Enero Group's (ASX:EGG) Upcoming Dividend Will Be Larger Than Last Year's

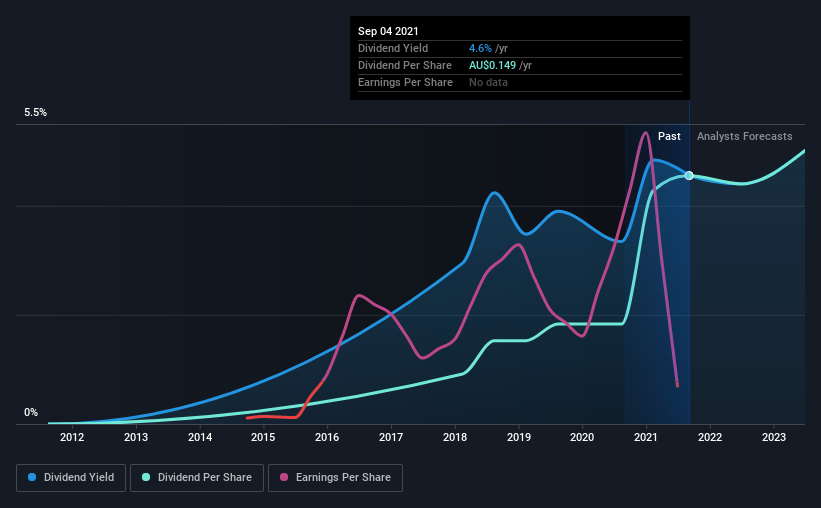

Enero Group Limited (ASX:EGG) will increase its dividend on the 6th of October to AU$0.044. This takes the annual payment to 4.6% of the current stock price, which is about average for the industry.

Check out our latest analysis for Enero Group

Enero Group Might Find It Hard To Continue The Dividend

While it is always good to see a solid dividend yield, we should also consider whether the payment is feasible. While Enero Group is not profitable, it is paying out less than 75% of its free cash flow, which means that there is plenty left over for reinvestment into the business. This gives us some comfort about the level of the dividend payments.

Looking forward, earnings per share could rise by 16.2% over the next year if the trend from the last few years continues. It's nice to see things moving in the right direction, but this probably won't be enough for the company to turn a profit. The healthy cash flows are definitely as good sign, though so we wouldn't panic just yet, especially with the earnings growing.

Enero Group Doesn't Have A Long Payment History

The company has maintained a consistent dividend for a few years now, but we would like to see a longer track record before relying on it. Since 2017, the dividend has gone from AU$0.03 to AU$0.15. This works out to be a compound annual growth rate (CAGR) of approximately 49% a year over that time. It is always nice to see strong dividend growth, but with such a short payment history we wouldn't be inclined to rely on it until a longer track record can be developed.

The Company Could Face Some Challenges Growing The Dividend

The company's investors will be pleased to have been receiving dividend income for some time. Enero Group has impressed us by growing EPS at 16% per year over the past five years. Unprofitable companies aren't normally our pick for a dividend stock, but we like the growth that we have been seeing. All is not lost, but the future of the dividend definitely rests upon the company's ability to become profitable soon.

In Summary

Overall, we always like to see the dividend being raised, but we don't think Enero Group will make a great income stock. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. Overall, we don't think this company has the makings of a good income stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Taking the debate a bit further, we've identified 2 warning signs for Enero Group that investors need to be conscious of moving forward. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.