inTest Corp (INTT) Delivers Record Revenue and Net Income, Aligning with Analyst Projections

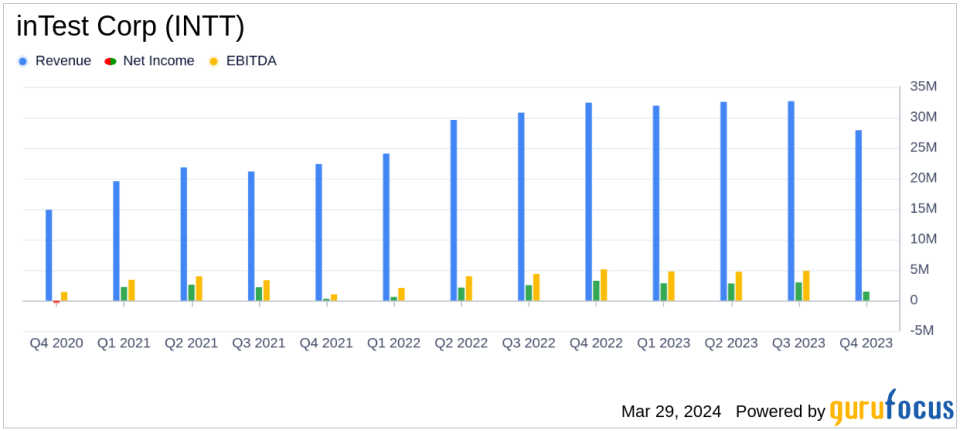

Revenue: Record $123.3 million for full year 2023, a 6% increase over the prior year.

Net Income: $9.3 million for 2023, marking the highest level in over a decade.

Earnings Per Share (EPS): $0.79 per diluted share, a 1% increase from the previous year.

Gross Margin: Expanded by 50 basis points to 46.2% for the year.

Cash and Cash Equivalents: Ended the year at $45.3 million, a substantial increase from 2022.

Backlog: Ended the fourth quarter at $40.1 million, with approximately 45% expected to ship beyond Q1 2024.

2024 Guidance: Revenue projected to be between $145 million to $155 million with gross margin between 45% to 46%.

inTest Corp (INTT) released its 8-K filing on March 27, 2024, reporting a successful fiscal year with record revenue and net income despite challenges in the semiconductor market. The company, a global supplier of test and process technology solutions for manufacturing and testing in various markets, including automotive, defense/aerospace, and semiconductor, has demonstrated strong execution of its 5-Point Strategy, leading to significant financial achievements.

Financial Performance and Challenges

For the fourth quarter of 2023, inTest Corp reported revenue of $27.9 million, a decrease of 14% from the same period in the previous year, primarily due to lower sales in the semiconductor market. However, the company saw a significant increase in sales to the industrial and defense/aerospace markets, which helped offset the semiconductor weakness. The gross margin for the quarter contracted by 160 basis points to 44.6% due to lower volume and product mix, while operating expenses increased slightly by 3.6%.

Despite these challenges, inTest Corp's full-year revenue reached a record $123.3 million, up 6% from the prior year, driven by higher sales to the defense/aerospace and industrial markets. The company's net income for the year was $9.3 million, the highest in more than a decade, and the earnings per diluted share (EPS) increased by 1% to $0.79, aligning with analyst projections of an estimated EPS of $0.1.

Strategic Achievements and Industry Importance

The company's strategic achievements, including the recent acquisition of Alfamation, have expanded its test and automation capabilities and broadened its geographic and market presence. These accomplishments are critical for a company in the semiconductor industry, which is characterized by rapid technological advancements and the need for sophisticated testing solutions.

Financial Health and Outlook

inTest Corp's financial health is underscored by its strong cash flow, with $4.7 million generated from operations in the fourth quarter and $16.2 million in 2023. The company's solid balance sheet is reflected in its cash and cash equivalents, which stood at $45.3 million at year-end, an increase facilitated by net proceeds from an equity offering. The company also reduced its total debt to $12.0 million by the end of the year.

Looking ahead, inTest Corp has provided guidance for the first quarter of 2024, expecting revenue of approximately $29 million with a gross margin of 45% to 46%. For the full year 2024, the company anticipates revenue to be between $145 million to $155 million, with gross margin remaining steady and operating expenses projected to be between $57 million to $59 million.

inTest Corp's President and CEO, Nick Grant, commented on the company's success, stating, "The effective execution of our 5-Point Strategy continues to drive strong results as we delivered a second consecutive year of record revenue while also achieving net income of $9.3 million, the highest level in more than a decade." Grant's vision for the company's growth and diversification has positioned inTest well for future success.

For a more detailed analysis of inTest Corp's financial performance, including income statements, balance sheets, and cash flow statements, investors and interested parties can access the full 8-K filing.

inTest Corp will host a conference call and webcast to further discuss its financial results and corporate strategy on March 28, 2024, at 8:30 a.m. ET.

Explore the complete 8-K earnings release (here) from inTest Corp for further details.

This article first appeared on GuruFocus.