4 Solid Dividend-Paying Steel Stocks to Shield Your Portfolio

The Zacks Steel Producers industry has hit a speed bump after enjoying a short-lived bull run as steel prices have cooled off after catapulting to historic highs last year.

The steel industry staged a strong recovery last year after the pandemic-led downturn, courtesy of solid pent-up demand and a rally in steel prices to historic highs. The resumption of operations across major steel-consuming sectors such as construction and automotive, following the easing of lockdowns and restrictions globally, led to an upturn in steel demand.

Steel prices hit record highs in 2021 on solid demand, higher raw material costs, tight supply and low steel supply-chain inventories globally. Notably, U.S. steel prices skyrocketed in 2021 on supply tightness and robust demand. The benchmark hot-rolled coil (“HRC”) prices hit a record high of $1,960 per short ton in late September 2021, per S&P Global Platts. But prices lost steam since last October, dragged down by the stabilization of demand, improved supply conditions and higher steel imports. HRC prices slumped to nearly $1,000 per short ton at the beginning of March 2022.

However, since Russia invaded Ukraine, steel prices significantly rebounded on supply worries and a spike in lead times. Prices witnessed a significant rally as the war threatened supplies from the two major producing nations. Both Russia and Ukraine are key the producers and suppliers of steel and steel-making raw materials, including coking coal and pig iron. The conflict led to a spike in steel input costs due to disruptions in the supply chains.

However, after surging to nearly $1,500 per short ton around mid-April, the rally in HRC prices stalled as prices witnessed a significant downward correction. HRC prices have tumbled more than 45% since their April peak, falling below the $800 per short ton level. The downward drift partly reflects weaker demand. Demand in the automotive market has weakened due to the semiconductor crunch, which is affecting automotive production. The Russia-Ukraine war and soaring energy costs have also dwindled demand in Europe. Falling cost of raw materials (including scrap prices), additions of new production capacity and fears of a recession have also contributed to the downswing in U.S. HRC prices. Mills are also negotiating lower prices for new orders. These factors are likely to keep steel prices under pressure over the near term.

Nevertheless, order activities in the non-residential construction market remain healthy, underscoring the underlying strength of this industry. Demand in the energy sector has also improved on the back of an uptick in oil and gas prices.

The current challenges in the steel industry should not, however, leave investors shunning the stocks belonging to this space. We believe that attractive dividend-paying steel stocks — Ternium S.A. TX, Gerdau S.A. GGB, Aperam S.A. APEMY and Acerinox, S.A. ANIOY — should remain on investors’ watchlist despite the near-term headwinds.

Strengthen Your Portfolio with Dividends Amid Volatility

Financial markets across the globe have been rattled by a concoction of factors this year. The markets have been battered by issues such as rising interest rates, persistently high inflation and fears of a recession. These factors have contributed to a rough ride for investors for the most part of 2022.

With market volatility unlikely to subside anytime soon, it is wise for investors to look for safe-haven stocks that promise attractive and steady returns. Stocks offering healthy dividend hold up well in an uncertain macroeconomic environment, when capital gains are hard to come by.

Stocks with a solid dividend yield and attractive growth prospects offer excellent choices for investors seeking to create a portfolio that not only performs well in a growing market but also offers some downside protection during market downturns. In other words, high-yielding dividend stocks provide a cushion against stormy markets.

Consistent dividend payouts also underscore a company’s financial strength and stability. Dividend income helps to mitigate losses in a bear market.

How to Pick the Top-Notch Dividend Stocks?

Against the current volatile macroeconomic backdrop, it would be prudent to add some top-quality dividend-paying steel stocks to your portfolio.

We have employed the Zacks Stocks Screener to find companies that offer a dividend yield of more than 2% (the ratio measures how much a firm pays its shareholders in dividends annually per dollar invested. The criterion includes companies with a dividend yield above the S&P 500′s average dividend yield of roughly 2%), a dividend payout ratio of less than 60% (calculated as Dividends Per Share/Earnings Per Share, the metric helps an investor measure the safety of a company's dividend. A payout ratio below 60% is a good indicator that the dividend will be sustainable), and five-year historical dividend growth of greater than or equal to 0.001 (includes companies that have increased their dividend over the past five years).

Our shortlisted stocks also carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Our Choices

Below, we highlight four top picks from the Zacks Steel Producers industry.

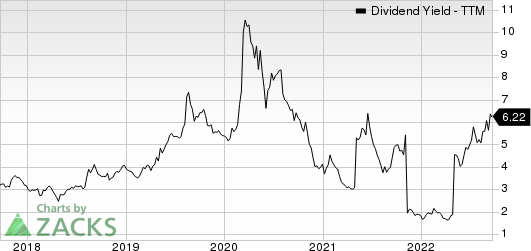

Ternium: Based in Luxembourg, Ternium is a leading producer of flat and long steel products in Latin America. It is expected to benefit from strong demand for steel products. Its shipments in Mexico are likely to be aided by healthy demand from industrial and commercial customers. Healthy demand for construction materials is also expected to support shipments in Argentina. TX is also benefiting from the cost competitiveness of its facilities. It is also taking actions to boost liquidity and strengthen its financial position in the wake of the pandemic.

Ternium has a dividend yield of 6.24% at the current stock price. TX’s payout ratio is 9%, with a five-year dividend growth rate of 6.50%. Check Ternium’s dividend history here>>>

Ternium S.A. Dividend Yield (TTM)

Ternium S.A. dividend-yield-ttm | Ternium S.A. Quote

Gerdau: Brazil-based Gerdau is a leading producer of long steel in the Americas and one of the biggest global suppliers of special steel. It is benefiting from healthy demand for steel in its key operations, which is supporting its volumes. A recovery in major consumer sectors is driving its steel shipments. The company is seeing higher production and shipments on increased demand from the construction and industrial sectors. Healthy demand from construction and manufacturing sectors is driving shipments in Brazil. Higher demand from the non-residential construction market is also supporting volumes in North America. GGB is also gaining from a gradual recovery in demand from the oil and gas industry.

Gerdau has a dividend yield of 11.97% at the current stock price. GGB’s payout ratio is 18%, with a five-year dividend growth rate of 67.35%. Check Gerdau’s dividend history here>>>

Gerdau S.A. Dividend Yield (TTM)

Gerdau S.A. dividend-yield-ttm | Gerdau S.A. Quote

Aperam: Luxembourg-based Aperam is a global player in the stainless, electrical and specialty steel markets. It is benefiting from healthy market conditions in Brazil, which is offsetting the ongoing weakness in Europe. Higher steel selling prices in the Stainless & Electrical Steel segment are supporting its results. The company also remains focused on reducing debt.

Aperam has a dividend yield of 6.40% at the current stock price. APEMY’s payout ratio is 11%, with a five-year dividend growth rate of 7.62%. Check Aperam’s dividend history here>>>

Aperam Dividend Yield (TTM)

Aperam dividend-yield-ttm | Aperam Quote

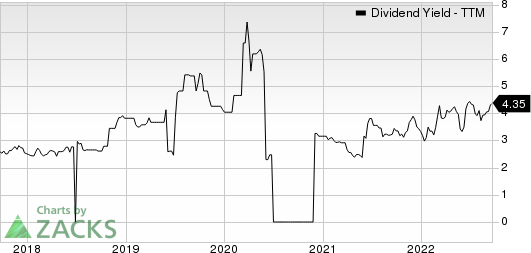

Acerinox: Spain-based Acerinox is a leading manufacturer of stainless steel and nickel alloys. The company is expected to gain from strong demand for stainless steel. It is seeing higher demand for flat products in the United States and Europe. Price increases in stainless steel is also aiding its performance. ANIOY has a strong balance sheet with ample liquidity.

Acerinox has a dividend yield of 4.26% at the current stock price. ANIOY’s payout ratio is 17%, with a five-year dividend growth rate of 3.61%. Check Acerinox's dividend history here>>>

Acerinox Dividend Yield (TTM)

Acerinox dividend-yield-ttm | Acerinox Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Gerdau S.A. (GGB) : Free Stock Analysis Report

Ternium S.A. (TX) : Free Stock Analysis Report

Aperam (APEMY) : Free Stock Analysis Report

Acerinox (ANIOY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research