Better Times Are Ahead for Barrick Gold

In February, Toronto-based Barrick Gold Corp. (NYSE:GOLD) reported its fourth quarter and full-year results for 2023.

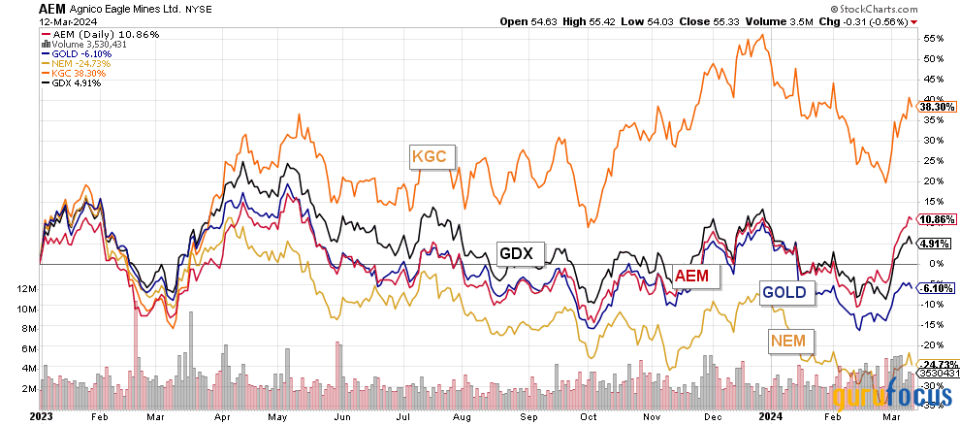

Barrick Gold is one of my top four long-term gold miners, along with Newmont (NYSE:NEM), Agnico Eagle (NYSE:AEM) and Kinross Gold (NYSE:KGC). These companies should be the first choice for an average investor looking to make a long-term investment in gold.

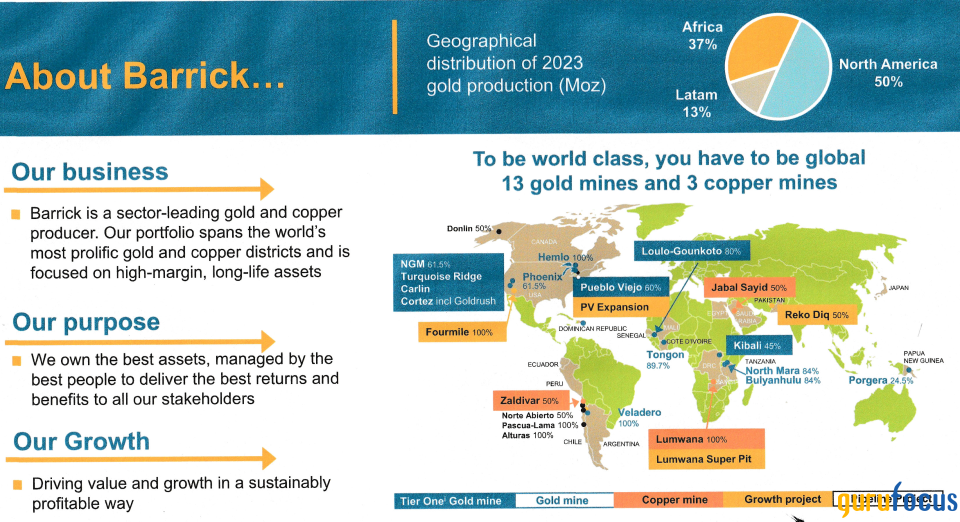

Based on a recent presentation, it was revealed that half of Barrick Gold's production comes from North America, with 13 gold mines and three copper mines.

Agnico Eagle and Kinross Gold have outperformed the VanEck Gold Miner ETF (GDX), rising 11% and 38% year over year, compared to the exchange-traded fund's 5% increase. Barrick Gold and Newmont, on the other hand, have continued to underperform, falling by 6% and 25% in a single year.

The spot price of gold ended at $2,156 an ounce on Friday. It should have driven gold stocks higher, but that is not happening. It proved the relationship between gold miners and the metal is not as strong as the correlation between oil producers and oil prices.

Gold prices have experienced a significant increase in the past six and a half years. In October 2018, the price was approximately $1,200 per ounce, and it has now climbed to $2,159, nearing an all-time high. Unfortunately, the mining industry has not followed the same trajectory.

A variety of factors contributed to the mining industry's underperformance. We can identify a few intrinsic factors that could explain Barrick Gold's undervaluation.

First, the number of favorable jurisdictions for gold mining has decreased over the last decade. Many previously safe jurisdictions in Asia, Africa and Latin America are now under threat. Political risks have resulted in a valuation decline that is difficult to reverse for companies like Barrick Gold, whose output is partially dependent on less favorable locations like West Africa.

Barrick, for example, intends to resume operations at the Porgera mine in Papua New Guinea. The mine has been under care and maintenance since 2020 due to the country's refusal to renew permits and renegotiate the agreement. With a 49% stake, Barrick is now the mine's operator.

It is the same issue that Freeport-McMoRan (NYSE:FCX) encountered with its Grasberg gold and copper mine in Papua New Guinea. We can also recall the North Mara in Tanzania, which experienced numerous setbacks a few years ago before resuming production under a new agreement.

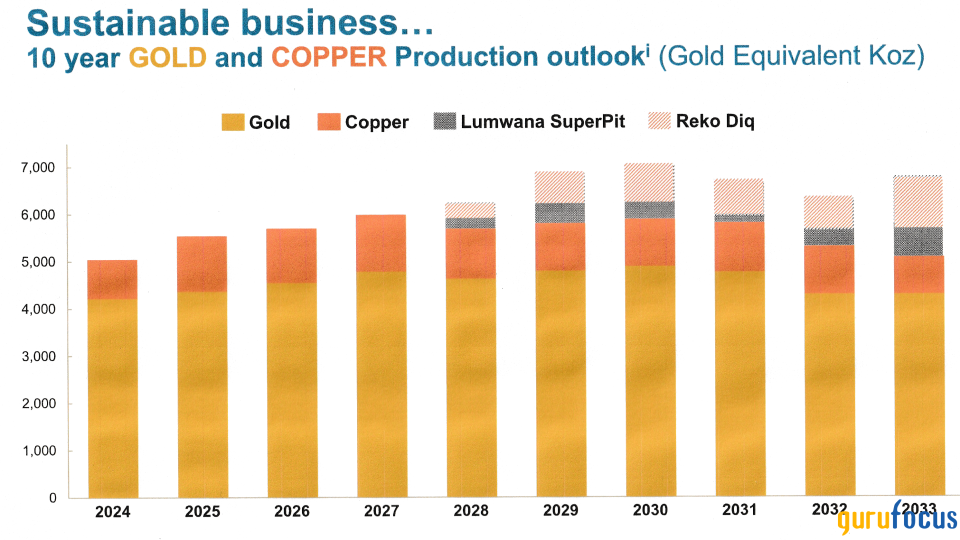

One of the company's main strategic priorities is to raise copper production. Lumwana's development is planned to produce 240,000 tons of copper annually. Additionally, the company is progressing with its Reko Diq project, which focuses on gold and copper production.

The project's capital expenditure is expected to be $7 billion, with a potential start date of 2025 and first production in 2028. It is a significant investment, but I have some reservations. Balochistan Province in Pakistan faces increasing security threats and local opposition to the project. The company seems intent to press on even though local tribes claim ownership of the site and the Baloch Raji Aajoi Sangar insurgent organization warned it to stay away.

As a result, when investing in Barrick Gold, it is critical to consider these risk factors. Investors hesitant to expose themselves to high-risk companies should look into Agnico Eagle, which has a much safer asset portfolio, or Newmont, which is undervalued and owns good tier-1 assets.

Regardless, CEO Mark Bristow clearly stated why the company's strategy will be successful and noted its 2023 reserves are an important indicator. He said during the fourth-quarter conference call:

"Highlights of the year were our sustained and industry-leading gold and copper reserve replacement, one of the key differentiators between Barrick and its peers."

Mineral reserves for 2023 are now 77 million ounces of gold, 5.6 million tons of copper and 170 million ounces of silver. This is much higher than Agnico Eagle's 53.8 million ounces of gold, 56.9 million ounces of silver and 0.7 million tons of copper.

However, Newmont is the leading gold miner in reserves with 135.9 million ounces of gold, 596 million ounces of silver and 13.6 million tons of copper following the recent acquisition of Newcrest. Unfortunately, large mineral reserves are not a guarantee of success.

Fouth-quarter results snapshot and commentary

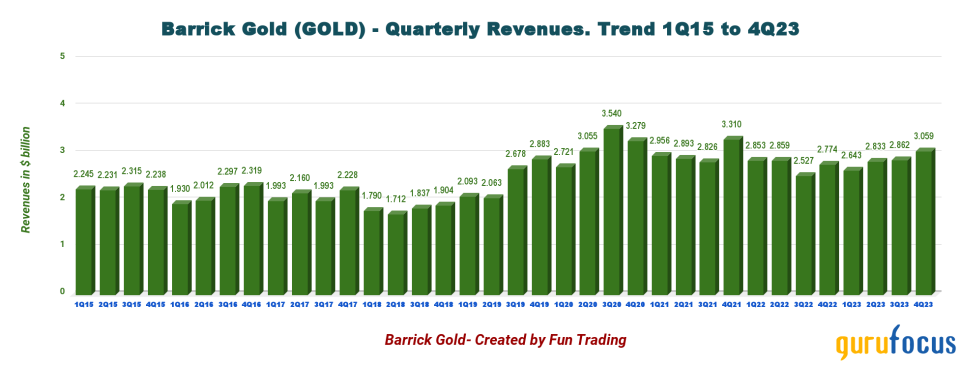

Barrick's net earnings rose from a loss of $735 million, or 42 cents, in the same period last year to a profit of $479 million, or 27 cents per diluted share, in fourth-quarter 2023. Revenue rose from $2.77 billion in the fourth quarter of 2022 to $3.06 billion.

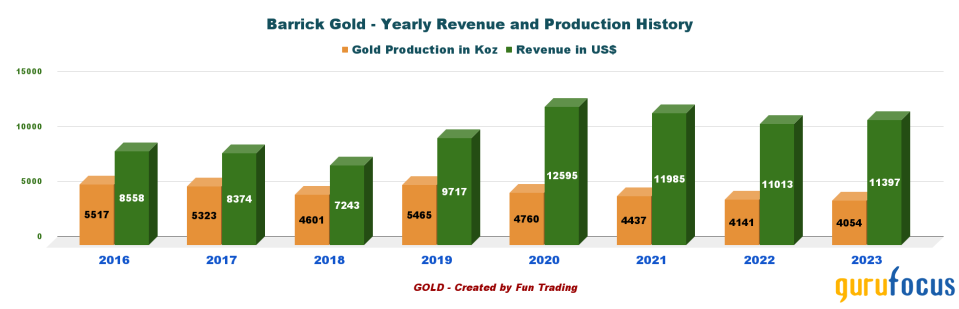

Yearly revenue and production were slightly better than the preceding year, as shown below:

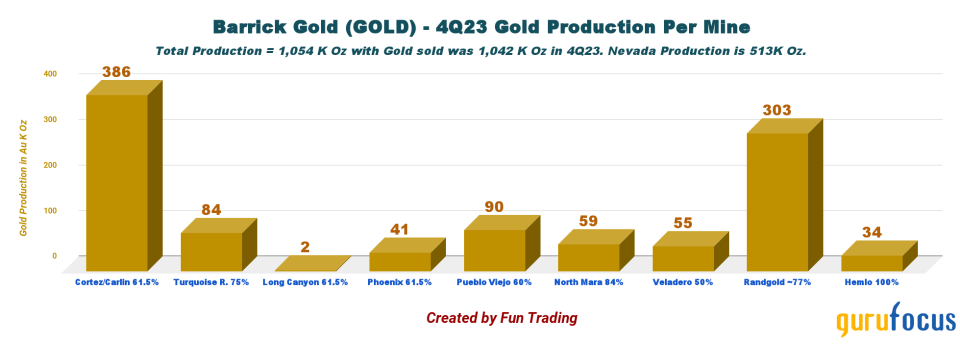

The results exceeded analysts' expectations, indicating the company's production is expanding. I was pleasantly surprised by Nevada's mine production this quarter, which totaled 513,000 ounces of gold equivalent, up from 478,000 ounces in the third quarter of 2023.

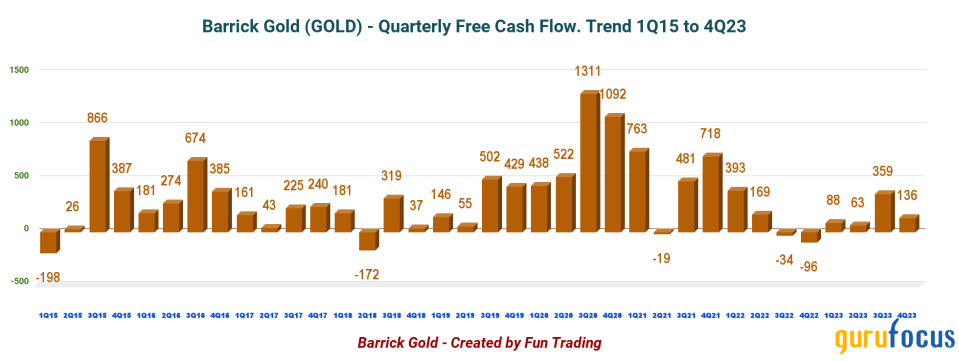

The trailing 12-month free cash flow was $626 million, but was $136 million in the fourth quarter. I find it a little low.

The cash flow generated from operations was $997 million, higher than the previous year's $795 million. This capital expenditure was $861 million, slightly lower than the previous year.

The company is experiencing a positive impact due to the rise in gold prices and increased output. This trend is expected to continue as the current price of gold is more than $2,160 per ounce. Moreover, Barrick Gold is confident about producing a solid amount of gold equivalent production until 2033.

On Feb. 13, the board of directors authorized a new share buyback program to purchase up to $1 billion of Barrick's outstanding common shares over the next 12 months. The company did not buy back any shares in 2023.

According to the company's dividend policy, Barrick Gold announced a quarterly dividend of 10 cents per share in the fourth quarter, offering a 2.50% dividend yield.

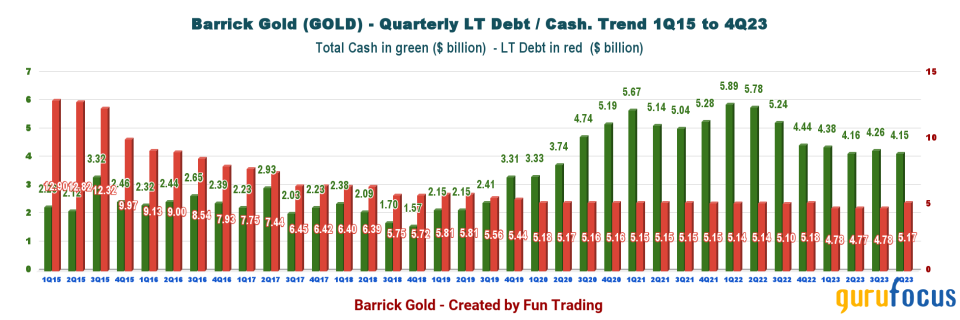

Finally, the debt situation has increased noticeably with $1.02 billion in net debt and a net debt-to-Ebitda ratio of 0.15. The chart below shows net debt is up slightly quarter over quarter.

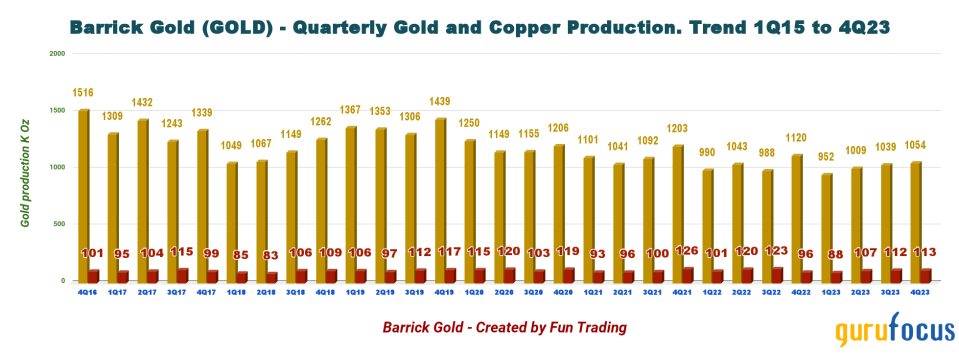

Gold and copper production

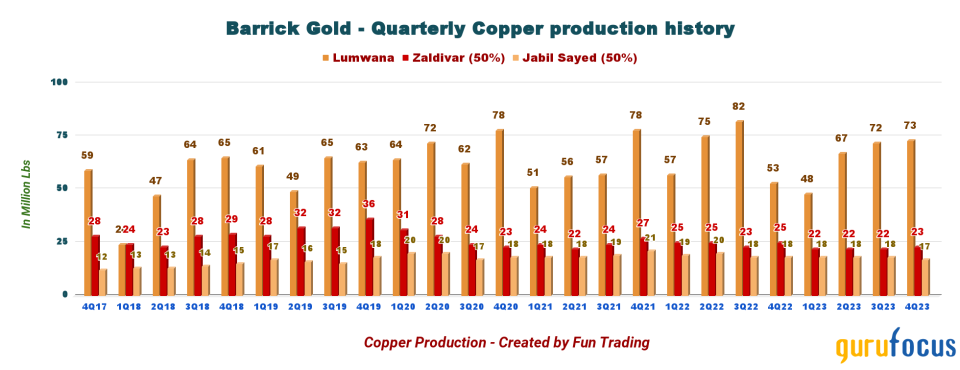

During the fourth quarter, 1,054,000 ounces of gold (1,042,000 ounces sold) and 113 million pounsd of copper (117 million pounds sold) were produced at a gold price of $1,971 per ounce. While gold production fell by 5.90% per year, copper production rose by 17.70%.

The realized average copper price was $3.78 per pound compared to $3.81 last year.

Gold production has steadily increased over the next four quarters and is expected to continue with the restart of the Porgera mine in the first quarter of 2024. Gold production per mine is indicated below:

As for copper, the Lumwana mine did particularly well with 73 million pounds, up 1.50% quarter over quarter. The Lumwana feasibility study is on track for completion by the end of 2024.

Copper production is likely to increase, with the price of copper increasing to $3.78 per pound this quarter.

Technical analysis and commentary

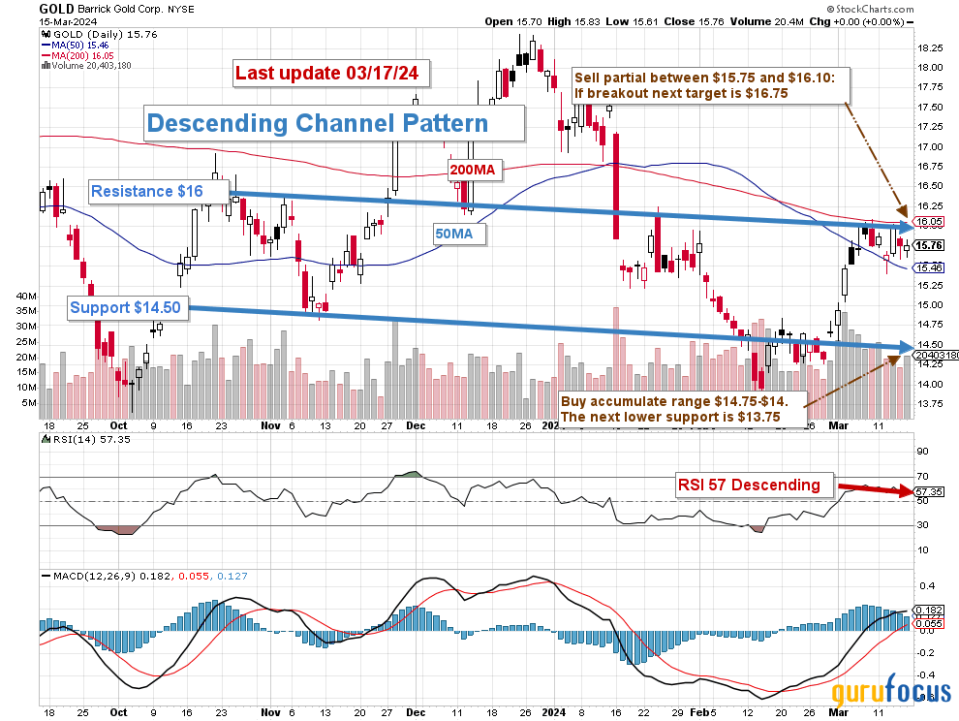

Note, the dividend is taken into account in the chart.

Gold follows a descending channel pattern, with resistance at $16 and support at $14.50. The relative strength index is now 57, insignificant enough to indicate a possible extended trend. The chart pattern is still descending, suggesting a short-term bearish trend. However, after a brief period of consolidation, it could signal a longer-term upward trend. Notice how the stock price retraced to the 50-day moving average, which is frequently used as a weak intermediate support.

It is recommended to keep a core long-term holding and allocate roughly 40% to LIFO trading while waiting for a potential final breakthrough in 2024, assuming gold prices stay between $2,150 and $2,200 per ounce.

Selling between $15.90 and $16.25 is the recommended mid-term trading strategy; a higher resistance level at $16.75 might also be present. I recommend accumulating between $14.75 and $14, with a lower potential support at $13.75

Warning: The TA chart must be updated frequently to be relevant. The chart above has a possible validity of about a week or two.

This article first appeared on GuruFocus.