The Walt Disney Co (DIS) Faces Challenges Despite Meeting Adjusted EPS Estimates in Q2

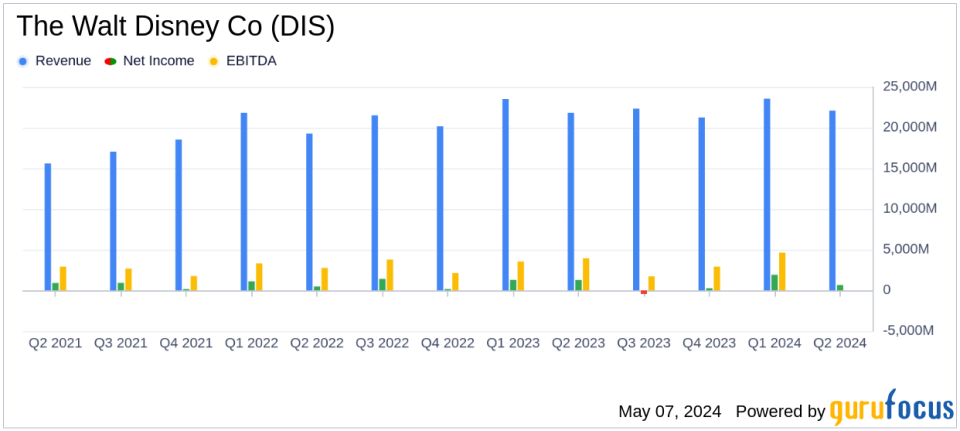

Revenue: Reached $22.1 billion, up from $21.8 billion in the prior-year quarter, meeting estimates of $22.116 billion.

Net Income: Reported a loss due to $2,052 million in goodwill impairments, significantly below opposing the estimated net income of $2015.55 million.

Earnings Per Share (EPS): Recorded a loss of $0.01 per share, falling short falling significantly below the estimated earnings of $1.10 per share.

Adjusted EPS: Increased to $1.21 from $0.93 in the prior-year quarter, exceeding the estimated $1.10 per share.

Free Cash Flow: Reported $2.407 billion, up 21% from the previous year, indicating robust cash generation capabilities.

Streaming Business: Disney+ Core subscribers grew by over 6 million, with a sequential ARPU increase of 44 cents, highlighting strong performance in direct-to-consumer services.

Share Repurchases: Continued returning capital to shareholders with $1 billion in share repurchases during the quarter.

On May 7, 2024, The Walt Disney Co (NYSE:DIS) disclosed its financial outcomes for the second quarter of fiscal year 2024, revealing a complex performance landscape marked by both achievements and setbacks. The company released its findings through an 8-K filing, which detailed various financial metrics and strategic updates.

The Walt Disney Co operates across three primary segments: entertainment, sports, and experiences. Each segment leverages iconic franchises and characters developed over Disney's storied history. The entertainment segment includes significant assets such as ABC, Disney+ and Hulu, while the sports segment features ESPN. The experiences segment is renowned for its theme parks and merchandise licensing.

Financial Performance Overview

For Q2, Disney reported revenues of $22.1 billion, a modest increase from $21.8 billion in the same quarter the previous year. Notably, the diluted earnings per share (EPS) showed a loss of $0.01, a stark contrast to the profit of $0.69 per share in the prior-year quarter. This loss was primarily due to significant goodwill impairments, although partially offset by higher operating income in the Entertainment and Experiences segments. Adjusted EPS, excluding certain items, improved to $1.21 from $0.93, aligning closely with analyst expectations of $1.10 for the quarter.

The company highlighted a robust 30% increase in adjusted EPS year-over-year and set a new target for full-year adjusted EPS growth at 25%. Disney remains on track to generate substantial cash flows, projecting about $14 billion from operations and over $8 billion in free cash flow for the fiscal year.

Segment Performance and Strategic Developments

The Entertainment segment faced a revenue decline of 5% year-over-year, with particular weakness in linear networks and content sales/licensing partially mitigated by growth in direct-to-consumer (DTC) platforms. The sports segment saw a slight revenue increase, although operating income dipped marginally due to the timing of College Football Playoff games. Conversely, the Experiences segment was a strong performer, with revenue and operating income both growing by double digits, driven by increased consumer spending and operational efficiencies.

CEO Robert A. Iger emphasized the strategic successes, particularly in the Experiences segment and the profitability of the entertainment streaming services. The company anticipates continued profitability in streaming by Q4 of fiscal 2024, with further improvements expected in fiscal 2025.

Challenges and Forward-Looking Statements

Despite the positive adjusted EPS, Disney faced challenges including a nominal loss in EPS due to goodwill impairments related to its Star India operations and entertainment linear networks. The company also anticipates softer results in the Entertainment DTC segment in the upcoming quarter, driven by Disney+ Hotstar.

Looking ahead, Disney is focused on enhancing its streaming services, capitalizing on its robust content slate, and continuing to expand its theme park experiences. The company's forward-looking statements suggest a strategic emphasis on leveraging its strong brand and diversified business model to navigate current challenges and drive future growth.

In summary, while Disney faces some headwinds, particularly with certain segment performances and goodwill impairments, its strategic adjustments and focus on core growth areas like streaming and experiences appear poised to sustain its long-term growth trajectory.

Explore the complete 8-K earnings release (here) from The Walt Disney Co for further details.

This article first appeared on GuruFocus.