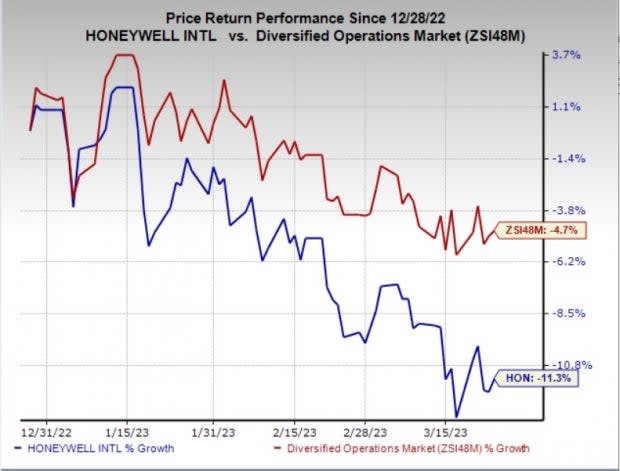

Honeywell (HON) Down 11.3% in 3 Months: What's Ailing it?

Shares of Honeywell International HON have declined 11.3% in the past three months compared with the industry’s decrease of 4.7%. The downside can be attributed to supply-chain woes, cost inflation and weakness in the Safety and Productivity Solutions segment.

Image Source: Zacks Investment Research

Softness in volumes due to supply-chain constraints, particularly related to the availability of semiconductors, has been a drag on HON’s operations. The company expects the Aerospace segment’s first-quarter performance to be suppressed compared to the rest of the quarters due to the effects of supply-chain constraints. Parts shortages are dampening the performance of the Building Technologies segment.

Raw material cost inflation poses a threat to Honeywell’s bottom-line performance. Labor market challenges are also weighing on the company’s operations.

HON has been experiencing persistent weakness in the Safety and Productivity Solutions segment due to lower personal protective equipment and warehouse automation volume. In 2022, sales from the segment declined 12% year over year. The company expects sales from the segment to decline mid-high single digits for 2023 due to the volatile demand environment. Honeywell’s Building Technologies segment is also likely to experience weakness in 2023 due to demand softness in shorter-cycle businesses.

Given Honeywell’s significant international exposure, adverse movements in foreign currencies have also weighed on shares of the company. Foreign exchange headwinds had an adverse impact of 1%, 6%, 4% and 3% on the Aerospace, Honeywell Building Technologies, Performance Materials and Technologies and Safety and Productivity Solutions segments in 2022. The same had an impact of 3% on total sales in the year.

Zacks Rank & Key Picks

Honeywell currently carries a Zacks Rank #3 (Hold).

Here are some better-ranked stocks for your consideration:

Deere & Company DE currently sports a Zacks Rank #1 (Strong Buy). The company pulled off a trailing four-quarter earnings surprise of 4.7%, on average. You can see the complete list of today’s Zacks #1 Rank stocks.

Deere has an estimated earnings growth rate of approximately 31% for the current fiscal year. The stock has gained approximately 12% in the past six months.

Ingersoll Rand IR presently carries a Zacks Rank #2 (Buy). The company delivered a trailing four-quarter earnings surprise of 8.5%, on average.

Ingersoll Rand has an estimated earnings growth rate of approximately 7% for the current year. The stock has rallied around 25% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Honeywell International Inc. (HON) : Free Stock Analysis Report

Deere & Company (DE) : Free Stock Analysis Report

Ingersoll Rand Inc. (IR) : Free Stock Analysis Report