SmileDirectClub (SDC) Moves up on New Strategic Actions

SmileDirectClub, Inc. SDC recently unveiled a series of strategic actions to position the company for enhanced business performance and growth. SmileDirectClub closed the session at $1.9900 with a slight gain of 2.05% on Jan 24. Consequent to the announcement, the stock saw an upsurge by adding a further 11.06% in after-hours.

The new strategic steps reflect SmileDirectClub’s commitment to optimize its investments in those plans that are expected to bring sustainable long-term revenue growth, accelerate improved profitability, and right-size the organization to support these programs.

Strategic Actions in Detail

Based on the evaluation of the business and the continued impact of macroeconomic factors on consumers, SmileDirectClub is taking specific strategic steps focused on supporting the key growth initiatives that will generate the highest return on investment.

The planned actions include the expansion of SmileDirectClub Partner Network, innovations for aligner products to capture a greater market share of the teen and higher-household income demographics. The company’s strategic action is also intended to focus on its promising oral care product business and growth of SmileShop in markets with strong consumer demand.

Further, the company’s expansion into new international markets will be paused to allow recovery from the pandemic and macroeconomic pressures. In line with these operational changes, the company announced the suspension of operations in Mexico, Spain, Germany, Netherlands, Austria, Hong Kong, Singapore and New Zealand.

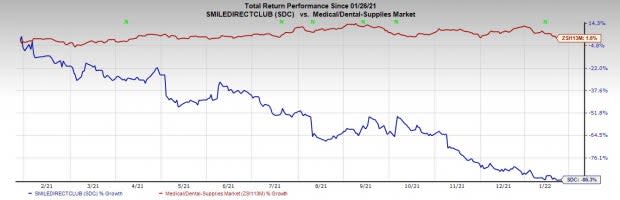

Image Source: Zacks Investment Research

With these operational changes, the company will lay off workforce or alignment with an operating structure tailored to the countries in which the company will continue to operate and focus.

Expected Impact

SmileDirectClub’s expected year-over-year cost and capital savings as a result of the above-mentioned changes and actions are estimated to be around $120 million in 2022. Additionally, a $25 million one-time recognition cost (including lease buyout, asset impairments due to closure of regional operations and few others) is expected between fourth-quarter 2021 and 2022. Out of this, $3 million are expected to be booked in fourth-quarter 2021 and the remaining in 2022.

In addition, the company also affirmed the previously issued guidance of $630-$650 million for full-year 2021 revenues.

Industry Prospects

Going by Fortune Business Insight report, the global oral care market size was $30.91 billion in 2019 and is projected to reach $38.89 billion by 2027, exhibiting a CAGR of 3.1%.

Considering the market opportunities, SmileDirectClub’s efforts to enhance its oral care business are well thought off.

Our Take

SmileDirectClub has been grappling with issues like escalating operating expenses and a leveraged balance sheet. The company is also facing the industry-wide issue of the COVID-19 induced issue of deferral of dental procedures considerably. Under such a situation, the investors seem optimistic about the new strategic plans decided by the company as it is focused on profitability enhancement.

Considering the favorable industry dynamics, we believe these initiatives are the right strategy for the future of SmileDirectClub as it involves right-sizing its cost structure to better support core growth initiatives and allocating capital to countries with the greatest potential for near-term profitability. The recent initiatives taken by SmileDirectClub will further stabilize its balance sheet and will enable the company to have sufficient cash to operate and invest in the business. This will allow the company to innovate continuously and lead the industry to a better oral care solution for all.

Yet, we are concerned that the company’s new strategic actions, including reducing workforce and closure of operations in certain countries, will reduce its global footprint and business network.

Price Performance

Shares of the company have lost 86.3% in a year against the industry's rise of 1.6%.

Zacks Rank and Key Picks

SmileDirectClub currently carries a Zacks Rank #3 (Hold). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

A few better-ranked stocks in the broader medical space that investors can consider are AMN Healthcare Services, Inc. AMN, Henry Schein, Inc. HSIC and West Pharmaceutical Services, Inc. WST.

AMN Healthcare, carrying a Zacks Rank #1, has a long-term earnings growth rate of 16.2%. The company surpassed earnings estimates in the trailing four quarters, delivering a surprise of 19.5%, on average. You can see the complete list of today's Zacks #1 Rank stocks here.

AMN Healthcare has outperformed its industry over the past year. AMN has gained 32.1% versus the 61.6% industry decline.

Henry Schein has an estimated long-term growth rate of 11.8%. HSIC’s earnings surpassed estimates in the trailing four quarters, the average surprise being 21.86%. It currently carries a Zacks Rank #2 (Buy).

Henry Schein has gained 7.6% compared with the industry’s 1.6% rise over the past year.

West Pharmaceutical has a long-term earnings growth rate of 27.6%. West Pharmaceutical surpassed earnings estimates in the trailing four quarters, delivering an average surprise of 29.4%.

West Pharmaceutical has outperformed its industry over the past year. WST currently carries a Zacks Rank of 2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Henry Schein, Inc. (HSIC) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

West Pharmaceutical Services, Inc. (WST) : Free Stock Analysis Report

SmileDirectClub, Inc. (SDC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research