Signature Bank (NASDAQ:SBNY) Is Due To Pay A Dividend Of US$0.56

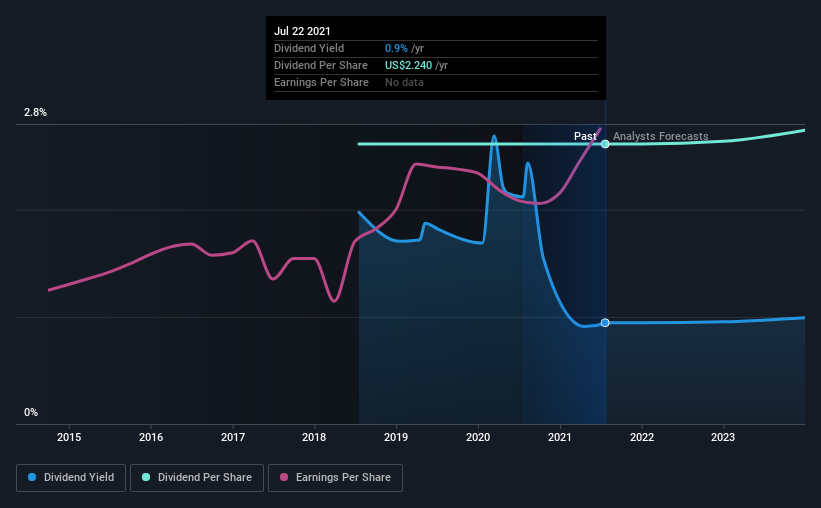

The board of Signature Bank (NASDAQ:SBNY) has announced that it will pay a dividend on the 13th of August, with investors receiving US$0.56 per share. Including this payment, the dividend yield on the stock will be 0.9%, which is a modest boost for shareholders' returns.

Check out our latest analysis for Signature Bank

Signature Bank's Payment Has Solid Earnings Coverage

The dividend yield is a little bit low, but sustainability of the payments is also an important part of evaluating an income stock. However, prior to this announcement, Signature Bank's dividend was comfortably covered by both cash flow and earnings. As a result, a large proportion of what it earned was being reinvested back into the business.

The next year is set to see EPS grow by 21.0%. If the dividend continues along recent trends, we estimate the payout ratio will be 14%, which is in the range that makes us comfortable with the sustainability of the dividend.

Signature Bank Doesn't Have A Long Payment History

The company has maintained a consistent dividend for a few years now, but we would like to see a longer track record before relying on it. The payments haven't really changed that much since 3 years ago. We like that the dividend hasn't been shrinking. However we're conscious that the company hasn't got an overly long track record of dividend payments yet, which makes us wary of relying on its dividend income.

The Dividend Looks Likely To Grow

The company's investors will be pleased to have been receiving dividend income for some time. Signature Bank has seen EPS rising for the last five years, at 10% per annum. Growth in EPS bodes well for the dividend, as does the low payout ratio that the company is currently reporting.

The company has also been raising capital by issuing stock equal to 13% of shares outstanding in the last 12 months. Regularly doing this can be detrimental - it's hard to grow dividends per share when new shares are regularly being created.

We Really Like Signature Bank's Dividend

Overall, we think that this is a great income investment, and we think that maintaining the dividend this year may have been a conservative choice. Distributions are quite easily covered by earnings, which are also being converted to cash flows. All in all, this checks a lot of the boxes we look for when choosing an income stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've picked out 1 warning sign for Signature Bank that investors should know about before committing capital to this stock. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.