REAL TIME PRICE

EXTENDED HOURS

| Day’s Range | - |

| 52 Week Range | - |

| Mining And Quarrying Of N... | |

JP Morgan Downgrades Martin Marietta Materials (MLM)

Fintel reports that on March 22, 2024, JP Morgan downgraded their outlook for Martin Marietta Materials (NYSE:MLM) from Overweight to Neutral.

Analyst Price Forecast Suggests 2.55% Downside

As of March 10, 2024, the average one-year price target for Martin Marietta Materials is 597.35. The forecasts range from a low of 469.65 to a high of $674.10. The average price target represents a decrease of 2.55% from its latest reported closing price of 612.95.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Martin Marietta Materials is 6,831MM, an increase of 0.79%. The projected annual non-GAAP EPS is 17.89.

Martin Marietta Materials Declares $0.74 Dividend

On February 22, 2024 the company declared a regular quarterly dividend of $0.74 per share ($2.96 annualized). Shareholders of record as of March 4, 2024 will receive the payment on March 28, 2024. Previously, the company paid $0.74 per share.

At the current share price of $612.95 / share, the stock's dividend yield is 0.48%.

Looking back five years and taking a sample every week, the average dividend yield has been 0.77%, the lowest has been 0.49%, and the highest has been 1.53%. The standard deviation of yields is 0.17 (n=233).

The current dividend yield is 1.75 standard deviations below the historical average.

Additionally, the company's dividend payout ratio is 0.16. The payout ratio tells us how much of a company's income is paid out in dividends. A payout ratio of one (1.0) means 100% of the company's income is paid in a dividend. A payout ratio greater than one means the company is dipping into savings in order to maintain its dividend - not a healthy situation. Companies with few growth prospects are expected to pay out most of their income in dividends, which typically means a payout ratio between 0.5 and 1.0. Companies with good growth prospects are expected to retain some earnings in order to invest in those growth prospects, which translates to a payout ratio of zero to 0.5.

The company's 3-Year dividend growth rate is 0.30%, demonstrating that it has increased its dividend over time.

What is the Fund Sentiment?

There are 1657 funds or institutions reporting positions in Martin Marietta Materials.

This is an increase

of

83

owner(s) or 5.27% in the last quarter.

Average portfolio weight of all funds dedicated to MLM is 0.37%,

an increase

of 6.69%.

Total shares owned by institutions increased

in the last three months by 0.15% to 67,408K shares.

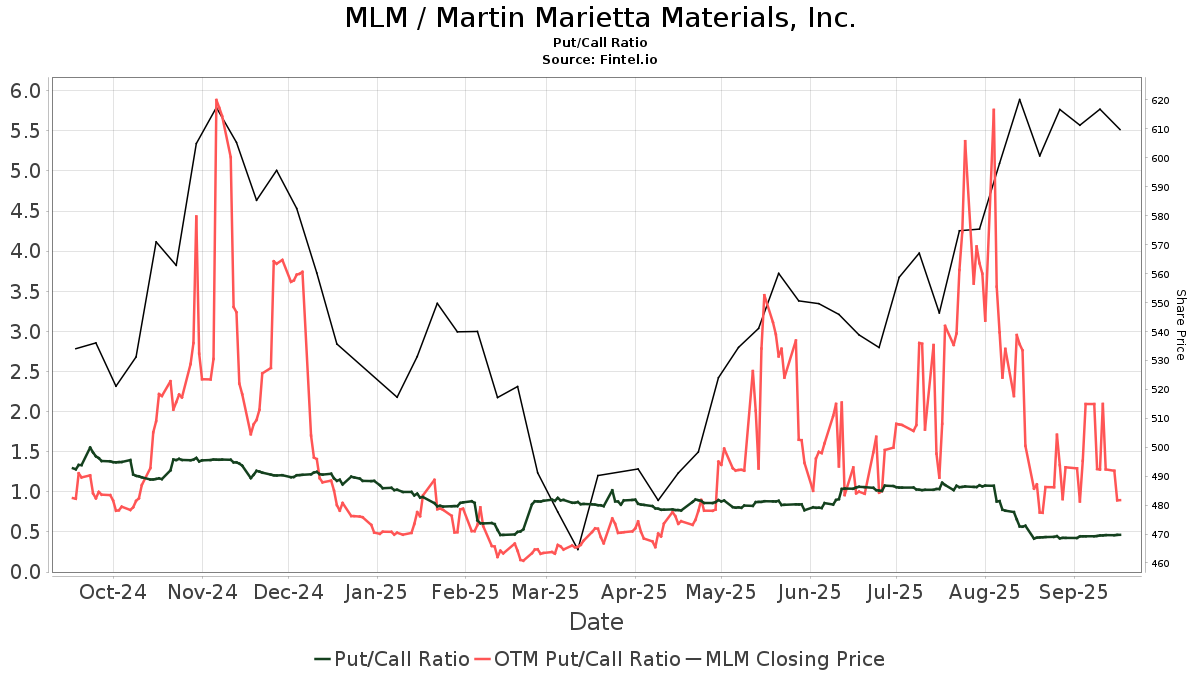

The put/call ratio of MLM is 0.82, indicating a

bullish

outlook.

The put/call ratio of MLM is 0.82, indicating a

bullish

outlook.

What are Other Shareholders Doing?

Aristotle Capital Management holds 2,970K shares representing 4.80% ownership of the company. In it's prior filing, the firm reported owning 3,109K shares, representing a decrease of 4.67%. The firm increased its portfolio allocation in MLM by 5.77% over the last quarter.

Baillie Gifford holds 2,635K shares representing 4.26% ownership of the company. In it's prior filing, the firm reported owning 2,761K shares, representing a decrease of 4.78%. The firm increased its portfolio allocation in MLM by 0.75% over the last quarter.

Select Equity Group holds 2,432K shares representing 3.93% ownership of the company. In it's prior filing, the firm reported owning 2,481K shares, representing a decrease of 1.98%. The firm increased its portfolio allocation in MLM by 3.53% over the last quarter.

Jpmorgan Chase holds 2,109K shares representing 3.41% ownership of the company. In it's prior filing, the firm reported owning 2,043K shares, representing an increase of 3.17%. The firm increased its portfolio allocation in MLM by 9.31% over the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 1,938K shares representing 3.14% ownership of the company. In it's prior filing, the firm reported owning 1,925K shares, representing an increase of 0.70%. The firm increased its portfolio allocation in MLM by 9.39% over the last quarter.

Martin Marietta Materials Background Information

(This description is provided by the company.)

An American-based company and a leading supplier of building materials, Martin Marietta teams supply the resources necessary for building the solid foundations on which our communities thrive.

Stories by George Maybach

Wells Fargo Upgrades Visteon (VC)

Fintel reports that on April 26, 2024, Wells Fargo upgraded their outlook for Visteon (NasdaqGS:VC) from Underweight to Equal-Weight.

Deutsche Bank Downgrades Boyd Gaming (BYD)

Fintel reports that on April 26, 2024, Deutsche Bank downgraded their outlook for Boyd Gaming (NYSE:BYD) from Buy to Hold.

Morgan Stanley Downgrades Mobileye Global (MBLY)

Fintel reports that on April 26, 2024, Morgan Stanley downgraded their outlook for Mobileye Global (NasdaqGS:MBLY) from Equal-Weight to Underweight.

JP Morgan Upgrades Dow (DOW)

Fintel reports that on April 26, 2024, JP Morgan upgraded their outlook for Dow (NYSE:DOW) from Neutral to Overweight.

Stifel Upgrades LeMaitre Vascular (LMAT)

Fintel reports that on April 26, 2024, Stifel upgraded their outlook for LeMaitre Vascular (NasdaqGM:LMAT) from Hold to Buy.

B of A Securities Downgrades Teledyne Technologies (TDY)

Fintel reports that on April 26, 2024, B of A Securities downgraded their outlook for Teledyne Technologies (NYSE:TDY) from Buy to Neutral.

DA Davidson Initiates Coverage of Napco Security Technologies (NSSC) with Buy Recommendation

Fintel reports that on April 26, 2024, DA Davidson initiated coverage of Napco Security Technologies (NasdaqGS:NSSC) with a Buy recommendation.

Morgan Stanley Downgrades Envista Holdings (NVST)

Fintel reports that on April 26, 2024, Morgan Stanley downgraded their outlook for Envista Holdings (NYSE:NVST) from Overweight to Equal-Weight.

B of A Securities Downgrades Hertz Global Holdings (HTZ)

Fintel reports that on April 26, 2024, B of A Securities downgraded their outlook for Hertz Global Holdings (NasdaqGS:HTZ) from Neutral to Underperform.

B of A Securities Upgrades Sonic Automotive (SAH)

Fintel reports that on April 26, 2024, B of A Securities upgraded their outlook for Sonic Automotive (NYSE:SAH) from Underperform to Buy.