Insider Sale at Procore Technologies Inc (PCOR): Chief Legal Officer Benjamin Singer Sells ...

On May 1, 2024, Benjamin Singer, Chief Legal Officer and Secretary of Procore Technologies Inc (NYSE:PCOR), sold 3,000 shares of the company. The transaction was filed on the same day with the SEC.

Procore Technologies Inc (NYSE:PCOR) specializes in construction management software. The company provides a platform that connects construction project stakeholders with the applications they require to enhance accountability and efficiency.

Following this transaction, the insider has sold a total of 95,090 shares over the past year, with no recorded purchases. This recent sale occurred with the stock priced at $69.05, valuing the transaction at approximately $207,150.

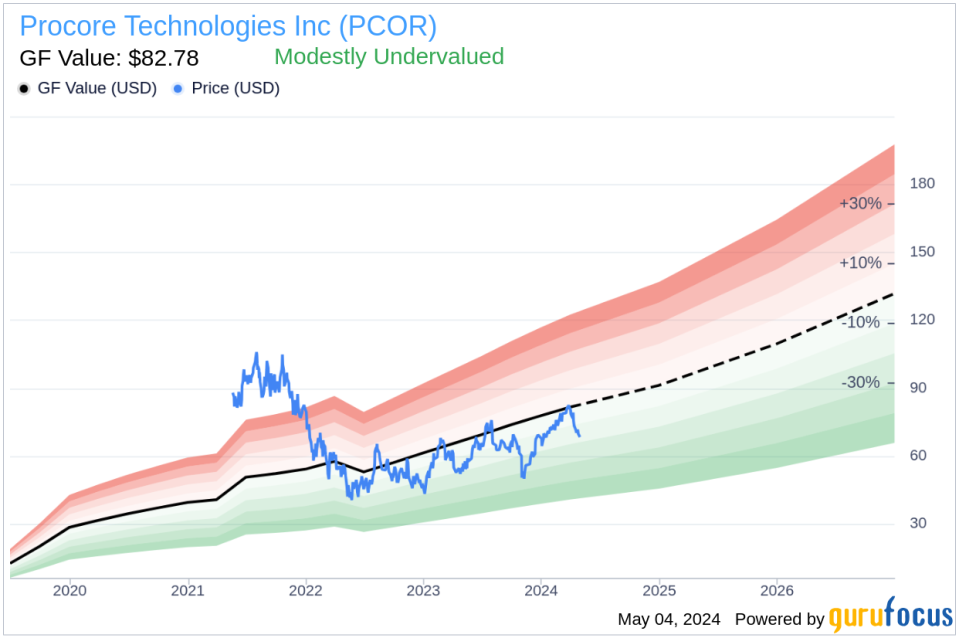

The company's market cap stands at approximately $9.97 billion. According to the GF Value, the stock is currently modestly undervalued, with a price-to-GF-Value ratio of 0.83, suggesting potential for price appreciation.

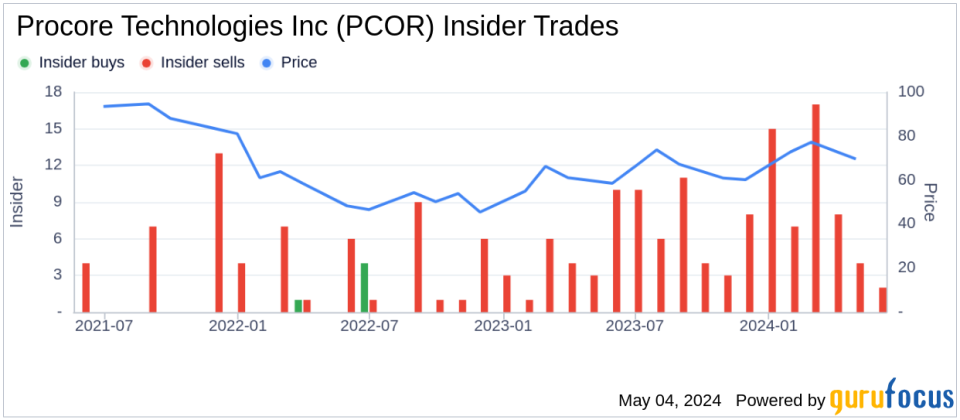

Over the past year, there have been no insider buys and 104 insider sells at Procore Technologies Inc (NYSE:PCOR), indicating a trend of insider sales.

The GF Value of $82.78 is derived from historical multiples such as price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow, adjusted for expected business performance.

This sale by the insider at Procore Technologies Inc (NYSE:PCOR) provides an interesting data point for investors tracking insider behaviors and company valuation metrics.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.