How Much Did Tufin Software Technologies'(NYSE:TUFN) Shareholders Earn From Share Price Movements Over The Last Year?

It's easy to match the overall market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Unfortunately the Tufin Software Technologies Ltd. (NYSE:TUFN) share price slid 12% over twelve months. That falls noticeably short of the market return of around 35%. Tufin Software Technologies hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. It's down 5.7% in the last seven days.

Check out our latest analysis for Tufin Software Technologies

Given that Tufin Software Technologies didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Tufin Software Technologies' revenue didn't grow at all in the last year. In fact, it fell 1.1%. That's not what investors generally want to see. The stock price has languished lately, falling 12% in a year. That seems pretty reasonable given the lack of both profits and revenue growth. We think most holders must believe revenue growth will improve, or else costs will decline.

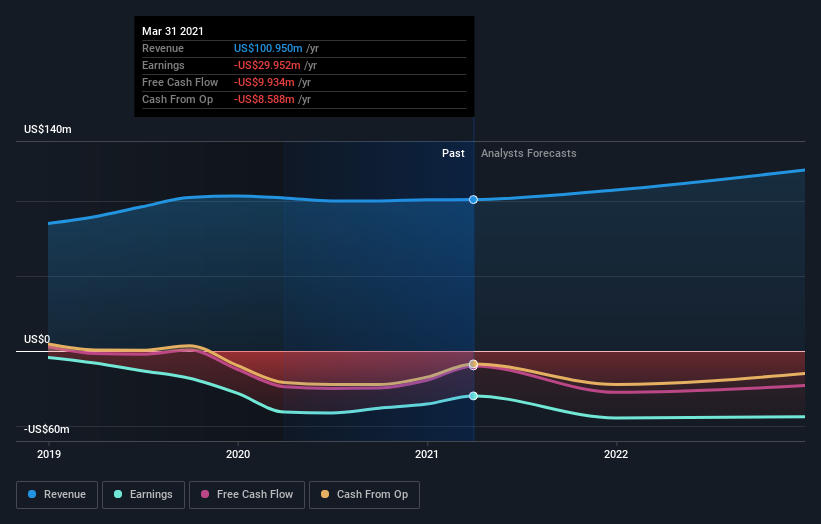

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

While Tufin Software Technologies shareholders are down 12% for the year, the market itself is up 35%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The share price decline has continued throughout the most recent three months, down 6.4%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. It's always interesting to track share price performance over the longer term. But to understand Tufin Software Technologies better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for Tufin Software Technologies you should be aware of, and 1 of them shouldn't be ignored.

Of course Tufin Software Technologies may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.