Harley-Davidson (NYSE:HOG) Reports Strong Q1

American motorcycle manufacturing company Harley-Davidson (NYSE:HOG) reported Q1 CY2024 results topping analysts' expectations , with revenue down 3.3% year on year to $1.73 billion. It made a GAAP profit of $1.72 per share, down from its profit of $2.04 per share in the same quarter last year.

Is now the time to buy Harley-Davidson? Find out in our full research report.

Harley-Davidson (HOG) Q1 CY2024 Highlights:

Revenue: $1.73 billion (Consensus not comparable)

Operating income: $263 million vs analyst estimates of $264 million (slight miss)

EPS: $1.72 vs analyst estimates of $1.52 (12.9% beat)

Gross Margin (GAAP): 26.4%, down from 34.4% in the same quarter last year

Free Cash Flow of $57.64 million is up from -$20.38 million in the previous quarter

Motorcycle Shipments: 57,700

Market Capitalization: $5.31 billion

Founded in 1903, Harley-Davidson (NYSE:HOG) is an American motorcycle manufacturer known for its heavyweight motorcycles designed for cruising on highways.

Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

Sales Growth

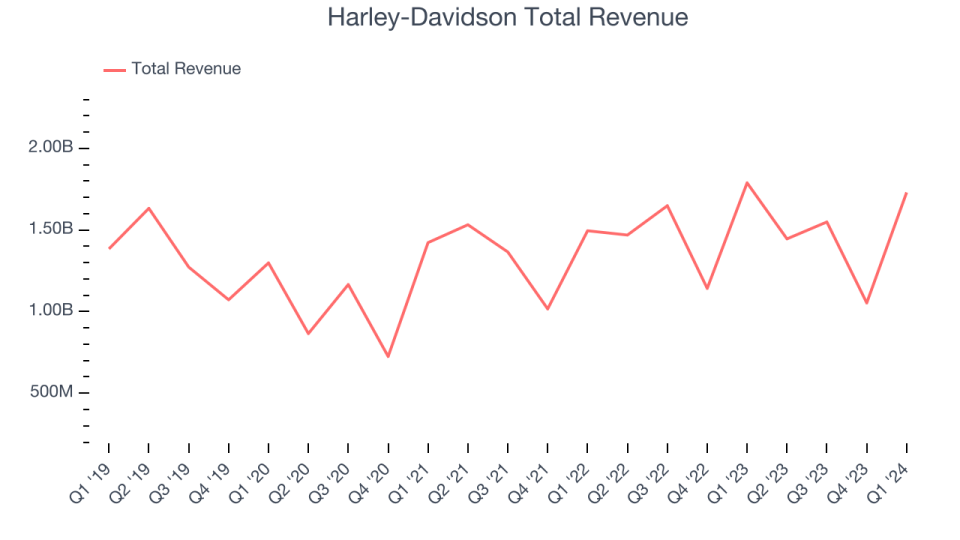

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Harley-Davidson's revenue was flat over the last five years.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Harley-Davidson's annualized revenue growth of 3.4% over the last two years is above its five-year trend, suggesting some bright spots.

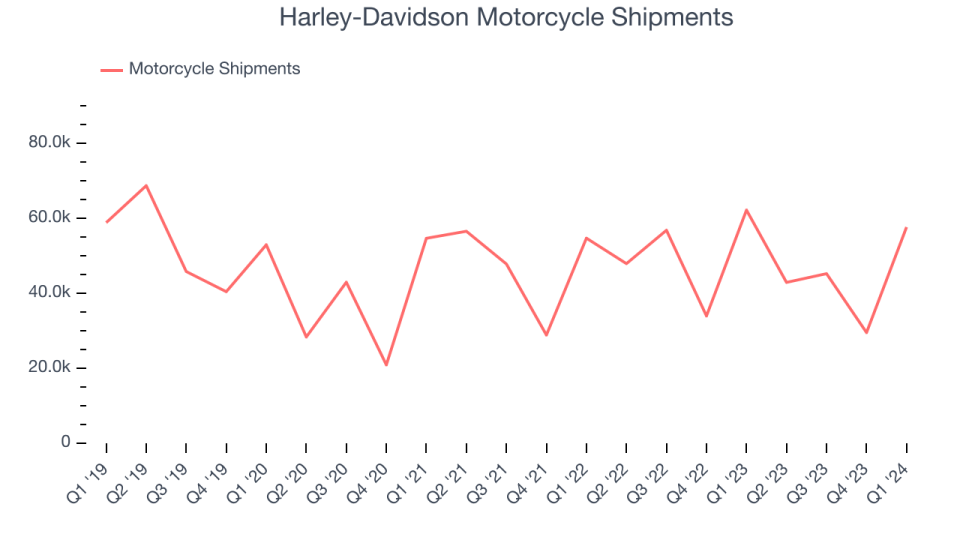

We can dig even further into the company's revenue dynamics by analyzing its number of motorcycle shipments, which reached 57,700 in the latest quarter. Over the last two years, Harley-Davidson's motorcycle shipments averaged 2% year-on-year declines. Because this number is lower than its revenue growth during the same period, we can see the company's monetization of its consumers has risen.

This quarter, Harley-Davidson's revenue fell 3.3% year on year to $1.73 billion but beat Wall Street's estimates by 28.4%. Looking ahead, Wall Street expects revenue to decline 19.5% over the next 12 months, a deceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

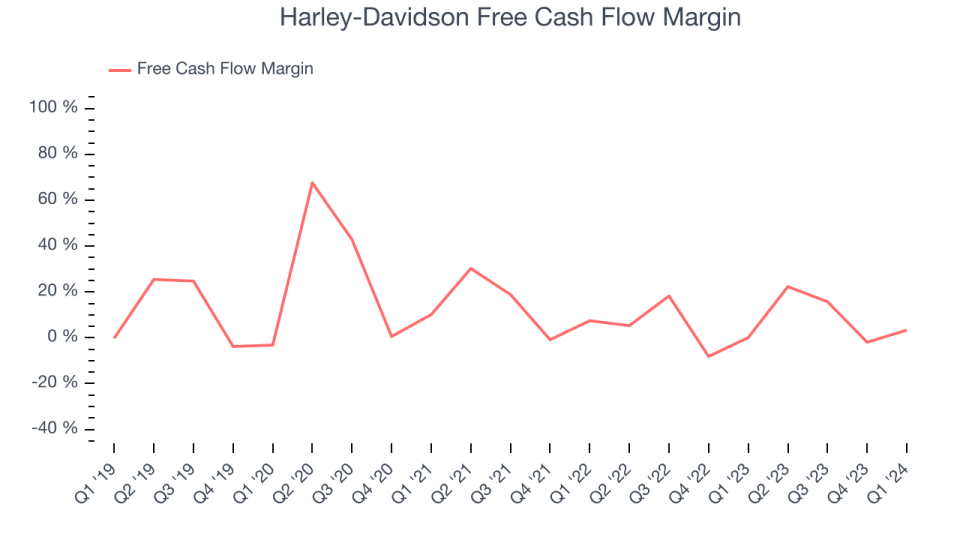

Over the last two years, Harley-Davidson has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 7.5%, subpar for a consumer discretionary business.

Harley-Davidson's free cash flow came in at $57.64 million in Q1, equivalent to a 3.3% margin and up 3,588% year on year.

Key Takeaways from Harley-Davidson's Q1 Results

Operating profit missed and both gross and operating margin in the core segment that sells motorcycles and parts declined meaningfully year over year. The results could have been better. The stock is down after reporting and currently trades at $39.11 per share.

So should you invest in Harley-Davidson right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.