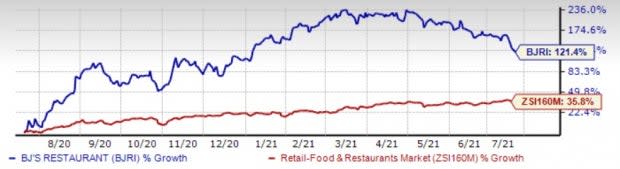

BJ's Restaurants (BJRI) Up 121% in Past Year: More Room to Run?

BJ's Restaurants, Inc. BJRI has been benefitting from digital efforts, loyalty program and other sales-building initiatives. Also, focus on off-premise business model and product introduction have been important factors for sales improvement over the last few quarters.

In the past year, shares of BJ’s Restaurants have gained 121.4% compared with the Retail - Restaurants industry’s 35.8% rise. The price performance was backed by a solid earnings surprise history. BJ’s Restaurants’ earnings surpassed the Zacks Consensus Estimate in five of the trailing six quarters. Earnings estimates for full-year 2021 and 2022 have moved up 3.6% and 0.4%, respectively, in the past 30 days. This positive trend signifies bullish analyst sentiments and justifies the company’s Zacks Rank #2 (Buy). This indicates robust fundamentals and expectation of outperformance in the near term. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Factors Driving Growth

Digitization Efforts: BJ’s Restaurants continues to drive awareness in its key markets through greater and more targeted marketing. In order to attract more customers, the company has rolled out several initiatives like digital check-ins, digital menus and digital payment options. Also, its transition from the current PDF form factor to a dynamic HTML version is encouraging. Additionally, the company’s loyalty guest database continues to grow well with the steady increase in transactions. The company is so far witnessing double-digit increases in loyalty sign up as well as similar increases in reward redemptions.

Emphasis on Off-Premise Sales: Although BJ’s Restaurants has reopened majority of its dining rooms with limited capacity, its off-premise operations continue to be a driving factor for overall sales. Notably, offerings such as individually portioned group meals, expanded family feast and bundle offerings have been major contributors to its off-premise sales. Moreover, upgrades in kitchen systems along with front-end order and pickup technology have been boosting consumers’ optimism and order accuracy. Going forward, the company expects the momentum to continue as more customers are resonating well with the expanded off-premise offerings along with its connected curbside service.

Focus on Menu Innovation: Meanwhile, the company continues to focus on refining and streamlining its menu for improved traffic. During fourth-quarter 2020, the company began testing its virtual brand — slow roast — across its 13 restaurants. The delivery-only concept features slow roast items and other protein-centric products. Backed by impressive sales and solid customer feedback, the company expanded the testing to approximately 30 restaurants across California and Texas in first-quarter 2021. Nonetheless, the company continues to focus on menu adjustments and pricing structure as it intends to establish a broader rollout plan in the upcoming periods.

Other Sales-Building Initiatives: To boost sales from its dine-in services, the restaurant operator has implemented glass partitions in its dining rooms to expand capacity. It has also initiated construction of outside dining spaces in nearly half of its restaurants. During the first quarter, the company installed temporary patio spaces in more than one-third of its restaurants. Meanwhile, the company has been receiving positive reviews with respect to its beer subscription service — Beer Club. Notably, high customer engagement is being witnessed on the back of new beer releases along with program benefits. Going forward, the company plans to expand this program at majority of its California restaurants and other states as well.

Image Source: Zacks Investment Research

Other Key Picks

A few other stocks which warrant a look in the same industry are Starbucks Corporation SBUX, The Wendy's Company WEN and Chuy's Holdings, Inc. CHUY, each carrying a Zacks Rank #2.

Starbucks has a three-five-year earnings per share growth rate of 12%.

The Wendy's Company has a trailing four-quarter earnings surprise of 17.3 %, on average.

Chuy's Holdings 2021 earnings are expected to rise 85.7% year over year, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BJs Restaurants, Inc. (BJRI) : Free Stock Analysis Report

Starbucks Corporation (SBUX) : Free Stock Analysis Report

The Wendys Company (WEN) : Free Stock Analysis Report

Chuys Holdings, Inc. (CHUY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research