SelectQuote's (NYSE:SLQT) Shareholders Are Down 27% On Their Shares

Investors can approximate the average market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Unfortunately the SelectQuote, Inc. (NYSE:SLQT) share price slid 27% over twelve months. That contrasts poorly with the market return of 41%. SelectQuote may have better days ahead, of course; we've only looked at a one year period. In the last ninety days we've seen the share price slide 45%.

See our latest analysis for SelectQuote

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

SelectQuote managed to increase earnings per share from a loss to a profit, over the last 12 months.

Earnings per share growth rates aren't particularly useful for comparing with the share price, when a company has moved from loss to profit. So it makes sense to check out some other factors.

SelectQuote's revenue is actually up 92% over the last year. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

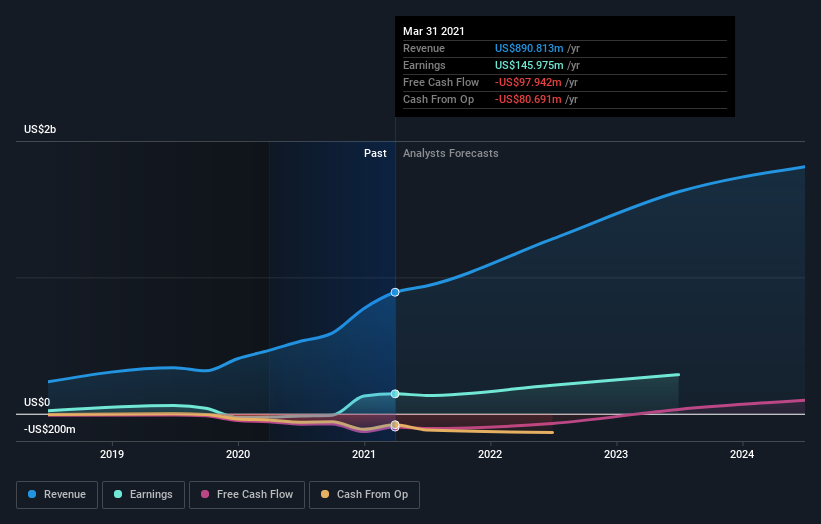

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It is of course excellent to see how SelectQuote has grown profits over the years, but the future is more important for shareholders. You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Given that the market gained 41% in the last year, SelectQuote shareholders might be miffed that they lost 27%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. Notably, the loss over the last year isn't as bad as the 45% drop in the last three months. So it seems like some holders have been dumping the stock of late - and that's not bullish. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for SelectQuote (of which 2 are potentially serious!) you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.