from the year-ago reported figure.

Factors to Consider

Phillips 66’s second-quarter operations were affected by the soft demand for refined products due to the continuing effects of the pandemic. This is expected to get reflected in the company’s second-quarter results.

Although the overall energy demand has recovered partially, rapidly spreading new variants of coronavirus across the major economies led to renewed social-distancing measures, which hindered mobility, causing a slowdown in economic activities to restore the original consumption behavior. In certain Latin America countries, the resurgence of infections reduced the company’s exports in the second quarter.

In second-quarter 2021, its refining margin is expected to have been under pressure due to a weakness in demand for jet fuel and gasoline. The Zacks Consensus Estimate for second-quarter adjusted pre-tax loss from the Refining segment is pegged at $570 million. As the segment is a significant contributor to the overall business, a loss from the same is expected to get reflected on its second-quarter results.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for Phillips 66 this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. That is not the case here as you will see below.

Earnings ESP: The company’s Earnings ESP is -21.00%. This is because the Most Accurate Estimate is currently pegged at a profit of 56 cents per share, missing the Zacks Consensus Estimate of a profit of 71 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Phillips 66 currently carries a Zacks Rank #4 (Sell).

Stocks to Consider

Here are some companies from the Energy space that you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat in the upcoming quarterly reports:

EOG Resources, Inc. EOG has an Earnings ESP of +0.50% and it sports a Zacks Rank #1 at present. The firm is scheduled to release earnings on Aug 4. You can see the complete list of today’s Zacks #1 Rank stocks here.

Devon Energy Corporation DVN has an Earnings ESP of +0.15% and it currently flaunts a Zacks Rank of 1. It is scheduled to report second-quarter results on Aug 3.

DCP Midstream Partners, LP DCP has an Earnings ESP of +4.55% and a Zacks Rank of 2. It is scheduled to report second-quarter results on Aug 4.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Devon Energy Corporation (DVN) : Free Stock Analysis Report

EOG Resources, Inc. (EOG) : Free Stock Analysis Report

Phillips 66 (PSX) : Free Stock Analysis Report

DCP Midstream Partners, LP (DCP) : Free Stock Analysis Report

To read this article on Zacks.com click here.