Does International General Insurance Holdings (NASDAQ:IGIC) Deserve A Spot On Your Watchlist?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In contrast to all that, I prefer to spend time on companies like International General Insurance Holdings (NASDAQ:IGIC), which has not only revenues, but also profits. While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for International General Insurance Holdings

International General Insurance Holdings's Improving Profits

In the last three years International General Insurance Holdings's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Like a firecracker arcing through the night sky, International General Insurance Holdings's EPS shot from US$0.36 to US$0.97, over the last year. You don't see 171% year-on-year growth like that, very often. That could be a sign that the business has reached a true inflection point.

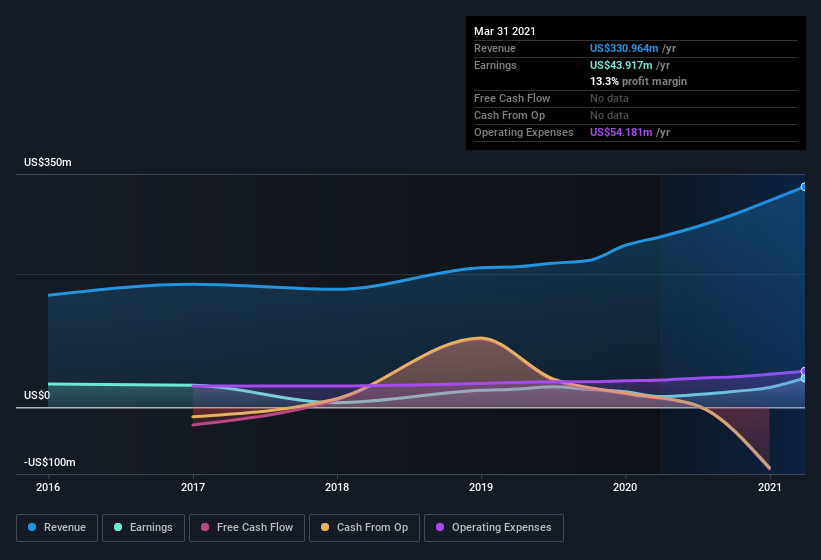

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). I note that International General Insurance Holdings's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. International General Insurance Holdings maintained stable EBIT margins over the last year, all while growing revenue 29% to US$331m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check International General Insurance Holdings's balance sheet strength, before getting too excited.

Are International General Insurance Holdings Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

One gleaming positive for International General Insurance Holdings, in the last year, is that a certain insider has buying shares with ample enthusiasm. Specifically, the Founder, Wasef Jabsheh, accumulated US$2.2m worth of shares around US$6.90. Big insider buys like that are almost as rare as an ocean free of single use plastic waste.

Along with the insider buying, another encouraging sign for International General Insurance Holdings is that insiders, as a group, have a considerable shareholding. Notably, they have an enormous stake in the company, worth US$158m. That equates to 34% of the company, making insiders powerful and aligned with other shareholders. Very encouraging.

Does International General Insurance Holdings Deserve A Spot On Your Watchlist?

International General Insurance Holdings's earnings have taken off like any random crypto-currency did, back in 2017. The cherry on top is that insiders own a bunch of shares, and one has been buying more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe International General Insurance Holdings deserves timely attention. However, before you get too excited we've discovered 3 warning signs for International General Insurance Holdings that you should be aware of.

As a growth investor I do like to see insider buying. But International General Insurance Holdings isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.