Bear of the Day: CarMax (KMX)

Stocks have staged a strong rebound in 2023, a welcomed development following a forgettable 2022.

In addition, many of them have seen their earnings outlooks drift higher so far in the year, but the same can’t be said for CarMax KMX.

The company currently sports a Zacks Rank #5 (Strong Sell), with earnings revisions heading entirely in the wrong direction.

Image Source: Zacks Investment Research

CarMax is the largest retailer of used vehicles in the U.S. and one of the nation's largest operators of wholesale vehicle auctions. The company operates under two reportable segments: CarMax Sales Operations and CarMax Auto Finance (CAF).

Let’s take a closer look at how the company currently stacks up.

Valuation

Presently, KMX shares trade at a 24.4X forward earnings multiple, above the 16.8X five-year median by a notable margin and the Zacks Retail and Wholesale sector average.

Image Source: Zacks Investment Research

In addition, the company’s forward price-to-sales works out to be a small 0.4X, below the five-year median of 0.7X and the Zacks sector average.

Image Source: Zacks Investment Research

The stock carries a Style Score of “C” for Value.

Growth Outlook

KMX is slated to take a growth hit, with estimates for its current fiscal year (FY23) indicating a 60% pullback in earnings and a 6% drop in revenue.

Earnings growth resumes in FY24, with the Zacks Consensus EPS Estimate of $2.93 suggesting a 4% increase in the bottom line year-over-year.

Quarterly Performance

CarMax has recently struggled to exceed quarterly estimates, falling short of earnings and revenue estimates in back-to-back quarters.

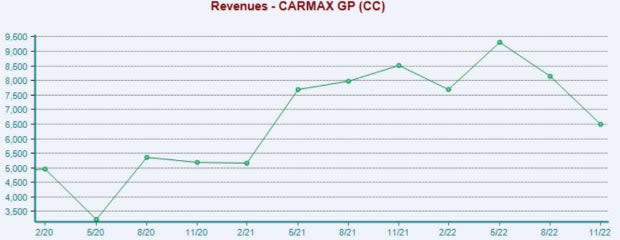

Just in its latest release, KMX fell short of earnings expectations by nearly 60% and reported sales 10% below expectations. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Bottom Line

Negative earnings estimate revisions and weak quarterly results paint a less-than-ideal picture for the company in the short term.

CarMax, Inc. KMX is a Zacks Rank #5 (Strong Sell), telling us it has a weak near-term earnings outlook.

Investors should pivot to stocks that either carry a Zacks Rank #1 (Strong Buy) or Zacks Rank #2 (Buy) – these stocks have a much stronger earnings outlook and potential to deliver explosive gains in the short term.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CarMax, Inc. (KMX) : Free Stock Analysis Report