REAL TIME PRICE

EXTENDED HOURS

| Day’s Range | - |

| 52 Week Range | - |

| Operative Builders | |

Zelman & Assoc Upgrades Taylor Morrison Home (TMHC)

Fintel reports that on April 12, 2024, Zelman & Assoc upgraded their outlook for Taylor Morrison Home (NYSE:TMHC) from Underperform to Neutral.

Analyst Price Forecast Suggests 9.26% Upside

As of March 31, 2024, the average one-year price target for Taylor Morrison Home is 62.05. The forecasts range from a low of 50.50 to a high of $73.50. The average price target represents an increase of 9.26% from its latest reported closing price of 56.79.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Taylor Morrison Home is 6,410MM, a decrease of 13.59%. The projected annual non-GAAP EPS is 5.44.

What is the Fund Sentiment?

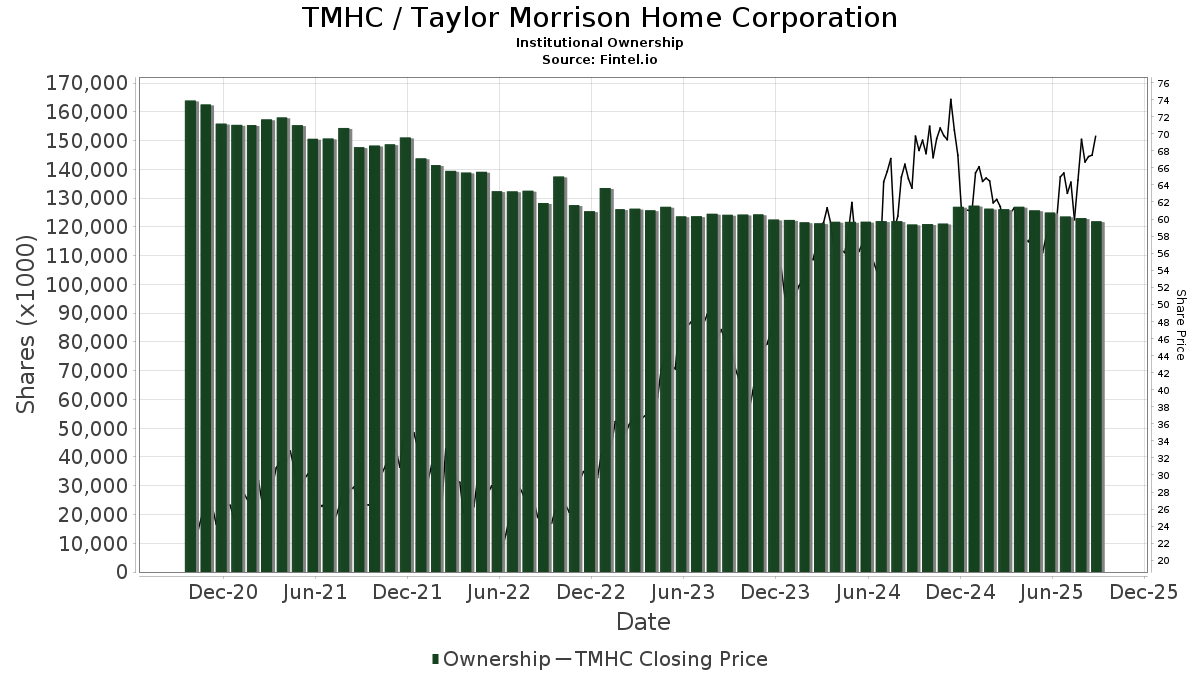

There are 889 funds or institutions reporting positions in Taylor Morrison Home.

This is an increase

of

32

owner(s) or 3.73% in the last quarter.

Average portfolio weight of all funds dedicated to TMHC is -2.03%,

a decrease

of 823.91%.

Total shares owned by institutions decreased

in the last three months by 0.54% to 121,752K shares.

The put/call ratio of TMHC is 0.46, indicating a

bullish

outlook.

The put/call ratio of TMHC is 0.46, indicating a

bullish

outlook.

What are Other Shareholders Doing?

IJH - iShares Core S&P Mid-Cap ETF holds 3,262K shares representing 3.06% ownership of the company. In it's prior filing, the firm reported owning 3,419K shares, representing a decrease of 4.82%. The firm increased its portfolio allocation in TMHC by 10.38% over the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 3,214K shares representing 3.02% ownership of the company. In it's prior filing, the firm reported owning 3,202K shares, representing an increase of 0.36%. The firm increased its portfolio allocation in TMHC by 12.29% over the last quarter.

Fuller & Thaler Asset Management holds 3,190K shares representing 3.00% ownership of the company. In it's prior filing, the firm reported owning 3,180K shares, representing an increase of 0.31%. The firm increased its portfolio allocation in TMHC by 10.64% over the last quarter.

FTHNX - Fuller & Thaler Behavioral Small-Cap Equity Fund Investor Shares holds 3,011K shares representing 2.83% ownership of the company. In it's prior filing, the firm reported owning 1,380K shares, representing an increase of 54.16%. The firm increased its portfolio allocation in TMHC by 103.39% over the last quarter.

Invesco holds 2,894K shares representing 2.72% ownership of the company. In it's prior filing, the firm reported owning 3,039K shares, representing a decrease of 5.02%. The firm increased its portfolio allocation in TMHC by 5.34% over the last quarter.

Taylor Morrison Home Background Information

(This description is provided by the company.)

Taylor Morrison Home Corporation is the nation's fifth largest homebuilder and developer based in Scottsdale, Arizona, that has been recognized as America's Most Trusted® Home Builder for six years running (2016-2021). Operating under a family of brands including Taylor Morrison, Darling Homes, William Lyon Signature Home and Christopher Todd Communities built by Taylor Morrison, the Company serves consumer groups coast to coast, from first-time to move-up, luxury and 55-plus buyers. Its unwavering pledge to sustainability, its communities and its team—outlined in the 2019 Environmental, Social and Governance (ESG) Report—extends to designing thoughtful living experiences homeowners can be proud of for generations to come. CONTACT: Alice Giedraitis

Stories by George Maybach

Wolfe Research Downgrades Ryan Specialty Holdings (RYAN)

Fintel reports that on May 6, 2024, Wolfe Research downgraded their outlook for Ryan Specialty Holdings (NYSE:RYAN) from Outperform to Peer Perform.

Craig-Hallum Initiates Coverage of Eton Pharmaceuticals (ETON) with Buy Recommendation

Fintel reports that on May 6, 2024, Craig-Hallum initiated coverage of Eton Pharmaceuticals (NasdaqGM:ETON) with a Buy recommendation.

William Blair Downgrades Perficient (PRFT)

Fintel reports that on May 6, 2024, William Blair downgraded their outlook for Perficient (NasdaqGS:PRFT) from Outperform to Market Perform.

Morgan Stanley Upgrades Bausch + Lomb (BLCO)

Fintel reports that on May 6, 2024, Morgan Stanley upgraded their outlook for Bausch + Lomb (NYSE:BLCO) from Equal-Weight to Overweight.

Needham Downgrades Perficient (PRFT)

Fintel reports that on May 6, 2024, Needham downgraded their outlook for Perficient (NasdaqGS:PRFT) from Buy to Hold.

Seaport Global Upgrades Wolverine World Wide (WWW)

Fintel reports that on May 6, 2024, Seaport Global upgraded their outlook for Wolverine World Wide (NYSE:WWW) from Neutral to Buy.

UBS Downgrades Johnson Controls International (JCI)

Fintel reports that on May 6, 2024, UBS downgraded their outlook for Johnson Controls International (NYSE:JCI) from Buy to Neutral.

Citigroup Downgrades Comerica (CMA)

Fintel reports that on May 6, 2024, Citigroup downgraded their outlook for Comerica (NYSE:CMA) from Buy to Neutral.

Leerink Partners Upgrades Blueprint Medicines (BPMC)

Fintel reports that on May 6, 2024, Leerink Partners upgraded their outlook for Blueprint Medicines (NasdaqGS:BPMC) from Underperform to Market Perform.

HC Wainwright & Co. Initiates Coverage of Jasper Therapeutics (JSPR) with Buy Recommendation

Fintel reports that on May 6, 2024, HC Wainwright & Co.