CNO Financial (CNO) Q2 Earnings Top Estimates, Revenues Up Y/Y

CNO Financial Group, Inc. CNO reported second-quarter 2021 adjusted earnings per share of 66 cents, which outpaced the Zacks Consensus Estimate of 54 cents by 22.2%. The bottom line improved 20% year over year.

The company’s results benefited from higher revenues, deferred care across its health lines and strong alternative investment performances, partly offset by escalating costs.

Total revenues of $1.1 billion rose 5.8% year over year in the quarter under review attributable to improved insurance policy income, increased net investment income, and higher fee revenue and other income.

Quarterly Operational Update

Total insurance policy income inched up 0.8% year over year to $630.5 million in the second quarter.

Net investment income grew 18.9% year over year.

Annuity collected premiums climbed 42% year over year to $344.3 million in the quarter under review.

New annualized premiums for life and health products of $93.8 million advanced 35% from the year-ago period.

Total benefits and expenses increased 6.9% year over year to $971.5 million primarily due to rise in insurance policy benefits.

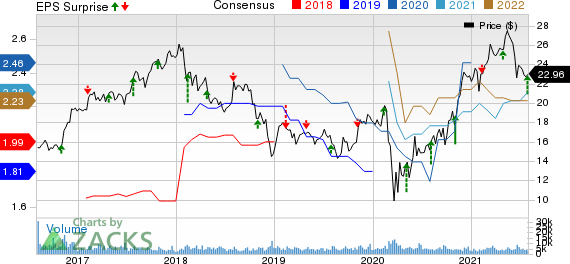

CNO Financial Group, Inc. Price, Consensus and EPS Surprise

CNO Financial Group, Inc. price-consensus-eps-surprise-chart | CNO Financial Group, Inc. Quote

Financial Update

CNO Financial exited the second quarter with unrestricted cash and cash equivalents of $652.5 million, which declined 30.4% from 2020-end level.

Total assets as of Jun 30, 2021 came in at $35.5 billion, which inched up 0.5% from the figure as of Dec 31, 2020.

At June-end, total shareholders’ equity dipped 2.9% from the 2020-end level to $5.3 billion.

Book value per share increased 24% year over year to $41.24 in the second quarter.

As of Jun 30, 2021, debt-to-capital of 17.6% came in higher than the 2020-end figure of 17.2%.

Share Repurchase and Dividend Update

The company rewarded shareholders with share buybacks to the tune of $87.4 million and dividends worth $17.4 million during the second quarter.

Zacks Rank

CNO Financial currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Insurers

Of the insurance industry players, which have reported second-quarter results so far, the bottom lines of Old Republic International Corporation ORI, The Hartford Financial Services Group, Inc. HIG and W. R. Berkley Corporation WRB beat the respective Zacks Consensus Estimate.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Hartford Financial Services Group, Inc. (HIG) : Free Stock Analysis Report

CNO Financial Group, Inc. (CNO) : Free Stock Analysis Report

W.R. Berkley Corporation (WRB) : Free Stock Analysis Report

Old Republic International Corporation (ORI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research