REAL TIME PRICE

EXTENDED HOURS

| Day’s Range | - |

| 52 Week Range | - |

| Arrangement of Transporta... | |

B of A Securities Initiates Coverage of Expeditors International of Washington (EXPD) with Neutral Recommendation

Fintel reports that on March 15, 2024, B of A Securities initiated coverage of Expeditors International of Washington (NYSE:EXPD) with a Neutral recommendation.

Analyst Price Forecast Suggests 7.23% Downside

As of March 11, 2024, the average one-year price target for Expeditors International of Washington is 111.18. The forecasts range from a low of 84.84 to a high of $136.50. The average price target represents a decrease of 7.23% from its latest reported closing price of 119.85.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Expeditors International of Washington is 12,982MM, an increase of 39.59%. The projected annual non-GAAP EPS is 5.53.

What is the Fund Sentiment?

There are 1639 funds or institutions reporting positions in Expeditors International of Washington.

This is an increase

of

46

owner(s) or 2.89% in the last quarter.

Average portfolio weight of all funds dedicated to EXPD is 0.25%,

a decrease

of 7.16%.

Total shares owned by institutions decreased

in the last three months by 3.80% to 154,631K shares.

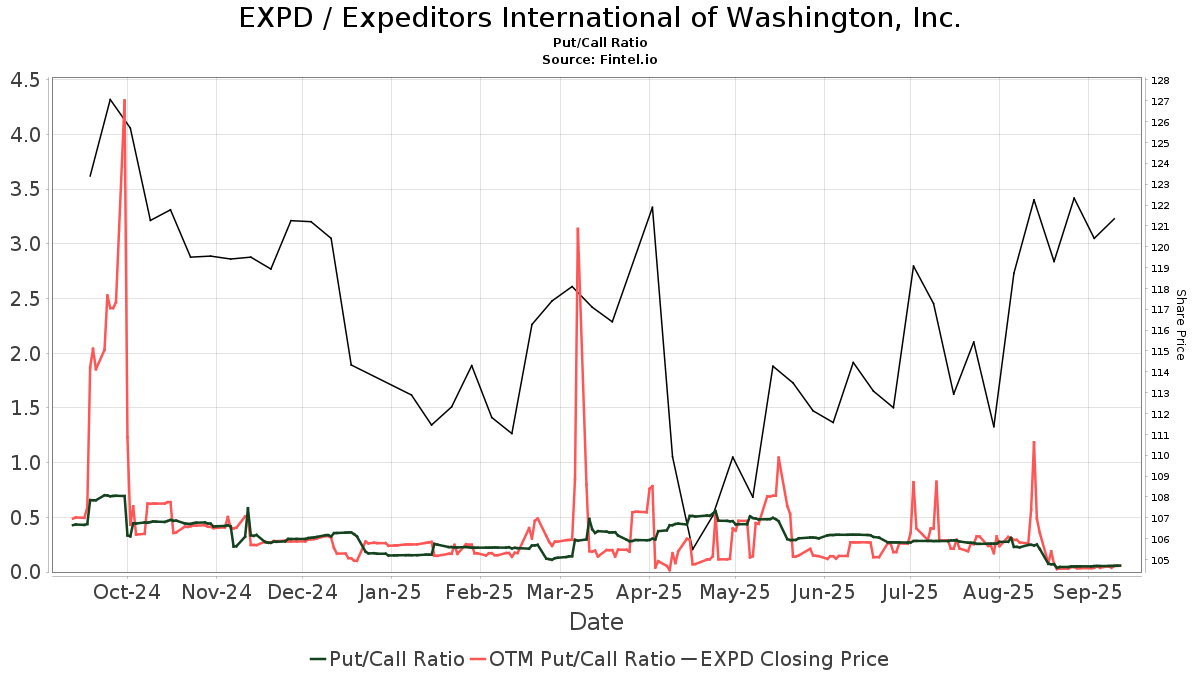

The put/call ratio of EXPD is 0.32, indicating a

bullish

outlook.

The put/call ratio of EXPD is 0.32, indicating a

bullish

outlook.

What are Other Shareholders Doing?

Loomis Sayles & Co L P holds 6,152K shares representing 4.28% ownership of the company. In it's prior filing, the firm reported owning 6,215K shares, representing a decrease of 1.03%. The firm decreased its portfolio allocation in EXPD by 66.82% over the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 4,550K shares representing 3.16% ownership of the company. In it's prior filing, the firm reported owning 4,594K shares, representing a decrease of 0.97%. The firm decreased its portfolio allocation in EXPD by 1.79% over the last quarter.

Geode Capital Management holds 3,593K shares representing 2.50% ownership of the company. In it's prior filing, the firm reported owning 3,736K shares, representing a decrease of 3.98%. The firm decreased its portfolio allocation in EXPD by 6.31% over the last quarter.

VFINX - Vanguard 500 Index Fund Investor Shares holds 3,554K shares representing 2.47% ownership of the company. In it's prior filing, the firm reported owning 3,554K shares, representing an increase of 0.00%. The firm decreased its portfolio allocation in EXPD by 1.98% over the last quarter.

VIMSX - Vanguard Mid-Cap Index Fund Investor Shares holds 3,260K shares representing 2.27% ownership of the company. In it's prior filing, the firm reported owning 3,349K shares, representing a decrease of 2.74%. The firm decreased its portfolio allocation in EXPD by 3.47% over the last quarter.

Expeditors International Of Washington Background Information

(This description is provided by the company.)

Expeditors is a global logistics company headquartered in Seattle, Washington. The Company employs trained professionals in 176 district offices and numerous branch locations located on six continents linked into a seamless worldwide network through an integrated information management system. Services include the consolidation or forwarding of air and ocean freight, customs brokerage, vendor consolidation, cargo insurance, time-definite transportation, order management, warehousing and distribution and customized logistics solutions.

Stories by George Maybach

Nippon Pillar Packing Co. (TSE:6490) 価格予想増加 26.99% - 6,606.20

1年の平均価格予想、Nippon Pillar Packing Co.

Nippon Pillar Packing Co. (TSE:6490) Price Target Increased by 26.99% to 6,606.20

The average one-year price target for Nippon Pillar Packing Co.

Aston Martin Lagonda Global Holdings plc - Depositary Receipt () (ARGGY) Price Target Decreased by 5.24% to 3.12

The average one-year price target for Aston Martin Lagonda Global Holdings plc - Depositary Receipt () (OTCPK:ARGGY) has been revised to 3.

Rezolute (RZLT) Price Target Increased by 15.08% to 9.86

The average one-year price target for Rezolute (NasdaqCM:RZLT) has been revised to 9.

Kinross Gold (KGC) Price Target Increased by 11.46% to 8.21

The average one-year price target for Kinross Gold (NYSE:KGC) has been revised to 8.

Toyota Motor Corporation - Depositary Receipt () (TM) Price Target Decreased by 9.10% to 231.06

The average one-year price target for Toyota Motor Corporation - Depositary Receipt () (NYSE:TM) has been revised to 231.

VBI Vaccines (VBIV) Price Target Decreased by 16.67% to 5.10

The average one-year price target for VBI Vaccines (NasdaqCM:VBIV) has been revised to 5.

Cullinan Therapeutics (CGEM) Price Target Increased by 21.52% to 32.64

The average one-year price target for Cullinan Therapeutics (NasdaqGS:CGEM) has been revised to 32.

Origin Materials (ORGN) Price Target Increased by 33.21% to 3.03

The average one-year price target for Origin Materials (NasdaqCM:ORGN) has been revised to 3.

Tempest Therapeutics (TPST) Price Target Increased by 14.25% to 21.68

The average one-year price target for Tempest Therapeutics (NasdaqCM:TPST) has been revised to 21.