Badger Meter (BMI) Q2 Earnings Meet Estimates, Revenues Up Y/Y

Badger Meter, Inc. BMI reported solid second-quarter 2021 results, with the bottom line matching the Zacks Consensus Estimate and top line surpassing the same. Record order momentum, impressive sales growth, higher adoption of innovative digital water solutions and recovering market trends post the COVID-19 crisis drove the performance. In response to the results, shares of the Milwaukee, WI-based controls products manufacturer rallied 6.7% to close at $100.53 on Jul 20.

Net Income

Net earnings in the reported quarter were $14 million or 48 cents per share compared with $9.5 million or 33 cents per share in the year-ago quarter. The year-over-year improvement can be primarily attributed to higher revenues. The bottom line matched the Zacks Consensus Estimate.

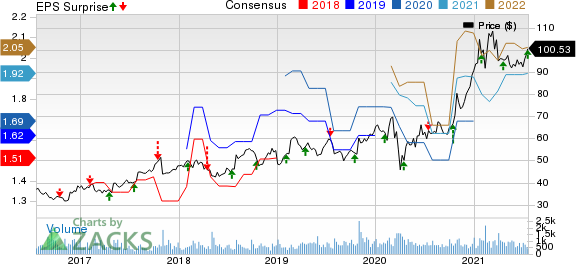

Badger Meter, Inc. Price, Consensus and EPS Surprise

Badger Meter, Inc. price-consensus-eps-surprise-chart | Badger Meter, Inc. Quote

Revenues

With strong momentum, quarterly net sales increased to $122.9 million from $91.1 million in the year-ago quarter. The 34.8% surge was primarily due to solid order rates, driven by accelerated adoption of innovative digital water technologies among customers. Market recovery of global flow instrumentation played a crucial role as well. The top line surpassed the consensus mark of $121 million.

As pandemic lockdown relaxed, utility water sales rose 38% owing to the water quality acquisitions of s::can and Analytical Technologies, Inc (“ATi”), fueled by strong order activity. Strength in ORION cellular-based AMI demand, strategic value-based pricing initiatives, favorable sales mix of high-end products and services along with higher BEACON Software-as-a-Service (SaaS) revenues acted as major tailwinds.

The company witnessed another quarter of record-high order backlog, owing to manufacturing disruptions from electronic component shortages and logistics challenges. Flow instrumentation sales grew 22% year over year with stabilizing global order trends. With double digit increase across a plethora of industrial end markets and applications, the segment is expected to witness sales growth in the upcoming quarters.

Other Details

Gross profit was $50.1 million, up 39.8% from $35.9 million in the year-earlier quarter. Gross margin was 40.8%, up 150 basis points. The upside was primarily driven by higher SaaS revenues with favorable product sales and acquisition mix. Value-based pricing actions drove the margin as well. Operating earnings were $18.7 million or 15.2% of sales compared with respective tallies of $12.7 million and 13.9% in the year-earlier quarter.

Selling, engineering and administration expenses were $31.4 million compared with $23.2 million in the prior-year quarter. The increase was primarily due to the inclusion of s::can and ATi coupled with higher personnel costs and other COVID-19 related cost reduction actions.

Cash Flow & Liquidity

During the first six months of 2021, Badger Meter generated $45.1 million of net cash from operations compared with $52.3 million in the prior-year period. Free cash flow in the quarter declined 40.8% to $11.9 million due to higher working capital and income tax payments. With adequate financial flexibility and strong earnings conversion, the company expanded its credit facility to $150 million to fund capital allocation priorities.

As of Jun 30, the company had $57.4 million of cash and cash equivalents with $72.3 million of total current liabilities.

Moving Forward

With the gradual stabilization of overall end-market activities post lockdown, Badger Meter’s near-term outlook remains bullish. It expects to witness solid backlog and bid pipeline on the back of increasing orders in the forthcoming quarters. This will eventually help the company to ensure smooth functioning of business operations with strong profitability. Thanks to recovering macro trends, the company continues to expand its portfolio of smart water solutions while driving their adoption.

Value-based pricing efforts will also help in mitigating the surge in brass costs. Although logistics challenges serve as a prime headwind, effective sourcing strategies and supply chain management are expected to enhance Badger Meter’s operational agility. It remains committed to delivering critical products and services to its diversified customer base during this hour of crisis.

Despite a challenging price/cost environment, Badger Meter is well poised to enable strategic, tuck-in mergers and acquisitions to augment offerings across global markets with a healthy liquidity position. It is focused on investing in digital solutions that operationalize real-time data and utilize remote solutions to reduce overall costs and enhance efficiency. Customer demand is predicted to be the crux of product and technology roadmap. Continued R&D investments with inventory planning capabilities and backlog conversion are likely to provide potential opportunities in the future.

Zacks Rank & Stocks to Consider

Badger Meter currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the industry are Transcat, Inc. TRNS, Watts Water Technologies, Inc. WTS and Sensata Technologies Holding plc ST, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Transcat delivered a trailing four-quarter earnings surprise of 107.8%, on average.

Watts Water delivered a trailing four-quarter earnings surprise of 36.1%, on average.

Sensata delivered a trailing four-quarter earnings surprise of 14.6%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Sensata Technologies Holding N.V. (ST) : Free Stock Analysis Report

Watts Water Technologies, Inc. (WTS) : Free Stock Analysis Report

Transcat, Inc. (TRNS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research