Capitol Federal Financial's (NASDAQ:CFFN) Dividend Will Be $0.085

Capitol Federal Financial, Inc. (NASDAQ:CFFN) has announced that it will pay a dividend of $0.085 per share on the 17th of May. The dividend yield will be 7.1% based on this payment which is still above the industry average.

View our latest analysis for Capitol Federal Financial

Capitol Federal Financial Not Expected To Earn Enough To Cover Its Payments

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained.

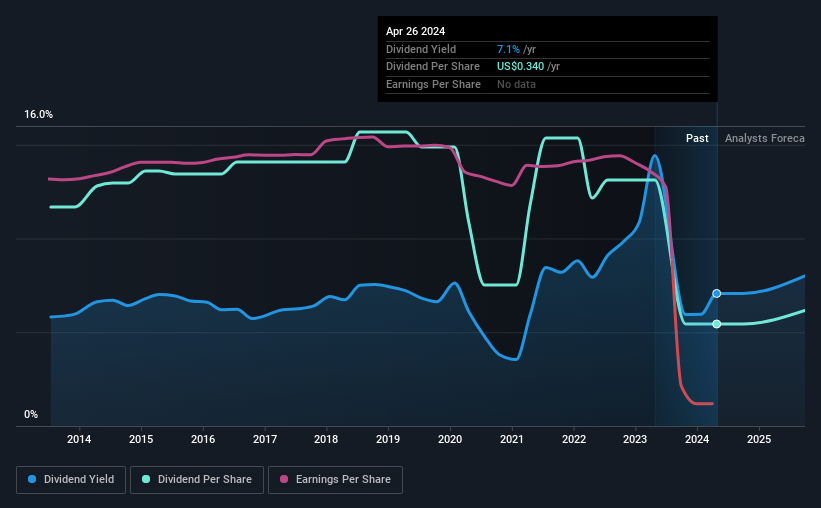

Capitol Federal Financial has established itself as a dividend paying company with over 10 years history of distributing earnings to shareholders. Past distributions unfortunately do not guarantee future ones, and Capitol Federal Financial's last earnings report actually showed that the company went over its net earnings in its total dividend distribution. This is an alarming sign that could mean that Capitol Federal Financial's dividend at its current rate may no longer be sustainable for longer.

The next 12 months is set to see EPS grow by 140.4%. Assuming the dividend continues along recent trends, we think the future payout ratio could reach 95%, which probably can't continue putting some pressure on the balance sheet.

Dividend Volatility

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. Since 2014, the dividend has gone from $0.73 total annually to $0.34. The dividend has shrunk at around 7.4% a year during that period. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

Dividend Growth Potential Is Shaky

With a relatively unstable dividend, and a poor history of shrinking dividends, it's even more important to see if EPS is growing. Capitol Federal Financial's EPS has fallen by approximately 35% per year during the past five years. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in. It's not all bad news though, as the earnings are predicted to rise over the next 12 months - we would just be a bit cautious until this becomes a long term trend.

We're Not Big Fans Of Capitol Federal Financial's Dividend

In summary, while it is good to see that the dividend hasn't been cut, we think that at current levels the payment isn't particularly sustainable. The company's earnings aren't high enough to be making such big distributions, and it isn't backed up by strong growth or consistency either. Overall, the dividend is not reliable enough to make this a good income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. To that end, Capitol Federal Financial has 2 warning signs (and 1 which is potentially serious) we think you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.