Why Acadia Healthcare (ACHC) Lost 3% Since Q3 Earnings Release

Shares of Acadia Healthcare Company, Inc. ACHC have lost 2.5% since it reported third-quarter 2022 results on Oct 31. Despite witnessing solid demand for behavioral health services and improved admissions, an elevated expense level, probably resulting from the labor scarcity hounding the entire United States, might have dampened ACHC’s quarterly results.

Acadia Healthcare reported third-quarter 2022 adjusted earnings of 78 cents per share, missing the Zacks Consensus Estimate by 2.5%. The bottom line improved 6.8% year over year.

Total revenues of $666.7 million rose 13.5% year over year in the quarter under review. The top line outpaced the consensus mark by 1.5%.

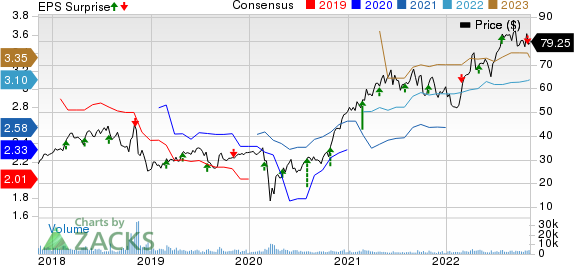

Acadia Healthcare Company, Inc. Price, Consensus and EPS Surprise

Acadia Healthcare Company, Inc. price-consensus-eps-surprise-chart | Acadia Healthcare Company, Inc. Quote

Q3 Operations

Total U.S. same-facility revenues rose 10.2% year over year to $640.3 million. The improvement came on the back of 6.9% growth in revenue per patient day and a 3.1% rise in patient days. Average length of stay increased 2.5% year over year in the third quarter. Admissions inched up 0.6% year over year, while the Zacks Consensus Estimate suggested the metric to witness a 2.5% year-over-year increase.

In the overall U.S. facility, patient days rose 5.3% year over year. Revenue per patient day grew 7.7% year over year in the quarter under review, while admissions increased 5.4% year over year.

Adjusted EBITDA of $162.8 million climbed 14.7% year over year. Adjusted EBITDA margin expanded 30 basis points year over year to 24.4%. Adjusted EBITDA, excluding income from provider relief fund (PRF), ascended 9.3% year over year to $155.1 million in the third quarter.

Total expenses escalated 13.4% year over year to $569.6 million, mainly due to increased salaries, wages and benefits, transaction-related expenses and professional fees.

Acadia Healthcare added 132 beds to its existing operations during the third quarter.

Financial Update (as of Sep 30, 2022)

ACHC exited the third quarter with cash and cash equivalents of $93.4 million, which plunged 30.2% from the 2021-end level. It had $515 million left under its $600-million revolving credit facility at the third-quarter end.

Total assets of $4,943.1 million increased 3.7% from the figure at 2021 end.

Long-term debt amounted to $1,379.3 million, down 6.7% from the figure as of Dec 31, 2021. The current portion of the long-term debt was $21.3 million.

Total equity improved 9% from the 2021-end level to $2,743.7 million. Net leverage ratio came in at 2.1X at the third-quarter end.

During the first nine months ended Sep 30, 2022, net cash provided by operating activities declined 3.5% from the prior-year comparable period’s level to $267 million.

2022 Outlook

Management revised full-year guidance.

Revenues are presently estimated within $2.58-$2.60 billion. The lower end of the altered outlook was raised from the prior outlook of $2.56-$2.60 billion. The mid-point of the adjusted guidance indicates a rise of 12.6% from the 2021 reported figure.

Acadia Healthcare is on course to adding roughly 300 beds to its existing facilities this year. It also remains on track to inaugurate a minimum of six Comprehensive Treatment Centers (CTCs) in 2022.

Adjusted EBITDA, including income from PRF, is anticipated between $611 million and $621 million. The earlier view called for the metric to lie within $591.5-$621.5 million. Adjusted EBITDA, excluding income from PRF, is predicted within $595-$605 million compared with the prior guidance of $583-$613 million.

Adjusted EPS is estimated within $3.00-$3.10. The lower end of the updated outlook was increased from the prior view of $2.93-$3.18, while the higher end was trimmed. The midpoint of the revised guidance indicates an increase of 19.1% from the 2021 reported figure.

Interest expense is anticipated at around $70 million, while the earlier outlook estimated the metric within $67-$70 million.

Operating cash flows for 2022 are expected in the $360-$400 million range, down from the prior view of $380-$430 million.

Capital expenditures for expansion initiatives are predicted to stay between $210 million and $230 million, down from the previous expectation of $240-$280 million. The same for maintenance is projected at around $60 million, up from the prior view of roughly $50 million.

Zacks Rank

Acadia Healthcare currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Medical Sector Releases

Of the Medical sector players that have reported third-quarter results so far, the bottom-line results of Humana Inc. HUM, Molina Healthcare, Inc. MOH and Centene Corporation CNC beat the respective Zacks Consensus Estimate.

Humana reported a third-quarter 2022 adjusted EPS of $6.88, beating the Zacks Consensus Estimate by 10.1%. The bottom line soared 42.4% year over year. HUM’s revenues improved 10.2% year over year to $22,799 million but fell short of the consensus mark by a whisker. Total premiums of Humana amounted to $21,468 million, which grew 8% year over year in the quarter under review.

Molina Healthcare reported third-quarter 2022 adjusted earnings of $4.36 per share, which outpaced the Zacks Consensus Estimate by 2.6%. The bottom line soared 54% year over year. MOH’s total revenues of $7.9 billion rose 12.6% year over year in the quarter under review and beat the consensus mark by a whisker. Premium revenues improved 12% year over year to $7.6 billion in the third quarter.

Centene reported third-quarter 2022 adjusted EPS of $1.30, which outpaced the Zacks Consensus Estimate by 6.6%. The bottom line grew 3.2% year over year. CNC’s revenues of $35.9 billion advanced 11% year over year in the quarter under review and also beat the consensus mark by 1.1%. Premiums of $31.8 billion rose 10.3% year over year in the quarter under review, while service revenues climbed 14.7% year over year to $1.9 billion.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Humana Inc. (HUM) : Free Stock Analysis Report

Molina Healthcare, Inc (MOH) : Free Stock Analysis Report

Centene Corporation (CNC) : Free Stock Analysis Report

Acadia Healthcare Company, Inc. (ACHC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research