Ligand (LGND) Q2 Earnings & Sales Beat, 2021 Guidance Cut

Ligand Pharmaceuticals Incorporated LGND reported second-quarter 2021 adjusted earnings of $1.63 per share, which beat the Zacks Consensus Estimate of $1.45. The company had reported adjusted earnings of $1.00 in the year-ago quarter.

Total revenues were $84.7 million, up 104.4% from the year-ago quarter. The significant increase was mainly due to higher year-over-year Captisol revenues as well as contract revenues. The top line also beat the Zacks Consensus Estimate of $73.32 million.

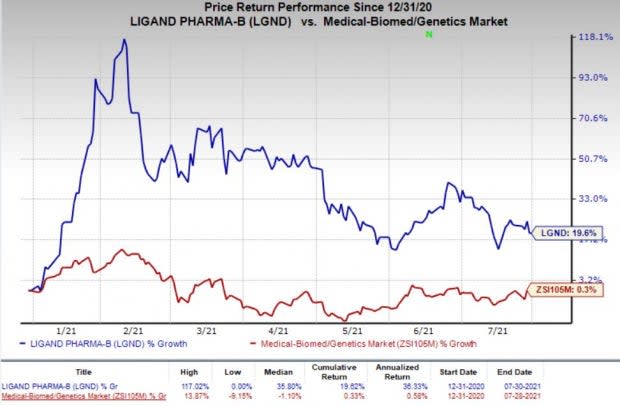

Ligand’s shares have gained 19.6% so far this year against the industry’s 0.3% decrease.

Image Source: Zacks Investment Research

Quarterly Highlights

Royalty revenues were up 20% year over year to $8.6 million in the second quarter. Ligand primarily earns royalties on sales of Amgen's AMGN Kyprolis and Acrotech Biopharma’s Evomela, which were developed using its Captisol technology.

Captisol sales gained 155.5% year over year to $62.5 million. The increase was due to higher sales of Captisol to support availability of Gilead’s GILD remdesivir, which is approved for treating severe COVID-19 patients in the United States and several other countries.

Contract revenue were up 38.7% year over year to $13.6 million in the second quarter. The increase was driven by milestone payment from partners made during the second quarter.

Key Partnered Pipeline Progress

Two of Ligand’s partnered products received FDA approval recently. In June, the FDA approved Jazz Pharmaceuticals’ Rylaze as a component of a multi-agent chemotherapeutic regimen for the treatment of leukemia. Merck’s MRK 15-valent pneumococcal conjugate vaccine (PCV), Vaxneuvance, received approval in July. Both these products were developed using Ligand’s Pelican Expression technology.

Moreover, BeiGene received first approval for Kyprolis in China as a treatment for multiple myeloma.

The company currently has 19 different OmniAb-derived antibodies under development through different partners. The leading OmniAb-derived antibody candidate, CStone Pharmaceuticals’ sugemalimab is under review in China as a potential first-line treatment for advanced squamous and non-squamous non-small cell lung cancer. CStone also successfully completed a late-stage study on the candidate evaluating it in stage III non-small cell lung cancer. A new drug application is expected to be filed for this indication in China soon.

Several other partnered programs are progressing well with successful completion of a few late-stage studies.

2021 Guidance Lowered

Ligand lowered its previously announced guidance for sales and earnings for 2021 to reflect lower demand for remdesivir. It now expects total revenues to be between $265 million and $275 million in 2021 compared with the previous guidance of $291 million.

Currently, the company expects earnings to be in the range of $5.80-$6.05 per share for the year versus the previous guidance of $6.15.

Our Take

Ligand reported encouraging second-quarter results wherein it beat estimates for earnings as well revenues. Revenues recorded significant year-over-year growth. Demand for the company’s key royalty revenue generator, Kyprolis, seems to be improving. The approval for the drug in China is likely to boost revenues further. Moreover, approval to new partnered products will bring additional revenues going forward.

However, Captisol sales are likely to decline in the upcoming quarters as vaccinations will likely reduce severe COVID-19 cases, thereby negatively affecting demand for remdesivir.

Meanwhile, the company has been adding new drug-discovery technologies to its already robust portfolio. These technologies are boosting partnership deals, which are likely to boost the company’s revenues going forward.

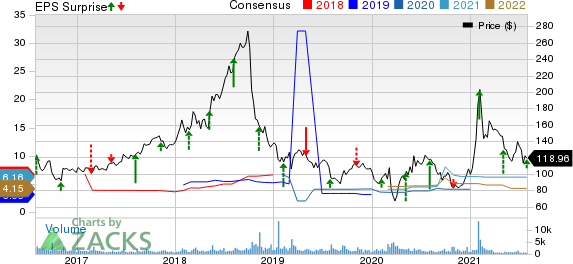

Ligand Pharmaceuticals Incorporated Price, Consensus and EPS Surprise

Ligand Pharmaceuticals Incorporated price-consensus-eps-surprise-chart | Ligand Pharmaceuticals Incorporated Quote

Zacks Rank

Currently, Ligand is a Zacks Rank #3 (Hold) stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Amgen Inc. (AMGN) : Free Stock Analysis Report

Gilead Sciences, Inc. (GILD) : Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research