CINF or MKL: Which P&C Insurance Industry Stock Has an Edge?

With another hurricane season already underway, property and casualty insurers are bracing up to weather its impact. The rise in interest rate is indicative of a healthy economy, which along with prudent underwriting, instills confidence for the days ahead.

Colorado State University (CSU) predicts an active Atlantic hurricane season (about 130% of the average season) this year with 19 named storms. These include nine hurricanes and four major hurricanes. Notably, P&C insurers’ profitability is inversely related to catastrophic events. Per a report published by Swiss Re Institute, natural catastrophes accounted for $105 billion of global insured losses, an increase of 17% from the 2020 level.

Continued improvement pricing will drive premium revenues as well as address claims smoothly. Per Willis Towers Watson’s 2022 Insurance Marketplace Realities report, rates will continue to rise but by a small margin. Per Deloitte insights, global non-life premiums are estimated to grow 3.7% in 2022. Exposure growth, prudent underwriting, favorable reserve development and sturdy capital level are other tailwinds that should support P&C insurers.

The interest rate environment has started to improve. The Fed has already made three hikes in 2022. Investment income, an important component of the top line of insurers, is thus poised to improve. The interest rate currently stands at 1.5%-1.75%. Also, an improving rate environment will majorly benefit long-tail property and casualty insurance providers.

Accelerated digitalization with the use of technology like blockchain, artificial intelligence, advanced analytics, telematics, cloud computing and robotic process automation expedite business operations and save costs.

Solid policyholders’ surplus helps the industry absorb losses. Per American Property Casualty Insurance Association and Verisk, private U.S. property/casualty insurers’ policyholders’ surplus was a record of $1.032.5 trillion in 2021. Also, given the solid capital level, insurers are actively pursuing strategic mergers and acquisitions and investing in growth initiatives. These apart, insurers are also increasing dividends, paying out special dividends or buying back shares.

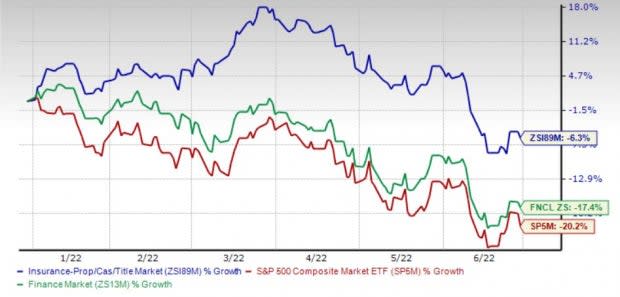

The industry has lost 6.3% year to date compared with the Finance sector’s decrease of 17.4% and the Zacks S&P 500 composite’s decline of 20.2%.

Image Source: Zacks Investment Research

Here we focus on two property and casualty insurers, namely Cincinnati Financial Corporation CINF and Markel Corporation MKL. While Cincinnati Financial, with a market capitalization of $18.9 billion, markets property and casualty insurance globally, Markel with a market capitalization of $17.4 billion, markets and underwrites specialty insurance products in the United States, the United Kingdom, Canada, and internationally. Both the companies carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Let’s now see how these P&C insurers have fared in terms of some of the key metrics.

Price Performance

Markel has risen 4.3% year to date against the industry’s decrease of 6.3%. Cincinnati Financial shares have rallied 3.5%.

Return on Equity (ROE)

Cincinnati Financial has a return on equity of 8.8%, which exceeds Markel’s ROE of 6.3% and the industry average of 5.4%.

Valuation

Price-to-book (P/B) value is the best multiple used for valuing insurers. Compared with Cincinnati Financial’s reading of 1.56, Markel is cheaper, with a reading of 1.29. The P&C insurance industry’s P/B ratio is 1.34.

Dividend Yield

Cincinnati Financial’s dividend yield of 2.3% tops the industry’s average of 0.4%. Markel does not pay dividends.

Debt-to-Equity

Cincinnati Financial’s debt-to-equity ratio of 7.4 is lower than the industry average of 25.3 as well as Markel’s reading of 31.4.

Earnings Surprise History

Cincinnati Financial’s outpaced expectations in each of the four trailing quarters, delivering an earnings surprise of 32.55%, on average. Markel surpassed estimates in two of the last four reported quarters, with the average surprise being negative 1.80%.

Growth Projection

The Zacks Consensus Estimate for 2022 earnings indicates a 23.4% increase from the year-ago reported figure for Markel, while the same for Cincinnati Financial implies a10.3% decline.

VGM Score

VGM Score rates each stock on their combined weighted styles, helping to identify those with the most attractive value, best growth and most promising momentum. Both Cincinnati Financial and Markel have a favorable VGM Score of B.

To Conclude

Our comparative analysis shows that Cincinnati Financial has the edge over Markel with respect to ROE, dividend yield, leverage and earnings surprise history, whereas the latter has an edge in terms of price performance, valuation and growth projection.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cincinnati Financial Corporation (CINF) : Free Stock Analysis Report

Markel Corporation (MKL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research