MBIA (MBI) Price Target Decreased by 5.17% to 9.35

The average one-year price target for MBIA (NYSE:MBI) has been revised to 9.35 / share. This is an decrease of 5.17% from the prior estimate of 9.86 dated March 28, 2024.

The price target is an average of many targets provided by analysts. The latest targets range from a low of 7.07 to a high of 13.65 / share. The average price target represents an increase of 49.36% from the latest reported closing price of 6.26 / share.

What is the Fund Sentiment?

There are 259 funds or institutions reporting positions in MBIA.

This is a decrease

of

341

owner(s) or 56.83% in the last quarter.

Average portfolio weight of all funds dedicated to MBI is 0.05%,

a decrease

of 81.53%.

Total shares owned by institutions increased

in the last three months by 6.19% to 32,186K shares.

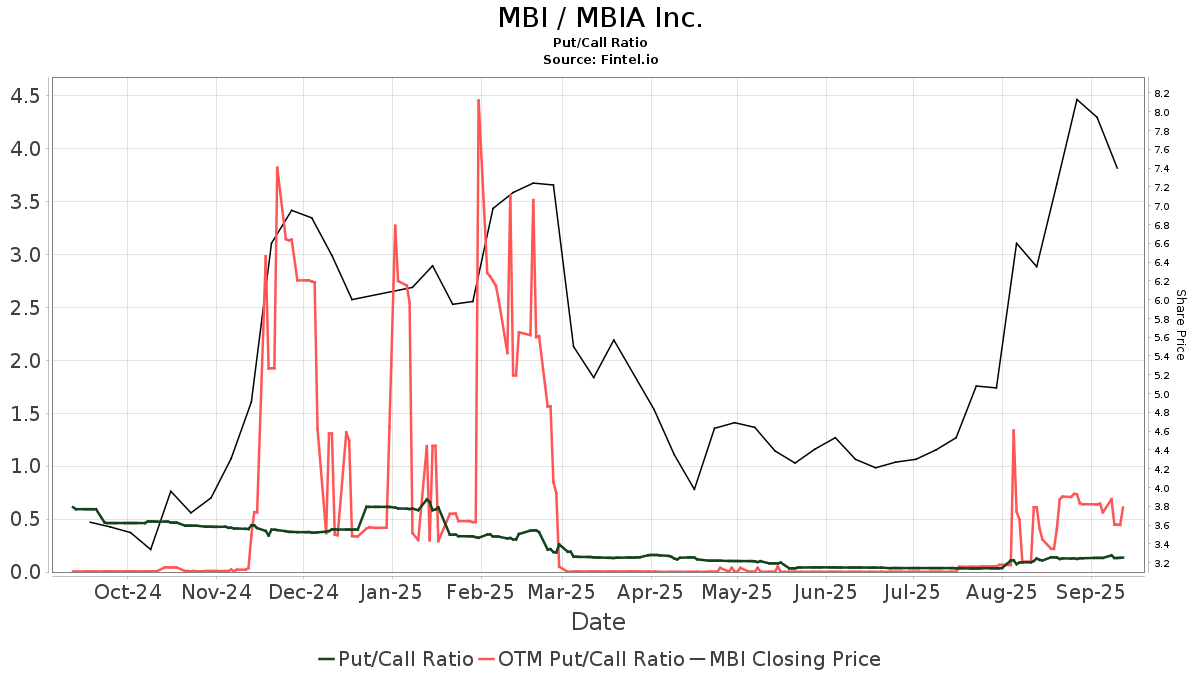

The put/call ratio of MBI is 0.90, indicating a

bullish

outlook.

The put/call ratio of MBI is 0.90, indicating a

bullish

outlook.

What are Other Shareholders Doing?

Kahn Brothers Group holds 4,830K shares representing 9.42% ownership of the company. In it's prior filing, the firm reported owning 4,809K shares, representing an increase of 0.42%. The firm decreased its portfolio allocation in MBI by 13.93% over the last quarter.

Newtyn Management holds 1,875K shares representing 3.66% ownership of the company. In it's prior filing, the firm reported owning 1,425K shares, representing an increase of 24.00%. The firm decreased its portfolio allocation in MBI by 11.16% over the last quarter.

Hosking Partners LLP holds 1,812K shares representing 3.53% ownership of the company. In it's prior filing, the firm reported owning 1,943K shares, representing a decrease of 7.23%. The firm decreased its portfolio allocation in MBI by 24.55% over the last quarter.

London Co Of Virginia holds 1,501K shares representing 2.93% ownership of the company. In it's prior filing, the firm reported owning 1,554K shares, representing a decrease of 3.49%. The firm decreased its portfolio allocation in MBI by 23.05% over the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 1,382K shares representing 2.70% ownership of the company. No change in the last quarter.

MBIA Background Information

(This description is provided by the company.)

MBIA Inc., headquartered in Purchase, New York, is a holding company whose subsidiaries provide financial guarantee insurance for the public and structured finance markets.

Stories by George Maybach

Tenet Healthcare (THC) Price Target Increased by 16.02% to 132.54

The average one-year price target for Tenet Healthcare (NYSE:THC) has been revised to 132.

Enthusiast Gaming Holdings (EGLXF) Price Target Decreased by 5.71% to 0.47

The average one-year price target for Enthusiast Gaming Holdings (OTCPK:EGLXF) has been revised to 0.

Draganfly (DPRO) Price Target Decreased by 47.91% to 0.78

The average one-year price target for Draganfly (NasdaqCM:DPRO) has been revised to 0.

Algonquin Power & Utilities - Preferred Security (AQNB) Price Target Decreased by 7.94% to 21.02

The average one-year price target for Algonquin Power & Utilities - Preferred Security (NYSE:AQNB) has been revised to 21.

QUALCOMM (QCOM) Price Target Increased by 5.04% to 184.01

The average one-year price target for QUALCOMM (NasdaqGS:QCOM) has been revised to 184.

Adyen N.V. - Depositary Receipt () (ADYEY) Price Target Decreased by 8.97% to 508.44

The average one-year price target for Adyen N.

Tetra Tech (TTEK) Price Target Increased by 7.13% to 221.17

The average one-year price target for Tetra Tech (NasdaqGS:TTEK) has been revised to 221.

NHPC (NSEI:NHPC) मूल्य लक्ष्य को 09.13% से बढ़ाकर 79.28 कर दिया गया

NHPC (NSEI:NHPC) के लिए औसत एक साल का मूल्य लक्ष्य संशोधित कर 79.

NHPC (NSEI:NHPC) Price Target Increased by 9.13% to 79.28

The average one-year price target for NHPC (NSEI:NHPC) has been revised to 79.

American Healthcare REIT (AHR) Price Target Decreased by 11.96% to 16.47

The average one-year price target for American Healthcare REIT (NYSE:AHR) has been revised to 16.