Ashland (ASH) to Hike Prices for PSA Products in North America

Ashland Global Holdings Inc. ASH announced that it is raising prices for pressure sensitive adhesives (“PSA”) products in North America. The price hike will be between 7 cents/lb to 10 cents/lb. and include Arocure, Aroset and Flexcryl product lines.

Ashland will keep its focus on managing costs to deliver top-quality products and excellent service to consumers. The price increase was essential given the recent hike in prices of key raw materials and global freight.

The price rise is applicable world-wide and is effective Jul 19, 2021 or as permitted by the agreement.

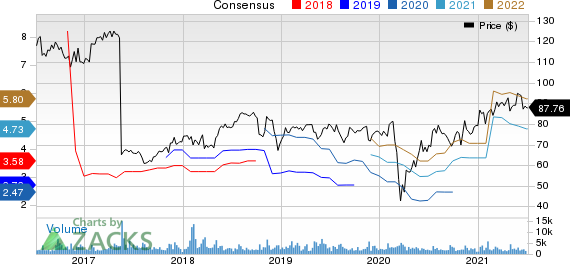

Shares of Ashland have gained 25.2% in the past year against 14.7% fall of the industry.

Image Source: Zacks Investment Research

Last month, Ashland announced an update for preliminary third-quarter fiscal 2021 and full-year financial results. It noted that restricted availability of some raw materials as well as shipping, logistics and packaging challenges are offsetting demand.

The company expects $5-$10 million of adjusted EBITDA pressure in fiscal third quarter. The company anticipates these factors to stabilize in fiscal fourth quarter. Also, Ashland reaffirmed its adjusted EBITDA guidance for fiscal 2021 at $570-$590 million.

Ashland’s Performance Adhesives segment is also being affected by high raw-material cost and restricted availability. This is impacting the company’s ability to meet customer demand. Ashland is undertaking pricing actions to offset the impact of high raw material costs.

Ashland Global Holdings Inc. Price and Consensus

Ashland Global Holdings Inc. price-consensus-chart | Ashland Global Holdings Inc. Quote

Zacks Rank & Key Picks

Ashland currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Nucor Corporation NUE, Olin Corporation OLN and Cabot Corporation CBT.

Nucor has a projected earnings growth rate of around 386.2% for the current year. The company’s shares have surged 134.4% in a year. It currently flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Olin has an expected earnings growth rate of around 506.7% for the current year. The company’s shares have skyrocketed 316.7% in the past year. It currently carries a Zacks Rank #2 (Buy).

Cabot has an expected earnings growth rate of around 137.5% for the current fiscal. The company’s shares have surged 55.9% in the past year. It currently flaunts a Zacks Rank #1.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it’s poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in a little more than 9 months and Nvidia which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nucor Corporation (NUE) : Free Stock Analysis Report

Ashland Global Holdings Inc. (ASH) : Free Stock Analysis Report

Cabot Corporation (CBT) : Free Stock Analysis Report

Olin Corporation (OLN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research