Five Below (FIVE) Earnings and Sales Miss Estimates in Q4

Five Below, Inc. FIVE reported mixed fourth-quarter fiscal 2023 results, wherein the top and bottom lines missed the Zacks Consensus Estimate. However, net sales and earnings increased on a year-over-year basis. Management cited that an improved transaction trend and sales growth contributed to the company’s performance amid macroeconomic headwinds.

Five Below, Inc. Price, Consensus and EPS Surprise

Five Below, Inc. price-consensus-eps-surprise-chart | Five Below, Inc. Quote

Let’s Delve Deeper

Five Below posted earnings per share of $3.65 in the fourth quarter of fiscal 2023, lagging the Zacks Consensus Estimate of $3.78 per share. However, the company’s earnings per share increased 18.9% from $3.07 in the year-ago quarter.

Net sales of $1,337.7 million increased 19.1% year over year but missed the Zacks Consensus Estimate of $1,350 million. Comparable sales for the quarter under discussion rose 3.1% against a decrease of 1.9% registered in the year-ago period. The increase was driven by 3.9% growth in comparable transactions. Our estimate for comparable sales growth was pegged at 2.8% for the quarter.

The gross profit grew 21.9% year over year to $551.6 million. Meanwhile, the gross margin contracted 90 basis points (bps) to 41.2%, primarily driven by lower inbound freight and leverage on fixed costs due to the extra week. The metric fell short of our estimate of 41.8%.

We note that selling, general and administrative (“SG&A”) expenses shot up 24.5% to $246.1 million. SG&A, as a percentage of net sales, decreased approximately 80 bps to 18.4%, attributed to the comparison with the previous year's cost-control strategies and a rise in incentive compensation from the prior year. Our estimate for SG&A expenses, as a rate of net sales, was pegged at 21.1% for the quarter under review.

Operating income was up 18.9% to $268.4 million for the quarter under discussion. The operating margin was 20.1% in the quarter compared with our estimate of 20.7%.

Financials

Five Below ended the fiscal fourth quarter with cash and cash equivalents of $179.7 million, and short-term investment securities of $280.3 million. Total shareholders’ equity was $1,585 million as of Feb 3, 2024. The company repurchased shares worth $80 million during the quarter.

Store Update

Five Below opened 63 stores in the reported quarter. This took the total count to 1,544 stores in 43 states as of Feb 3, 2024, reflecting an increase of 15.2% from the year-ago count. The company plans to open 225-235 stores in fiscal 2024. FIVE has converted more than 450 stores to the new Five Beyond format. In fiscal 2023, the company opened 205 stores and ended the year with more than half of its comparable stores in the Five Beyond format.

Image Source: Zacks Investment Research

Guidance

For the first quarter of fiscal 2024, net sales are expected to be $826-$846 million, which indicates a year-over-year increase of 13.7-16.5%. Comparable sales growth is projected between flat and 2%. It expects to generate a net income of $32-$38 million. The company plans to open 55-60 stores.

Management anticipates fiscal first-quarter earnings per share between 58 cents and 69 cents, whereas it reported 67 cents in the year-ago period.

Five Below projects fiscal 2024 net sales of $3.97-$4.07 billion, whereas it posted $3.56 billion in fiscal 2023. For fiscal 2023, the company anticipates comparable sales to see between flat and 3% growth.

Management anticipates earnings per share between $5.71 and $6.22 for fiscal 2024. This indicates an increase from the $5.41 reported in the year-ago period. For the fiscal year, it expects to generate a net income of $318-$346 million.

Approximately $365 million in gross capital expenditure (CapEx), excluding tenant allowances, is expected in fiscal 2024. This budget includes the opening of stores, approximately 200 conversions, the completion of distribution center expansions in Georgia and Arizona, the start of expansion at the Indiana distribution center, and investments in systems and infrastructure.

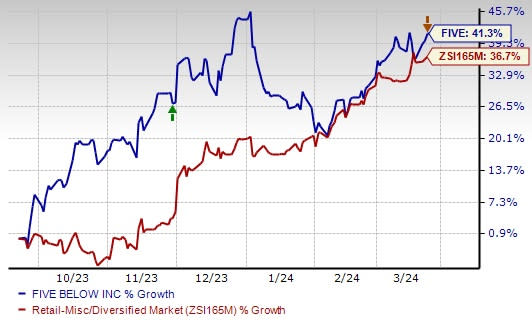

Shares of this Zacks Rank #3 (Hold) company have gained 41.3% in the past six months compared with the industry’s growth of 36.7%.

3 Red-Hot Stocks

A few better-ranked stocks in the same space are Deckers Outdoor Corporation DECK, American Eagle Outfitters Inc. AEO and Abercrombie & Fitch Co. ANF.

Deckers is a leading designer, producer and brand manager of innovative, niche footwear and accessories. It sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Deckers’ current fiscal-year earnings and sales indicates growth of 38.7% and 15.8% from the year-ago period’s reported figures. DECK has a trailing four-quarter average earnings surprise of 32.1%.

American Eagle Outfitters is a specialty retailer of casual apparel, accessories and footwear. It flaunts a Zacks Rank #1 at present.

The Zacks Consensus Estimate for American Eagle Outfitters’ current fiscal-year earnings and sales indicates growth of 12.5% and 3.3% from the year-ago period’s reported figures. AEO has a trailing four-quarter average earnings surprise of 22.7%.

Abercrombie & Fitch is a specialty retailer of premium, high-quality casual apparel. The company currently carries a Zacks Rank #1. ANF has a trailing four-quarter average earnings surprise of 715.6%.

The Zacks Consensus Estimate for Abercrombie & Fitch’s current fiscal-year earnings and sales indicates growth of 19.1% and 5.6% from the year-ago period’s reported figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

Deckers Outdoor Corporation (DECK) : Free Stock Analysis Report

Five Below, Inc. (FIVE) : Free Stock Analysis Report