Trimble (TRMB) Q3 Earnings Meet Mark, Revenues Fall Y/Y

Trimble Inc. TRMB reported third-quarter 2022 non-GAAP earnings of 66 cents per share, which matched the Zacks Consensus Estimate. The bottom line also matched the year-ago quarter’s figure but rose 3.1% sequentially.

TRMB’s revenues of $884.9 million missed the Zacks Consensus Estimate by 2.8%. Also, the figure was down 1.8% year over year and 6% sequentially.

The top-line decrease was attributed to declining product and services revenues. Also, weak momentum across geospatial and transportation segments negatively impacted the quarterly performance.

Softening demand in Europe, macroeconomic headwinds, and supply-chain constraints remained overhangs.

However, strong momentum across the building and infrastructure, and resources and utilities segments drove the quarterly revenues.

TRMB generated annualized recurring revenues of $1.55 billion in the reported quarter, which increased 13% on a year-over-year basis.

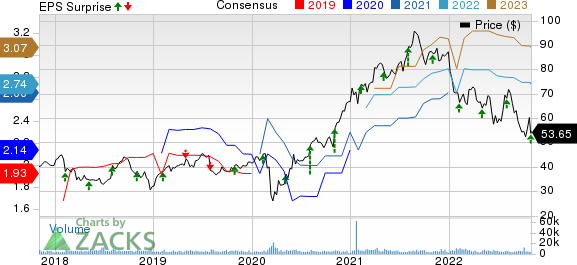

Trimble Inc. Price, Consensus and EPS Surprise

Trimble Inc. price-consensus-eps-surprise-chart | Trimble Inc. Quote

Top Line in Detail

Product revenues (accounting for 57% of total revenues) summed $503.9 million, down 8.6% on a year-over-year basis. Subscription revenues (25%) increased 17% from the year-ago quarter’s level to $222.7 million. Services revenues (18%) of $158.3 million dipped 1% from the year-ago quarter’s reported figure.

Trimble operates under the following four organized segments:

Buildings and Infrastructure: The segment generated revenues of $363.6 million (accounting for 41% of total revenues), which increased 4% on a year-over-year basis. The rise in revenues was driven by strong growth at e-Builder, Viewpoint, SketchUp and civil construction.

Geospatial: This segment generated revenues of $184.2 million (21% of total revenues), which fell 10.3% from the prior-year quarter’s level. The segment was affected by reduced hardware sales and supply-chain constraints.

Resources and Utilities: This segment generated revenues of $191.7 million (22% of total revenues), up 3.7% from the prior-year quarter’s level. Higher revenues were attributed to healthy agricultural markets. Also, strong growth in positioning services remained positive.

Transportation: The segment generated revenues of $145.4 million (accounting for 16% of total revenues), which dropped 10% on a year-over-year basis. The segment’s revenues were down due to reduced hardware sales in North America.

Operating Details

For the third quarter, non-GAAP gross margin came in at 60.9%, expanding 220 basis points (bps) year over year.

On a non-GAAP basis, operating expenses accounted for 37.1% of revenues and expanded 220 bps from the year-ago quarter’s figure.

Non-GAAP operating margin came in at 23.7%, which contracted 10 bps year over year.

Balance Sheet

At the end of third-quarter 2022, cash and cash equivalents were $308.7 million, down from $350.1 million at the end of second-quarter 2022.

Accounts receivables were $566.1 million in the reported quarter, decreasing from $589.3 million in the prior quarter.

Total debt was $1.59 billion at the third-quarter end compared with $1.29 billion at the second-quarter end.

Guidance

For 2022, Trimble lowered its guidance for revenues from $3.76-$3.82 billion to $3.67-$3.72 billion. The Zacks Consensus Estimate for full-year revenues is pegged at $3.79 billion.

Trimble also decreased 2022 non-GAAP earnings per share from $2.70-$2.80 to $2.61-$2.67. The Zacks Consensus Estimate for current-year earnings per share is pegged at $2.75.

Management expects its non-GAAP tax rate of 18.3% for 2022.

Zacks Rank & Stocks to Consider

Currently, Trimble has a Zacks Rank #4 (Sell).

Investors interested in the broader Zacks Computer & Technology sector can consider some better-ranked stocks like US Foods USFD, The Trade Desk TTD and Tencent Music Entertainment Group TME, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

US Foods is set to report third-quarter 2022 results on Nov 10. The Zacks Consensus Estimate for USFD’s earnings is pegged at 59 cents per share, suggesting an increase of 22.9% from the prior-year period’s reported figure. USFD has lost 17.5% in the year-to-date period. Its long-term earnings growth rate is currently projected at 20%.

The Trade Desk is scheduled to release third-quarter 2022 results on Nov 9. The Zacks Consensus Estimate for TTD’s earnings is pegged at 24 cents per share, suggesting an increase of 33.3% from the prior-year quarter’s reported figure. TTD has lost 46% in the year-to-date period. TTD’s long-term earnings growth rate is currently projected at 24%.

Tencent Music is scheduled to release third-quarter 2022 results on Nov 15. The Zacks Consensus Estimate for TME’s earnings is pegged at 11 cents per share, suggesting an increase of 22.2% from the prior-year quarter’s reported figure. TME has lost 45.4% in the year-to-date period. TME’s long-term earnings growth rate is currently projected at 17.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Trimble Inc. (TRMB) : Free Stock Analysis Report

US Foods Holding Corp. (USFD) : Free Stock Analysis Report

The Trade Desk (TTD) : Free Stock Analysis Report

Tencent Music Entertainment Group Sponsored ADR (TME) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research