Insight Enterprises Inc (NSIT) Achieves Record First Quarter Results, Surpassing Analyst ...

Gross Profit: Increased by 13% year-over-year to $440.9 million, with gross margin expanding by 170 basis points to a record 18.5%.

Net Income: Reported at $67.0 million, up from the previous year, surpassing the estimated $63.57 million.

Earnings Per Share (EPS): Diluted EPS reached $1.74, up 30% year-over-year, slightly below the estimated $1.81.

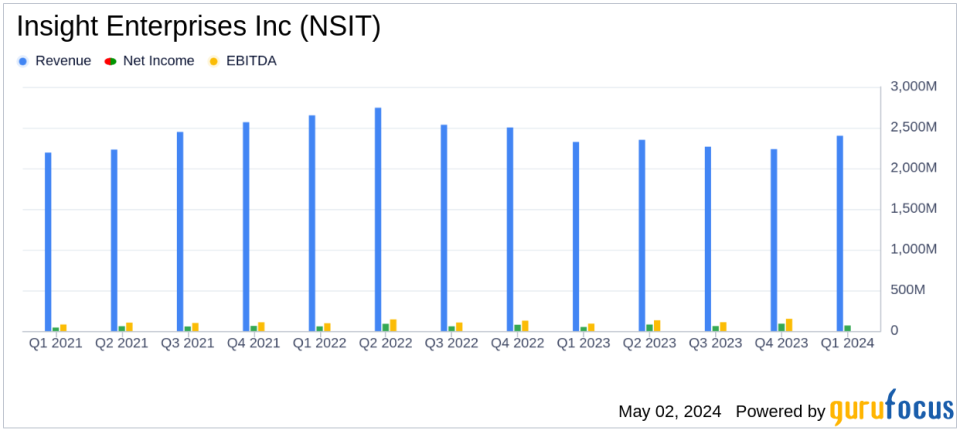

Revenue: Total revenue was $2.4 billion, showing a 2% increase year-over-year, closely aligning with the estimated $2.398 billion.

Segment Performance: Services net sales grew by 17% year-over-year, while product net sales remained flat.

Geographical Insights: North America net sales increased by 4% year-over-year, while EMEA and APAC experienced a decrease in sales.

Adjusted Metrics: Adjusted diluted EPS was $2.37, marking a 33% increase year-over-year and showcasing robust profit growth.

On May 2, 2024, Insight Enterprises Inc (NASDAQ:NSIT) disclosed its financial outcomes for the first quarter ended March 31, 2024, through its 8-K filing. The company reported a notable increase in gross profit by 13% year-over-year, reaching a record $440.9 million. This performance was significantly bolstered by a 170 basis point expansion in gross margin, achieving a first-quarter record of 18.5%. Notably, the company's diluted earnings per share (EPS) of $1.74 and adjusted EPS of $2.37 both marked significant increases from the previous year, surpassing analyst expectations of $1.81 per share.

Insight Enterprises Inc, a Fortune 500 IT provider, operates across three geographic segments: North America, EMEA, and APAC, with the majority of its revenue generated from the North American market. The company specializes in digital innovation, cloud/data center transformation, connected workforce, and supply chain optimization solutions and services.

Financial Highlights and Strategic Achievements

The first quarter of 2024 saw Insight Enterprises Inc achieve several financial records, including highest gross profit and adjusted diluted EPS. The company's net sales increased modestly by 2% year-over-year to $2.4 billion, with a notable 17% increase in services net sales. This growth reflects the company's successful strategic focus on high-margin areas such as cloud and Insight Core services, which saw gross profits grow by 33% and 24% respectively.

President and CEO Joyce Mullen highlighted the disciplined operational expenses and strategic focus as key drivers behind these record results. "We are pleased to announce another record-setting first quarter with very strong performance in our key strategic areas of cloud and Insight Core services, fortified by continued operating expense discipline," Mullen stated.

Segment Performance and Market Challenges

Insight Enterprises Inc reported varied performance across its geographical segments. North America continued to be the stronghold, with a 4% increase in net sales. However, the EMEA and APAC segments faced slight declines. Despite these challenges, the company managed to increase its consolidated earnings from operations significantly by 29% year-over-year to $100.0 million, with adjusted earnings from operations up by 30% to $121.8 million.

The company also provided guidance for the full year of 2024, projecting an adjusted diluted EPS between $10.60 and $10.90 and expecting gross profit growth in the mid to high teens. This guidance reflects the company's confidence in its operational strategy and market position.

Analysis of Financial Statements

Insight Enterprises Inc's balance sheet remains robust, with significant increases in gross profit contributing to a stronger financial position. The income statement reflects healthy growth in revenue and profits, indicating effective cost management and operational efficiency. The cash flow statements suggest that the company is generating sufficient cash to fund operations and strategic initiatives, which is crucial for sustaining growth and shareholder value.

In conclusion, Insight Enterprises Inc's first-quarter performance for 2024 not only surpassed analyst expectations but also set new financial records, underscoring the effectiveness of its strategic focus areas and operational discipline. The company's forward-looking statements suggest a positive outlook for 2024, with continued emphasis on high-margin services and strategic market positioning.

Explore the complete 8-K earnings release (here) from Insight Enterprises Inc for further details.

This article first appeared on GuruFocus.