3 Highly Ranked Energy Stocks to Buy Now

Over the last few weeks, sentiment in the energy sector has become very bearish. After Oil prices peaked back in mid-2022 at around $130 a barrel, they have been grinding lower. Most recently oil prices broke down below $70, which seemed to be a major level for many investors.

But after breaking down, oil prices have reversed higher quite aggressively, and are already back above the $70 level. It is possible that after such a long period of bullish sentiment, the oil market needed to shake the late comers before setting up another bull move higher.

Furthermore, a couple weeks ago, OPEC publicly committed to limiting production and tightening oil supply, thus putting a floor beneath the market.

Several energy stocks look to be setting up for another rally, and using the Zacks Rank, I have identified three that look particularly promising. Based on their rankings, it is likely that these stocks will outperform over the next few months.

Image Source: TradingView

Par Pacific

Par Pacific PARR manages and maintains energy and infrastructure businesses. The company's operates refining, retail, and logistics for energy assets. PARR also markets and distributes crude oil from the Western U.S. and Canada to refining hubs in the Midwest, Gulf Coast, East Coast and to Hawaii. Par Pacific was formerly known as Par Petroleum Corporation, and is headquartered in Houston, Texas.

So far this year Par Pacific has performed extremely well, even with the weakness in oil prices. PARR has considerably outperformed the industry and broad market. Over the last three years the stock is up 300%.

Image Source: Zacks Investment Research

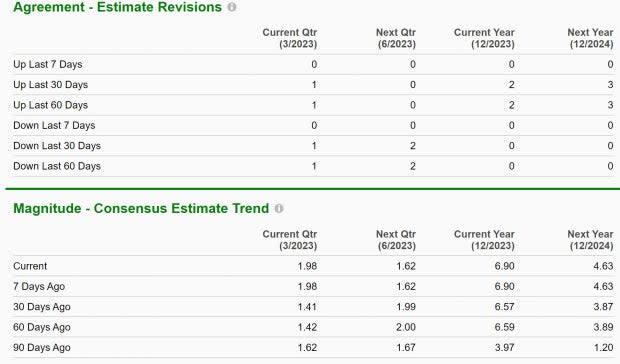

PARR is a Zacks Rank #1 (Strong Buy) stock, indicating upward trending earnings revisions. While current quarter and next quarter estimates have seen some mixed revisions, current year and next year have been upgraded significantly. Next year’s earnings have been revised higher by 286%.

Image Source: Zacks Investment Research

Parr Pacific is currently trading at a one-year forward earnings multiple of 4x, which is in line with its two-year median, and just below the industry average 5x.

Image Source: Zacks Investment Research

CVR Energy

Headquartered in Sugar Land, Texas, CVR Energy CVI is an independent refiner and marketer of high value transportation fuels such as gasoline and diesel. CVI owns and operates a coking medium-sour crude oil refinery in Kansas and a crude oil refinery in Oklahoma. The business serves retailers, railroads, farms and other refineries and marketers.

CVR Energy is currently a Zacks Rank #1 (Strong Buy) stock, indicating upward trending earnings revisions. CVI has been a strong performing stock over the last year although the upward movement has stopped since oil prices reversed last year. CVI also offers a hefty dividend yield of 6.8%.

Image Source: Zacks Investment Research

Over the next few earnings periods sales are expected to fall, but current quarter earnings are still expected to skyrocket 4,300% YoY to $0.88 per share. Over the last 60 days analysts have unanimously revised earnings higher across all reporting periods. Current year earnings expectations have nearly doubled over the last three months.

Image Source: Zacks Investment Research

CVI is trading at a one-year forward earnings multiple of 9x, which is below its 10-year median of 12x, and above the industry average 5x.

Image Source: Zacks Investment Research

Valero Energy

Valero Energy VLO is a deeply diversified oil refinery company with 15 plants across the U.S., Canada, and the Caribbean and capacity to refine 3.2 million barrels a day. The majority of VLO’s refinery plants are located in the Gulf Coast with easy access to export facilities, boosting margins. Valero recently reported strong fourth-quarter results with a 13% upside surprise on EPS.

VLO stock has been a very strong performer over the last year. Even with the substantial move lower in the price of oil, Valero stock has remained strong.

Image Source: Zacks Investment Research

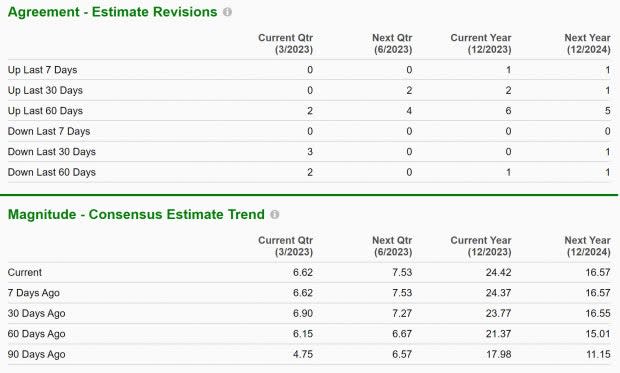

Valero Energy earns a Zacks Rank #2 (Buy), indicating upward trending earnings revisions. Current quarter earnings are expected to climb 186% YoY to $6.62 per share, while current quarter sale are expected to drop -13% to $33.5 billion.

Although there have been some slight revisions lower in the current quarter recently, earnings have still been revised much higher over the last three months. Furthermore, all other earnings periods have been revised considerably higher, with current year earnings upgraded by 36%.

Image Source: Zacks Investment Research

VLO is trading at a very reasonable 5x one-year forward earnings, which is in line with the industry and well below its five-year median of 13x. VLO also offers a dividend yield of 3.2%, which has been raised by an average of 4.8% annually over the last five years.

Image Source: Zacks Investment Research

Conclusion

Even with the stellar performance that the energy sector put up in 2022, many of the stocks still have reasonable valuations. If you pair that with the fact that many of these stocks have improving earnings, you have a very compelling setup for a bull run. Investors who are comfortable going against the current bearish sentiment in the energy market may be rewarded by buying now.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Valero Energy Corporation (VLO) : Free Stock Analysis Report

CVR Energy Inc. (CVI) : Free Stock Analysis Report

Par Pacific Holdings, Inc. (PARR) : Free Stock Analysis Report