3 High Insider Ownership Growth Companies With Earnings Expanding By 34%

Amid a buoyant U.S. stock market, where investors are keenly analyzing first-quarter earnings and anticipating key economic events like the Federal Reserve meeting, certain growth companies with high insider ownership stand out. In this environment, firms with substantial insider stakes may offer unique advantages, as these insiders often have a deep commitment to the company's long-term success.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Growth Rating |

PDD Holdings (NasdaqGS:PDD) | 32.1% | ★★★★★★ |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 28.6% | ★★★★★★ |

Li Auto (NasdaqGS:LI) | 35.2% | ★★★★★★ |

FTC Solar (NasdaqGM:FTCI) | 32.6% | ★★★★★★ |

Finance of America Companies (NYSE:FOA) | 17% | ★★★★★★ |

Cipher Mining (NasdaqGS:CIFR) | 19.6% | ★★★★★★ |

Alkami Technology (NasdaqGS:ALKT) | 14.4% | ★★★★★★ |

Carlyle Group (NasdaqGS:CG) | 27.3% | ★★★★★★ |

EHang Holdings (NasdaqGM:EH) | 33% | ★★★★★★ |

BBB Foods (NYSE:TBBB) | 23.8% | ★★★★★★ |

Below we spotlight a couple of our favorites from our exclusive screener.

Amazon.com

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Amazon.com, Inc. operates as a global online retailer and provides advertising and subscription services, with additional physical store offerings, boasting a market capitalization of approximately $1.87 trillion.

Operations: The company's revenue is derived from three primary segments: North America which generated $352.83 billion, International operations at $131.20 billion, and Amazon Web Services (AWS) contributing $90.76 billion.

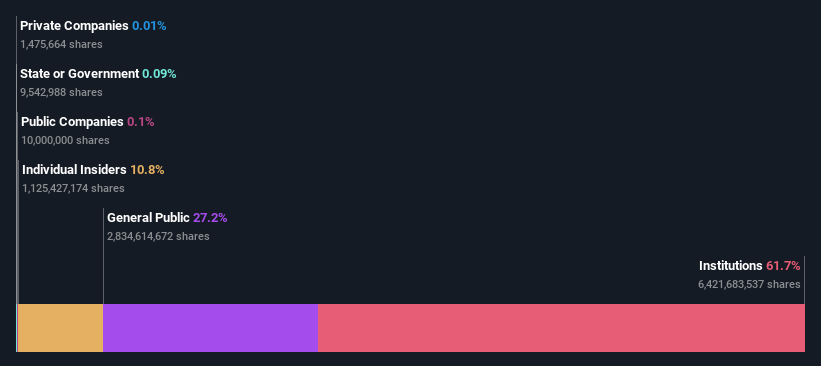

Insider Ownership: 10.8%

Earnings Growth Forecast: 21.7% p.a.

Amazon.com, despite its vast size and influence, shows a mixed scenario in terms of growth and insider ownership. The company's revenue is expected to grow at 9.9% annually, slightly above the US market average but well below high-growth benchmarks. Earnings are anticipated to increase significantly, with forecasts suggesting a 21.7% annual rise over the next three years—outpacing general market projections. However, Amazon's Return on Equity (ROE) is projected to remain modest at 17.9%. Recent shareholder activism highlights ongoing demands for greater transparency and responsibility in environmental and human rights practices, reflecting both challenges and engagement opportunities for investors focused on corporate governance.

Click here and access our complete growth analysis report to understand the dynamics of Amazon.com.

The valuation report we've compiled suggests that Amazon.com's current price could be inflated.

PDD Holdings

Simply Wall St Growth Rating: ★★★★★★

Overview: PDD Holdings Inc., a multinational commerce group, operates a diverse portfolio of businesses and has a market capitalization of approximately $179.58 billion.

Operations: The company's revenue from Internet Software & Services totals CN¥247.64 billion.

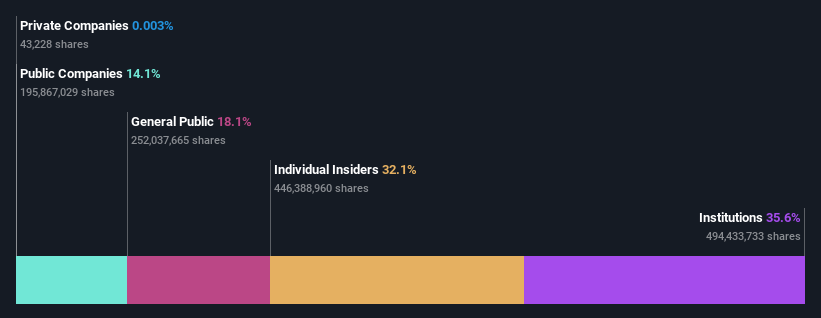

Insider Ownership: 32.1%

Earnings Growth Forecast: 23% p.a.

PDD Holdings, a notable player in the growth sector with high insider ownership, reported robust financial results for 2023, with sales more than doubling to CNY 247.64 billion and net income nearly doubling to CNY 60.03 billion. Despite recent shareholder dilution, PDD is trading at a significant discount of 60.1% below its fair value and analysts predict a potential price increase of 42%. The company's revenue and earnings are expected to grow at an impressive rate of 20.8% and 23% per year respectively, outpacing the US market forecasts significantly.

Super Micro Computer

Simply Wall St Growth Rating: ★★★★★★

Overview: Super Micro Computer, Inc. is a global company that develops and manufactures high-performance server and storage solutions based on modular and open architecture, with a market capitalization of approximately $50.20 billion.

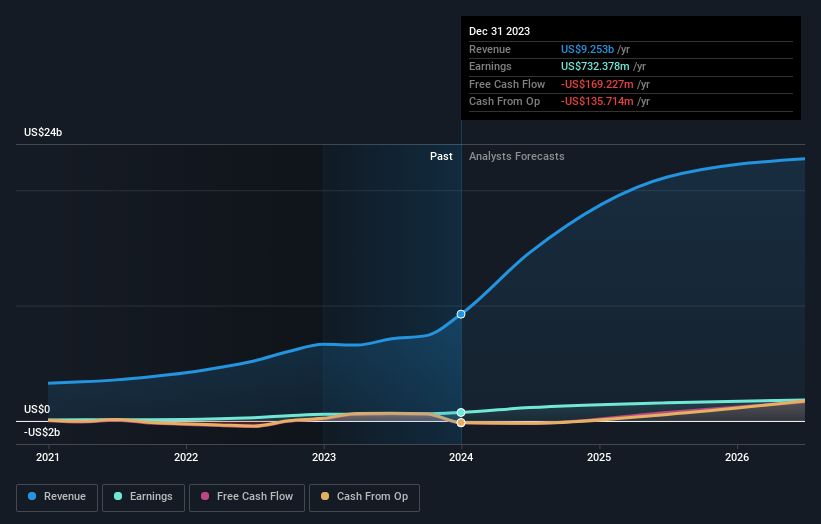

Operations: The company generates $9.25 billion from its high-performance server solutions segment.

Insider Ownership: 14.3%

Earnings Growth Forecast: 34% p.a.

Super Micro Computer, Inc. (SMCI) exhibits strong growth prospects with earnings forecasted to increase by 34% annually over the next three years, outstripping the US market's expected 14.7% growth rate. Despite a volatile share price recently, SMCI's revenue is also set to expand significantly at 24.8% per year. However, there has been notable insider selling and no substantial insider buying in the past three months, which could raise concerns about insider confidence levels moving forward.

Taking Advantage

Take a closer look at our Fast Growing Companies With High Insider Ownership list of 199 companies by clicking here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities.

Companies discussed in this article include NasdaqGS:AMZN NasdaqGS:PDD and NasdaqGS:SMCI.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com