Assurant (AIZ) Q1 Earnings & Revenues Beat Estimates, Rise Y/Y

Assurant, Inc. AIZ reported first-quarter 2024 net operating income of $4.78 per share, which beat the Zacks Consensus Estimate by 23.5%. The bottom line surged 73.8% year over year.

Quarterly results benefited from higher net earned premiums, fees and other income and net investment income, solid performance in the Global Housing and Global Lifestyle segments. It was partially offset by higher expenses and weakness in the Corporate & Other segment.

Total revenues increased 8.9% year over year to $2.8 billion, driven by higher net earned premiums, fees and other income and net investment income. The top line beat the Zacks Consensus Estimate by 2.6%.

Net investment income was up 20.4% year over year to $126.7 million, driven by higher yields and assets in fixed maturity securities, short-term investments and cash and cash equivalents. The figure was lower than our estimate of $141.7 million.

Total benefits, loss and expenses increased 3.7% to $2.5 billion, mainly due to higher underwriting and selling, general and administrative expenses. The figure matched our estimate.

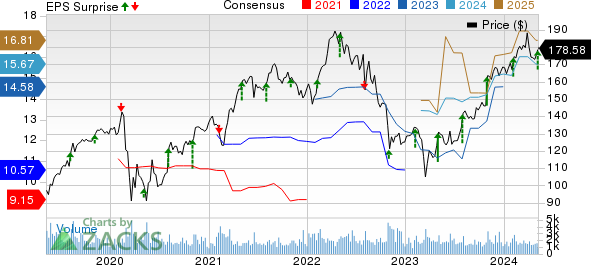

Assurant, Inc. Price, Consensus and EPS Surprise

Assurant, Inc. price-consensus-eps-surprise-chart | Assurant, Inc. Quote

Segmental Performance

Revenues at Global Housing increased 14% year over year to $600.7 million, primarily driven by higher net earned premiums and net investment income. The figure was higher than our estimate of $571.3 million.

Adjusted EBITDA surged nearly three-fold year over year to $192.5 million due to lower pre-tax reportable catastrophes. The figure was higher than our estimate of $99.7 million.

Revenues at Global Lifestyle rose 7.6% year over year to $2.3 billion. The increase was primarily driven by higher net earned premiums, fees and other income and net investment income. The figure was higher than our estimate of $2.2 billion.

Adjusted EBITDA of $207.7 million increased 4% year over year, driven by growth in Connected Living, partially offset by lower results in Global Automotive. The rise in Connected Living was due to stronger mobile device protection results across carrier and cable operator clients in North America, higher investment income and a one-time $6.9 million client contract benefit, partially offset by new client and program implementation expenses, as well as unfavorable foreign exchange.

The decline in Global Automotive was mainly due to ongoing elevated claims costs from inflation and the normalization of select ancillary products, partially offset by higher investment income. The figure was higher than our estimate of $199.1 million.

Adjusted EBITDA loss at Corporate & Other was $29.5 million, wider than the year-ago quarter’s adjusted EBITDA loss of $24.4 million. The wider loss was due to higher expenses to support enterprise growth initiatives.

Financial Position

Liquidity was $622 million as of Mar 31, 2024, which was $397 million higher than the company’s current targeted minimum level of $225 million.

Total assets decreased 1.2% to $33.2 billion as of Mar 31, 2024, from the end of 2023.

Total shareholders’ equity came in at $4.9 billion, up 2.3% year over year.

Share Repurchase and Dividend Update

In the first quarter, Assurant repurchased shares for $40 million. It now has $625 million remaining under the current repurchase authorization.

AIZ’s total dividends amounted to $37 million in the reported quarter.

2024 Guidance

Assurant expects adjusted EBITDA, excluding reportable catastrophes, to increase by mid-single-digits, driven by growth in Global Housing and Global Lifestyle.

Global Housing’s adjusted EBITDA, excluding reportable catastrophes, is expected to increase, following significant growth in 2023, mainly driven by improving non-catastrophe loss experience, top-line growth in Homeowners and lower catastrophe reinsurance premiums.

Global Lifestyle’ adjusted EBITDA is expected to increase, mainly driven by organic growth and improved profitability in Connected Living programs. Global Automotive is expected to be flat as higher investment income is likely to be offset by continued loss pressure, with rate actions expected to drive improvement over time. The rise in Global Lifestyle will likely be partially offset by investments to support growth, including new client and program implementation expenses.

Corporate and Other Adjusted EBITDA loss is expected to be $110 million.

Assurant expects adjusted earnings per share, excluding reportable catastrophes, growth rate to approximate the growth rate in adjusted EBITDA, excluding reportable catastrophes.

AIZ anticipates a depreciation expense of $130 million and continues to expect an interest expense of $107 million, amortization of purchased intangible assets of $70 million and an effective tax rate of 20-22%.

Zacks Rank

Assurant currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Multi-Line Insurers

Radian Group Inc. RDN reported first-quarter 2024 adjusted operating income of $1.03 per share, which beat the Zacks Consensus Estimate by 24%. The bottom line increased 5.1% year over year. Operating revenues rose 4.8% year over year to $318.9 million, primarily due to higher net premiums earned, services revenues and net investment income. Net investment income jumped 18.4% year over year to $69.2 million. MI New Insurance Written rose 2.4% year over year to $11.5 billion.

Primary mortgage insurance in force was $271 billion as of Mar 31, 2024, up 4% year over year. Persistency — the percentage of mortgage insurance in force that remains in the company’s books after a 12-month period — was 84% as of Mar 31, 2024, up 200 basis points (bps) year over year. Primary delinquent loans were 20,850 as of Mar 31, 2024, up 0.5% year over year. Total expenses climbed 14% year over year to $120.8 million. The expense ratio was 25, which improved 90 bps from the year-ago quarter.

EverQuote. Inc. EVER delivered first-quarter 2024 earnings per share of 5 cents in contrast to the Zacks Consensus Estimate of a loss of 7 cents, as well as the year-ago quarter’s loss of 8 cents per share. Though the top line of $91 million declined 16.5% year over year, it beat the Zacks Consensus Estimate by 12.8%. Revenues from the Automotive insurance vertical were $77.5 million, down 13.6% year over year. The Zacks Consensus Estimate was pegged at $67 million. Our estimate was $64.6 million.

Revenues in the Home and Renters insurance vertical totaled $12.7 million, which increased 34.2% year over year. The Zacks Consensus Estimate was pegged at $13.3 million. Our estimate was $15.3 million. Revenues in the Other insurance vertical totaled $0.1 million, which plunged 16.3% year over year. Total costs and operating expenses decreased 20% to $89.3 million. Our estimate was $77.5 million. EverQuote’s variable marketing margin decreased 13.4% year over year in the quarter under review to $30.8 million.

MGIC Investment Corporation MTG reported first-quarter 2024 operating net income per share of 65 cents, which beat the Zacks Consensus Estimate by 8.3%. The bottom line improved 20.3% year over year. MGIC Investment recorded total operating revenues of $303 million, which increased 3.8% year over year on higher net investment income. The top line, however, missed the consensus mark by 0.4%.

Net premiums earned declined 2.5% year over year to $242.6 million. The figure was lower than our estimate of $252 million. Net investment income increased 21.4% year over year to $61 million. The company beat our estimate of $52.7 million. Persistency, the percentage of insurance remaining in force from one year prior, was 85.7% as of Mar 31, 2024, up from 84.5% in the year-ago quarter. New insurance written was $9.1 billion, up 11% year over year, benefiting from favorable credit trends and the resiliency of the housing market.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MGIC Investment Corporation (MTG) : Free Stock Analysis Report

Assurant, Inc. (AIZ) : Free Stock Analysis Report

Radian Group Inc. (RDN) : Free Stock Analysis Report

EverQuote, Inc. (EVER) : Free Stock Analysis Report