Zillow Group (ZG) to Report Q2 Earnings: What's in Store?

Zillow Group ZG is set to release second-quarter 2021 results on Aug 5.

For the quarter, the company expects revenues between $1.236 billion and $1.284 billion. The Zacks Consensus Estimate for revenues is pegged at $1.27 billion, which suggests an improvement of 64.9% from the year-ago quarter’s reported figure.

For the second quarter, the consensus mark for earnings is pegged at 23 cents per share, unchanged over the past 30 days and indicating growth of 235.3% from the figure reported in the year-ago quarter.

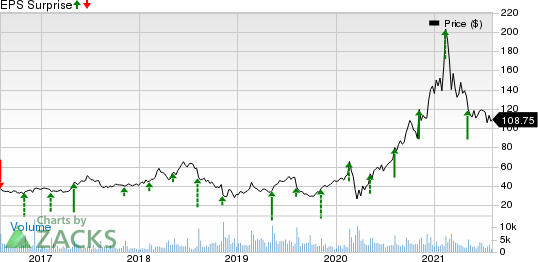

Zillow’ earnings beat the Zacks Consensus Estimate in all of the trailing four quarters, delivering an earnings surprise of 82.7%, on average.

Zillow Group, Inc. Price and EPS Surprise

Zillow Group, Inc. price-eps-surprise | Zillow Group, Inc. Quote

Let’s see how things have shaped up for Zillow prior to this announcement.

Factors to Consider

Zillow’s second-quarter performance is likely to reflect continued strength in Internet, Media & Technology (“IMT”) and Mortgage segments.

Zillow Group’s digital capabilities (like Zillow 3D Home technology) that facilitate virtual home tours for Zillow-owned homes and virtual consultations from the company’s broker and Premier Agents, are likely to have positively impacted the top line in the second quarter.

Increasing customer traffic and connections in premier agents, along with healthy partner retention and improving partner demand across the company’s marketplace businesses, are likely to drive top line for IMT segment. For the IMT segment, Zillow expects second-quarter revenues in the range of $459-$472 million.

The Zacks Consensus Estimate for IMT segment revenues is pegged at $467 million, which suggests 68.8% increase on a year-over-year basis.

Within the IMT segment, Premier Agent revenues are expected in the range of $342-$350 million. The consensus estimates for the same is pegged at $348 million, which calls for an increase of 81.3% year over year, at present.

Premier Agent revenues are likely to be driven by increase in traffic and healthy partner demand.

Mortgage segment’s second-quarter revenues are expected to be driven by improvement in mortgage technology platform. Revenues are expected between $57 million and $62 million. The Zacks Consensus Estimate for revenues in the Mortgage segment is pegged at $61 million, indicating year-over-year growth of 80.7%.

However, higher spend on product development and advertising amid increasing competition is likely to have limited profitability in the to-be-reported quarter.

What Our Model Says

Per the Zacks model, the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here.

Zillow has an Earnings ESP of 0.00% and carries a Zacks Rank #3, currently. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks to Consider

Here are a few companies you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat in their upcoming releases:

Avnet AVT has an Earnings ESP of +9.82% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

CyberArk Software CYBR has an Earnings ESP of +37.93% and a Zacks Rank #2.

Waters Corporation WAT has an Earnings ESP of +2.71% and a Zacks Rank #3.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Avnet, Inc. (AVT) : Free Stock Analysis Report

Waters Corporation (WAT) : Free Stock Analysis Report

CyberArk Software Ltd. (CYBR) : Free Stock Analysis Report

Zillow Group, Inc. (ZG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research