Quest Diagnostics' (DGX) Base Volumes Rise, Testing Recovers

Quest Diagnostics, Inc. DGX, as part of its two-point strategy, has been focusing on areas with high potential. The stock currently carries a Zacks Rank #2 (Buy).

Over the past three months, Quest Diagnostics has outperformed its industry. The stock has gained 12.7% against 5.9% decline of the industry.

The company reported better-than-expected second-quarter adjusted earnings and revenues. According to the company, this is the first quarter since 2019 in which it recorded organic base testing revenue growth. This was primarily driven by contributions from new hospital lab management contracts as well as people returning to the healthcare system. In June, organic base testing revenues returned to the pre-pandemic levels. More specifically, the company registered a strong recovery in most parts of the country and a slower recovery in the Northeast.

According to Quest Diagnostics, it is currently well-positioned to continue with this momentum and support the return to healthcare in the coming months, which is reflected in the company’s outlook for the remainder of 2021.

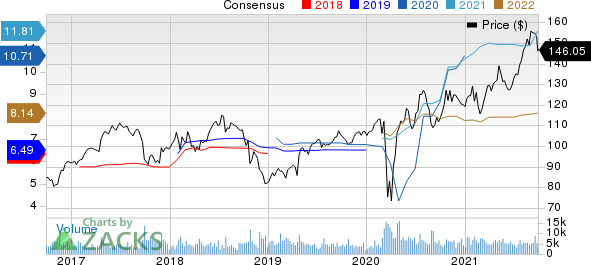

Quest Diagnostics Incorporated Price and Consensus

Quest Diagnostics Incorporated price-consensus-chart | Quest Diagnostics Incorporated Quote

In terms of COVID-19 testing, following a decline in volumes over the past few months, the company noted a stabilization in PCR volumes in the recent weeks. The volumes have started to increase modestly. According to Quest Diagnostics, the rapid spread of the Delta variant might boost the testing volume scenario once again.

In terms of the Protecting Access to Medicare Act (PAMA), the company is optimistic about the recent MedPAC report mandated under the LAB Act. This MedPAC report found it feasible to change the CMS data collection process to a statistically valid sample of private payer rates for independent labs, hospital labs,and physician office labs.

Meanwhile, the updated 2021 outlook also looks impressive on raised revenue, earnings and operating cash flow expectations.

On the flip side,volume pressure, owing to a difficult macro-economic situation and pricing, constitutes the primary risk for Quest Diagnostics. COVID-19 testing volumes continue to decline as expected in the second quarter, in line withtheindustry trends.

Quest Diagnostics performed an average of 57,000 COVID-19 molecular tests in the second quarter, well below its current capacity of approximately 300,000 tests per day. The unit price headwinds were in line with the company’s expectations.

Other Key Picks

Some other top-ranked stocks from the Medical-Products industry include VAREX IMAGING VREX, Envista Holdings Corporation NVST and BellRing Brands, Inc. BRBR, each carrying a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

VAREX has a long-term earnings growth rate of 5%.

Envista Holdings has a long-term earnings growth rate of 27.4%.

BellRing Brands has a long-term earnings growth rate of 29.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Quest Diagnostics Incorporated (DGX): Free Stock Analysis Report

VAREX IMAGING (VREX): Free Stock Analysis Report

Envista Holdings Corporation (NVST): Free Stock Analysis Report

BellRing Brands, Inc. (BRBR): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research