Announcing: Venator Materials (NYSE:VNTR) Stock Increased An Energizing 149% In The Last Year

Venator Materials PLC (NYSE:VNTR) shareholders have seen the share price descend 24% over the month. Despite this, the stock is a strong performer over the last year, no doubt about that. We're very pleased to report the share price shot up 149% in that time. So it is important to view the recent reduction in price through that lense. More important, going forward, is how the business itself is going.

See our latest analysis for Venator Materials

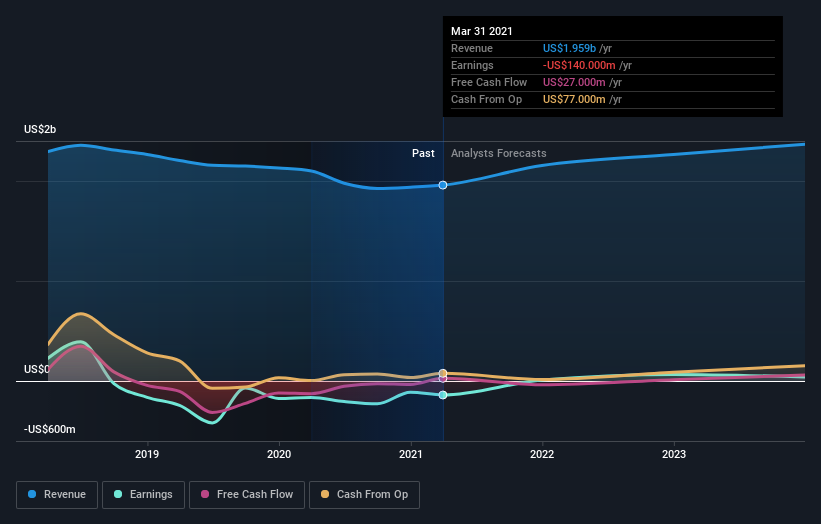

Given that Venator Materials didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last year Venator Materials saw its revenue shrink by 6.7%. We're a little surprised to see the share price pop 149% in the last year. This is a good example of how buyers can push up prices even before the fundamental metrics show much growth. Of course, it could be that the market expected this revenue drop.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Venator Materials is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So it makes a lot of sense to check out what analysts think Venator Materials will earn in the future (free analyst consensus estimates)

A Different Perspective

It's nice to see that Venator Materials shareholders have gained 149% (in total) over the last year. This recent result is much better than the 21% drop suffered by shareholders each year (on average) over the last three. We're generally cautious about putting too much weigh on shorter term data, but the recent improvement is definitely a positive. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 1 warning sign we've spotted with Venator Materials .

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.