Hedge Funds Are Crazy About EnerSys (ENS)

We at Insider Monkey have gone over 866 13F filings that hedge funds and prominent investors are required to file by the SEC. The 13F filings show the funds' and investors' portfolio positions as of March 31st. In this article, we look at what those funds think of EnerSys (NYSE:ENS) based on that data.

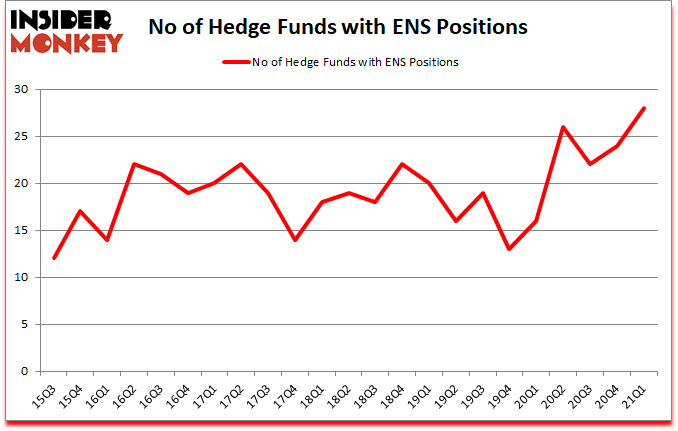

EnerSys (NYSE:ENS) investors should be aware of an increase in enthusiasm from smart money recently. EnerSys (NYSE:ENS) was in 28 hedge funds' portfolios at the end of March. The all time high for this statistic was previously 26. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that ENS isn't among the 30 most popular stocks among hedge funds (click for Q1 rankings).

Hedge funds' reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn't keep up with the unhedged returns of the market indices. Our research has shown that hedge funds' small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by 115 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Cliff Asness of AQR Capital Management

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, economists warn of inflation flare up. So, we are checking out this backdoor gold play that has hit peak gains of 718% in a little over a year. We go through lists like the 10 best battery stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Keeping this in mind let's take a look at the key hedge fund action surrounding EnerSys (NYSE:ENS).

Do Hedge Funds Think ENS Is A Good Stock To Buy Now?

At the end of the first quarter, a total of 28 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 17% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards ENS over the last 23 quarters. With the smart money's positions undergoing their usual ebb and flow, there exists an "upper tier" of notable hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

The largest stake in EnerSys (NYSE:ENS) was held by Hill City Capital, which reported holding $20 million worth of stock at the end of December. It was followed by ACK Asset Management with a $17 million position. Other investors bullish on the company included One Fin Capital Management, AQR Capital Management, and Skylands Capital. In terms of the portfolio weights assigned to each position ACK Asset Management allocated the biggest weight to EnerSys (NYSE:ENS), around 6.77% of its 13F portfolio. Hill City Capital is also relatively very bullish on the stock, designating 6.12 percent of its 13F equity portfolio to ENS.

As industrywide interest jumped, some big names have been driving this bullishness. Engineers Gate Manager, managed by Greg Eisner, created the most valuable position in EnerSys (NYSE:ENS). Engineers Gate Manager had $0.8 million invested in the company at the end of the quarter. Karim Abbadi and Edward McBride's Centiva Capital also made a $0.4 million investment in the stock during the quarter. The other funds with brand new ENS positions are Parvinder Thiara's Athanor Capital, Minhua Zhang's Weld Capital Management, and Jinghua Yan's TwinBeech Capital.

Let's also examine hedge fund activity in other stocks - not necessarily in the same industry as EnerSys (NYSE:ENS) but similarly valued. We will take a look at Umpqua Holdings Corp (NASDAQ:UMPQ), Brighthouse Financial, Inc. (NASDAQ:BHF), Glaukos Corporation (NYSE:GKOS), Spire Inc. (NYSE:SR), New Jersey Resources Corp (NYSE:NJR), Legend Biotech Corporation (NASDAQ:LEGN), and Red Rock Resorts, Inc. (NASDAQ:RRR). This group of stocks' market values match ENS's market value.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position UMPQ,25,245140,2 BHF,28,539727,-5 GKOS,18,47095,5 SR,9,20905,-6 NJR,12,26762,-1 LEGN,12,315484,-1 RRR,28,607053,2 Average,18.9,257452,-0.6 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.9 hedge funds with bullish positions and the average amount invested in these stocks was $257 million. That figure was $120 million in ENS's case. Brighthouse Financial, Inc. (NASDAQ:BHF) is the most popular stock in this table. On the other hand Spire Inc. (NYSE:SR) is the least popular one with only 9 bullish hedge fund positions. EnerSys (NYSE:ENS) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for ENS is 89. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we'd rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 24% in 2021 through July 9th and beat the market again by 6.7 percentage points. Unfortunately ENS wasn't nearly as popular as these 5 stocks and hedge funds that were betting on ENS were disappointed as the stock returned 7.3% since the end of March (through 7/9) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as many of these stocks already outperformed the market since 2019.

Get real-time email alerts: Follow Enersys (NYSE:ENS)

Suggested Articles:

Disclosure: None. This article was originally published at Insider Monkey.