Lamb Weston (LW) Stock Up More Than 35% in 6 Months: Here's Why

Lamb Weston Holdings, Inc. LW is gaining from strength in its strategic growth efforts, like boosting offerings and expanding capacity. The provider of value-added frozen potato products is benefiting from effective pricing efforts. These upsides were seen in its first-quarter fiscal 2023 results, with the top and the bottom line increasing year over year.

The company reiterated its fiscal 2023 outlook as it continues to build operating momentum. In its last earnings call, management highlighted that while the macro environment remains volatile, it is on track to deliver results at the high end of the sales target of $4.7 billion to $4.8 billion, with price driving the upside. Management is on track to deliver at the high end of the range of its adjusted diluted earnings per share (EPS) in the band of $2.45-$2.85. The upside can be mainly attributed to sales growth and gross-margin expansion.

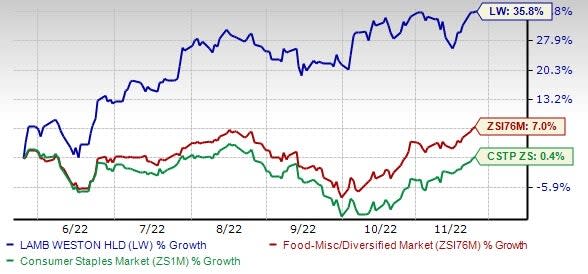

The Zacks Rank #1(Strong Buy) stock has gained 35.8% in the past six months compared with the industry’s 7% growth. The stock has comfortably outperformed the Zacks Consumer Staples sector’s 0.4% growth.

Let’s delve deeper.

Image Source: Zacks Investment Research

Pricing Actions Fuel Growth

Lamb Weston’s top line has been benefiting from robust price/mix, witnessed during the first quarter of fiscal 2023. The price/mix increased 19%, reflecting gains from pricing actions in the company’s core business segments to counter input, manufacturing and transportation cost inflation.

In the Global segment, price/mix increased 14% in the fiscal first quarter from the positive mix and domestic and international product and freight pricing actions undertaken to counter inflation. In the Foodservice business price/mix jumped 26%, reflecting carryover gains of product and freight pricing actions to mitigate inflation. In the Retail segment, price/mix advanced 32%, benefiting from the carryover impact of pricing actions in the branded and private label portfolios to counter inflation.

In its last earnings call, management highlighted that it expects to keep realizing the carryover benefit of product pricing actions in the Foodservice and Retail segments during fiscal 2023. In the Global segment, it expects to witness the benefit of pricing actions which includes pricing structures for contract renewals.

Efforts to Boost Capacity

Lamb Weston’s sturdy balance sheet and capacity to generate cash keep it well-placed to boost production capacity and fuel long-term growth. For 13 weeks ended Aug 28, 2022, capital expenditures (including IT expenditures) amounted to $121.2 million, as it continues to construct new French fry lines in Idaho and China. For fiscal 2023, the company expects cash used for capital expenditures in the band of $475-$525 million.

In September 2022, Lamb Weston unveiled expansion plans for french fry processing capacity in Argentina with the construction of a new manufacturing unit in Mar del Plata, Buenos Aires. In July 2021, the company announced the expansion plan for french fry processing capacity at its existing American Falls, ID facility – with an envisioned capacity to manufacture more than 350 million pounds of frozen french fries and other potato products annually. In March 2021, the company unveiled plans to build a new french fry processing facility in Ulanqab, Inner Mongolia, China. Lamb Weston’s efforts to boost offerings and expand capacity enable the company to effectively meet rising demand conditions for snacks and fries.

Apart from the abovementioned capacity-expansion endeavors, the company (in October 2022) signed an agreement to buy the remaining equity interests in its European joint venture with Meijer Frozen Foods B.V. The acquisition is in sync with LW’s capital allocation and acquisition framework. The move will solidify Lamb Weston’s manufacturing footprint to better serve its customers and tap into growth opportunities across Europe, the Middle East and Africa. The company (in Jul 2022) bought an additional 40% stake in Lamb Weston Alimentos Modernos S.A. ("LWAMSA") — which is its joint venture in Argentina — taking its total ownership to 90%.

We believe that such well-chalked expansion efforts and effective pricing actions will likely help LW stay in investors’ good books.

3 Solid Food Picks

Some top-ranked stocks are The Chef's Warehouse CHEF, General Mills GIS and Conagra Brands CAG.

The Chef's Warehouse, engaged in the distribution of specialty food products, currently sports a Zacks Rank #1. Chef's Warehouse has a trailing four-quarter earnings surprise of 93.8%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for CHEF’s current financial-year sales suggests growth of 46.5% from the year-ago reported number, while earnings indicate significant growth.

General Mills, which manufactures and markets branded consumer foods, carries a Zacks Rank #2 (Buy) at present. General Mills has a trailing four-quarter earnings surprise of 6.1%, on average.

The Zacks Consensus Estimate for GIS’ current financial-year sales and earnings suggests growth of 2.7% and 3.8%, respectively, from the year-ago reported numbers.

Conagra Brands, operating as a consumer-packaged goods food company, currently carries a Zacks Rank of 2. CAG has a trailing four-quarter earnings surprise of 1.8%, on average.

The Zacks Consensus Estimate for Conagra Brands’ current financial year sales and earnings suggests growth of 5.2% and 3.4%, respectively, from the corresponding year-ago reported figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Mills, Inc. (GIS) : Free Stock Analysis Report

Conagra Brands (CAG) : Free Stock Analysis Report

The Chefs' Warehouse, Inc. (CHEF) : Free Stock Analysis Report

Lamb Weston (LW) : Free Stock Analysis Report