MSA Safety (MSA) Bacharach Buyout to Aid Gas-Detection Business

MSA Safety Incorporated MSA announced that it completed the buyout of New Kensington, PA-based Bacharach, Inc. as well as its associated companies. The other party to the buyout was San Francisco, CA-based private equity firm FFL Partners.

The purchase consideration for MSA Safety was $337 million. It is worth noting here that the buyout agreement was signed between the above-mentioned parties on May 24, 2021.

Bacharach specializes in providing gas-detection and related analysis products for use in heating, ventilation, air conditioning and refrigeration markets. Also, it operates in industrial refrigeration, automotive, food retail, military and commercial markets. It was founded in 1909 and has 200 people working for it in Ireland, Canada and the United States. The firm’s annual revenues are $70 million.

Inside the Headlines

As noted, MSA Safety financed $200 million of the buyout consideration by issuing 15-year senior notes, with an interest rate of 2.69% (fixed). The remaining part of the buyout consideration was funded using borrowings under its revolving credit facility. The facility has interest rates of 1.25-1.50%. The company also noted that the cost of financing the buyout, on an after-tax basis, is <2%.

The buyout of Bacharach will strengthen MSA Safety’s product portfolio, manufacturing capabilities and technologies, presence in multiple end markets, and geographical presence. Bacharach’s offerings will complement MSA Safety’s existing portfolio of gas-detection products, sold under Sierra Monitor, General Monitors and Senscient brands. Also, Bacharach’s employee base of 200 people will likely be advantageous for MSA Safety.

MSA Safety anticipates the Bacharach acquisition to boost its earnings by 10-15 cents per share in the second half of 2021 and by 25-35 cents in 2022. In addition to the earnings accretion, the company also predicts incremental stock compensation expense of $4 million for second-quarter 2021. This expense will likely impact the company’s adjusted and GAAP earnings per share.

MSA Safety’s Other Buyout Activities

The company believes in the expansion of product lines, strengthening footholds in the existing and new markets, and expanding the customer base through acquisitions. In January 2021, it acquired Bristol Uniforms for $60 million. The buyout has been strengthening MSA Safety’s fire service personal protective equipment offerings.

Zacks Rank, Estimate Trend and Price Performance

With a $6.5-billion market capitalization, MSA Safety currently carries a Zacks Rank #3 (Hold). The company is poised to benefit from its focus on product development, healthy cash flow, cost-saving measures and buyout activities. However, the pandemic-related woes are impacting its performance.

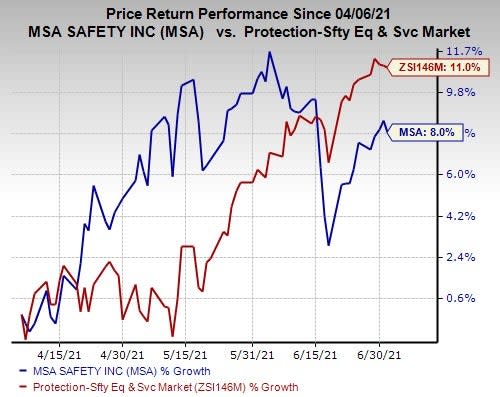

In the past three months, shares of the company have rallied 8% compared with the industry’s growth of 11%.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for earnings is pegged at $4.71 for 2021 and $5.41 for 2022. The estimates have been unchanged in the past 60 days. On a year-over-year basis, 2021 estimates suggest 4.7% growth and that for 2022 suggests a 14.9% increase.

Industry Players With Buyout Activities

Three companies from the same industry that engaged in acquisitive actions are Brady Corporation BRC, Verra Mobility Corporation VRRM and Allegion plc ALLE. While both Brady and Verra Mobility presently carry a Zacks Rank #2 (Buy), Allegion has a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In June 2021, Brady acquired Salt Lake City, UT-based The Code Corporation for $173 million. Also, the company added U.K.-based Magicard Limited for $59 million to its portfolio in May and bought Finland-based Nordic ID Oyj for $13 million in April.

Verra Mobility acquired Redflex Holdings Limited and its subsidiaries for A$152.5 million in June.

Likewise, Allegion acquired a technology company, Yonomi, in January.

Time to Invest in Legal Marijuana

If you’re looking for big gains, there couldn’t be a better time to get in on a young industry primed to skyrocket from $17.7 billion back in 2019 to an expected $73.6 billion by 2027.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could be a still greater bonanza for investors. Even before the latest wave of legalization, Zacks Investment Research has recommended pot stocks that have shot up as high as +285.9%.

You’re invited to check out Zacks’ Marijuana Moneymakers: An Investor’s Guide. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Allegion PLC (ALLE) : Free Stock Analysis Report

Brady Corporation (BRC) : Free Stock Analysis Report

MSA Safety Incorporporated (MSA) : Free Stock Analysis Report

VERRA MOBILITY CORP (VRRM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research