I Ran A Stock Scan For Earnings Growth And Quest Resource Holding (NASDAQ:QRHC) Passed With Ease

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Quest Resource Holding (NASDAQ:QRHC). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for Quest Resource Holding

How Fast Is Quest Resource Holding Growing Its Earnings Per Share?

In the last three years Quest Resource Holding's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Like a falcon taking flight, Quest Resource Holding's EPS soared from US$0.069 to US$0.09, over the last year. That's a commendable gain of 31%.

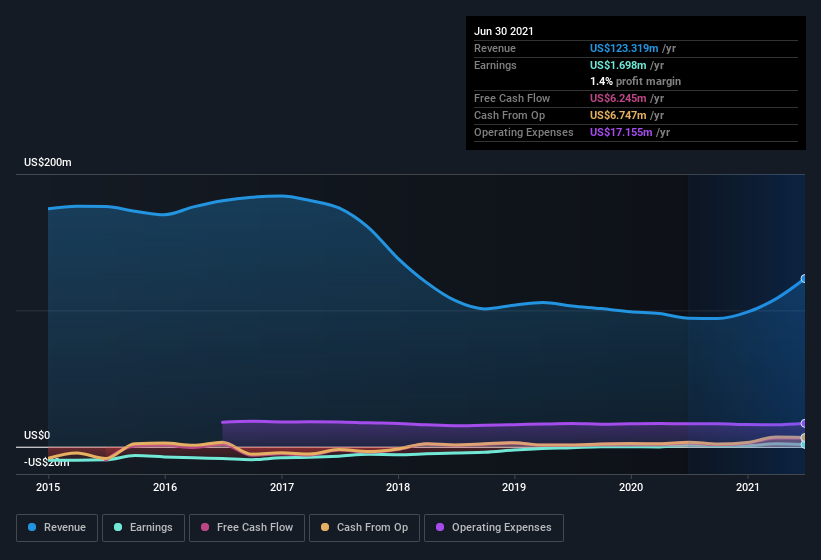

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Quest Resource Holding shareholders can take confidence from the fact that EBIT margins are up from 0.3% to 4.0%, and revenue is growing. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Quest Resource Holding's future profits.

Are Quest Resource Holding Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The good news for Quest Resource Holding shareholders is that no insiders reported selling shares in the last year. So it's definitely nice that President S. Hatch bought US$5.0k worth of shares at an average price of around US$3.90.

Is Quest Resource Holding Worth Keeping An Eye On?

For growth investors like me, Quest Resource Holding's raw rate of earnings growth is a beacon in the night. The growth rate whets my appetite for research, and the insider buying only increases my interest in the stock. To put it succinctly; Quest Resource Holding is a strong candidate for your watchlist. We should say that we've discovered 1 warning sign for Quest Resource Holding that you should be aware of before investing here.

The good news is that Quest Resource Holding is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.