Jim Simons Adjusts Position in Taitron Components Inc

Overview of Jim Simons (Trades, Portfolio)'s Recent Trade

On December 29, 2023, Renaissance Technologies, led by Jim Simons (Trades, Portfolio), made a notable adjustment to its investment portfolio by reducing its stake in Taitron Components Inc (NASDAQ:TAIT). The transaction involved the sale of 9,517 shares at a price of $3.5299 per share, leaving the firm with a total of 297,204 shares in the company. This move reflects a strategic decision by the firm, which is known for its data-driven and quantitative investment approach.

Jim Simons (Trades, Portfolio) and Renaissance Technologies

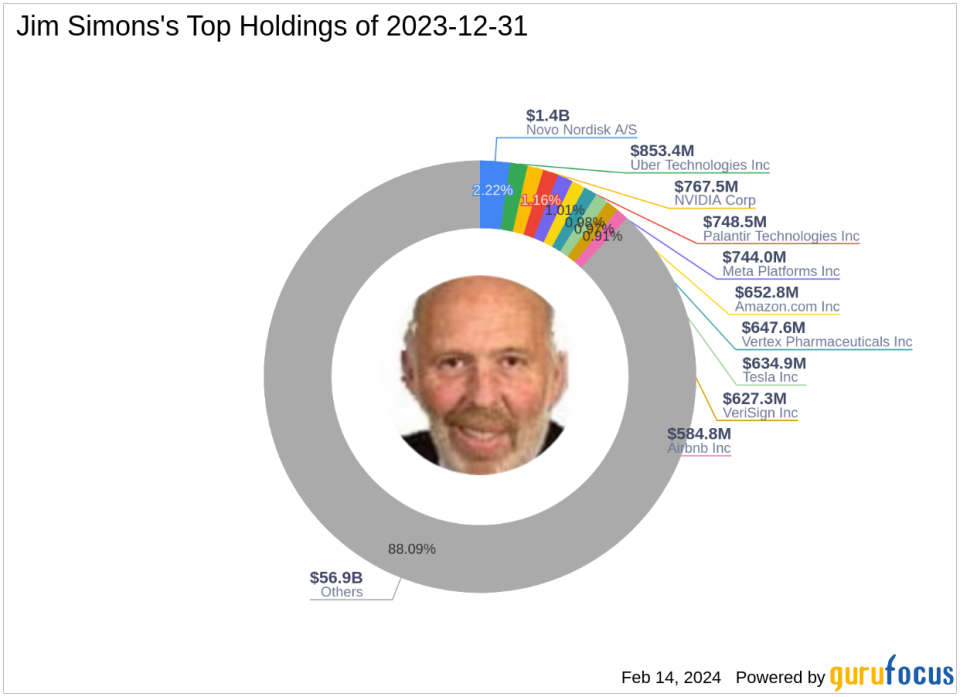

Jim Simons (Trades, Portfolio), the founder of Renaissance Technologies Corporation, has been a prominent figure in the investment world since 1982. The firm is renowned for its sophisticated mathematical models and automated trading strategies, which have consistently delivered strong returns. Simons's investment philosophy emphasizes the importance of scientific thinking and data analysis in uncovering market inefficiencies. Renaissance Technologies is particularly active in the technology and healthcare sectors, with top holdings including Meta Platforms Inc (NASDAQ:META), NVIDIA Corp (NASDAQ:NVDA), and Novo Nordisk A/S (NYSE:NVO).

Introduction to Taitron Components Inc

Taitron Components Inc, operating in the hardware industry, is a supplier and distributor of electronic components. The company specializes in providing original design and manufacturing (ODM) products, offering value-added engineering and turn-key solutions. Taitron caters to original equipment manufacturers (OEMs) and contract electronic manufacturers (CEMs) for their long-term projects. With a market capitalization of $19.448 million and a stock price of $3.23, Taitron has been a player in the market since its IPO in 1995.

Details of the Transaction

The reduction in shares by Renaissance Technologies has not significantly impacted the firm's overall position in Taitron, as the trade impact is currently at 0%. After the transaction, the firm's holding in Taitron represents 5.65% of its portfolio. Despite the sale, Renaissance Technologies maintains a substantial interest in the company, indicating a continued belief in its potential or strategic positioning within the portfolio.

Performance and Valuation Metrics

Taitron Components Inc is currently trading at a PE Percentage of 10.77, suggesting a reasonable valuation relative to earnings. The stock is deemed "Fairly Valued" according to the GF Value, with a GF Value of $3.17 and a price to GF Value ratio of 1.02. However, the stock has experienced a decline of 8.5% since the transaction date and a significant drop of 56.23% since its IPO. Year-to-date, the stock has also decreased by 7.18%.

Financial Health and Growth Prospects

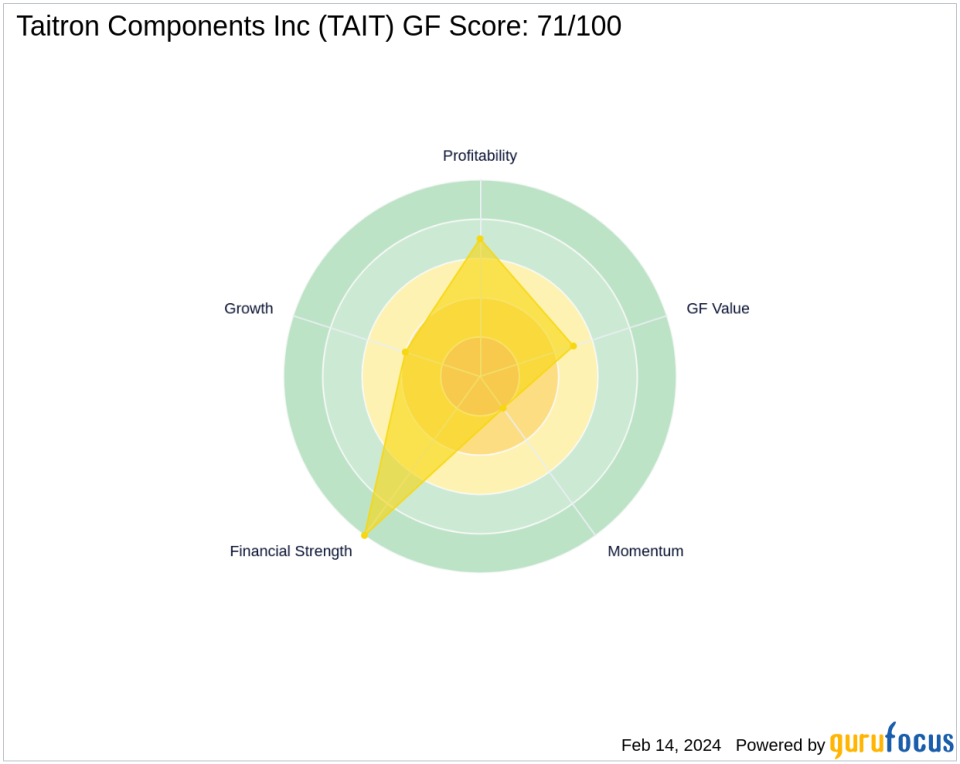

Taitron's financial health is robust, with a Balance Sheet Rank of 10/10 and a Profitability Rank of 7/10. However, its Growth Rank stands at 4/10, indicating potential challenges in expansion. The company's Operating Margin growth is at 19.10%, and it has seen a three-year EBITDA growth of 38.10%.

Comparative Stock Analysis

When comparing Taitron's stock performance to its intrinsic value, the company's shares appear to be trading close to their fair market value. The stock's GF Score of 71/100 suggests that it has average performance potential moving forward. The company's financial strength and profitability are solid, but its growth and momentum ranks indicate that there may be some concerns about its future expansion and stock price momentum.

Impact on Jim Simons (Trades, Portfolio)'s Portfolio

The recent transaction by Renaissance Technologies slightly reduces its exposure to Taitron Components Inc but does not signal a significant shift in strategy. With a portfolio heavily weighted in technology and healthcare, the firm's adjustment in Taitron's holdings may be part of a broader portfolio rebalancing or a response to changing market conditions. As of the latest data, Renaissance Technologies holds an equity of $64.61 billion, with Taitron remaining a part of its diverse investment landscape.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.