Here's Why Hold Strategy is Apt for Ralph Lauren (RL) Now

Ralph Lauren Corporation RL has been displaying resilience amid a challenging environment, backed by its business strategies, including the Next Great Chapter plan and continued digital momentum. The company has been witnessing continued momentum across all regions, driven by improved assortments, expanded capabilities and marketing efforts. Its robust surprise trend has been bolstering investors' sentiments.

The company has a trailing four-quarter earnings surprise of 86%, on average. The beat streak instills further investor confidence in the stock. In second-quarter fiscal 2022, the company reported the fifth straight earnings beat and the third consecutive revenue surprise. Earnings and revenues also improved year over year.

The results gained from solid performance across all regions, mainly Europe and North America. The Asia region also contributed to quarterly growth, driven by strength in China and Korea. Robust performances in casual bottoms, sweaters and fleece along with high potential in underdeveloped categories — particularly denim, accessories and home — bode well.

In the past 30 days, estimates for the company's fiscal 2022 and 2023 earnings per share have moved up 4.1% and 1.4%, respectively. For fiscal 2022, RL's earnings estimates stand at $7.32 per share, suggesting growth of 330.6% from the year-ago reported figure.

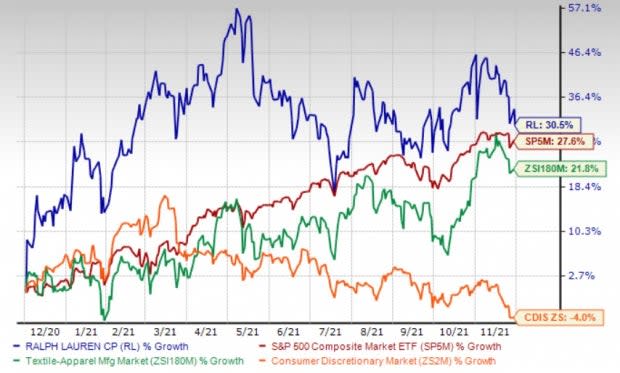

Shares of the Zacks Rank #3 (Hold) company have rallied 30.5% in the past year compared with the industry's growth of 21.8%. It also compares favorably against the Consumer Discretionary sector's decline of 4% and the Zacks S&P Composite's growth of 27.6%.

Image Source: Zacks Investment Research

Factors Supporting Growth

Ralph Lauren has been making significant progress in expanding digital and omni-channel capabilities through investments in mobile, omni-channel and fulfillment. In second-quarter fiscal 2022, the digital business continued to be a key growth driver, with accelerated digital sales across all regions. The global digital ecosystem sales advanced 45%, while owned digital e-commerce rose more than 35% year over year despite the gradual return of traffic to stores.

The company's digital investments continue to remain focused on creating content for all platforms, enhancing digital capabilities to improve the user experience, and continuing to leverage Artificial Intelligence (AI) and data management to serve its consumers more efficiently.

In the fiscal second quarter, the company, in association with Zepeto, launched its first digital apparel collection. It also introduced the exclusive Next-Generation-focused capsules for Urban Outfitters and ASOS as well as a new Ralph's Club fragrance. Ralph Lauren started its second digital-forward Emblematic retail concept in Shanghai.

Ralph Lauren is also on track to exceed its top and bottom-line targets under the "Next Great Chapter" plan announced in June 2018. Later, it announced measures to accelerate its "Next Great Chapter plan," which includes creating a simplified global organizational structure and rolling out improved technological capabilities. As part of the plan, RL completed the transition of Chaps to a licensed business, thus, concluding its portfolio realignment announced last year. The move will likely enable Ralph Lauren to focus on core brands as part of the Next Great Chapter elevation strategy.

The company envisions delivering low to mid-single-digit revenue compounded annual growth rate (CAGR) and a mid-teen operating margin by fiscal 2023 in constant currency. It anticipates marketing spend growth of 5% of revenues by fiscal 2023, while capital expenditure is expected to represent 4-5% of revenues. The company plans to return 100% free cash flow to shareholders in the next five years, amounting to $2.5 billion on a cumulative basis through fiscal 2023 in the forms of dividends and share repurchases.

Backed by the impressive second-quarter fiscal 2022 results and signs of recovery across all markets, Ralph Lauren raised its fiscal 2022 view. The company expects constant-currency revenue growth of 34-36% for fiscal 2022, up from the earlier mentioned 25-30%. The operating margin is anticipated to be 12-12.5% compared with 4.8% and 10.3% reported in fiscal 2021 and 2020, respectively. The gross margin is still envisioned to expand 50-70 bps, driven by average unit retail growth and positive product mix, which are expected to more than offset higher freight costs.

For third-quarter fiscal 2022, revenues are anticipated to rise 14-16% year over year at constant currency, with a favorable currency impact of 140 bps. The operating margin is forecast to be 13-13.5%, with a slight expansion in the gross margin. This is mainly due to the shift in the timing of investments from the fiscal second quarter to the third, higher freight costs, normalizing of the channel mix shift and foreign-currency headwinds of 30 bps.

Roadblocks Ahead

Ralph Lauren continues to witness elevated marketing expenses, owing to the reactivation of in-person activities, and high-impact digital campaigns and personalization. In second-quarter fiscal 2022, marketing investments surged 83% year over year. Marketing investments rose 27% from second-quarter fiscal 2020 due to customer acquisitions and digital brand campaigns.

RL expects marketing investments to remain elevated in fiscal 2022, at nearly 6% of sales, to support consumer engagement, acquisition and long-term brand-building initiatives. Adjusted operating expenses increased 17% from the year-ago period to $755 million for the fiscal second quarter, driven by compensation and higher marketing investments. Operating expenses are likely to be higher in the second half of fiscal 2022 due to increased marketing and other investments.

The company is also witnessing higher freight costs, which are weighing on the gross margin performance. In second-quarter fiscal 2022, the adjusted gross margin included freight headwinds of roughly 150 bps. Although Ralph Lauren provided a robust margin view for fiscal 2022, it expects margins to be offset by the persistence of certain costs, including global supply-chain pressures, higher freight costs and marketing investments.

The company's gross margin view for fiscal 2022 includes slightly higher freight headwinds of 130-150 bps versus the previously mentioned 100-120 bps. This is likely to partly offset gross margin growth. RL predicts higher freight costs for the second half of fiscal 2022 and normalizing of the channel mix shift compared with last year's COVID disruptions. RL also expects the highly volatile and inflationary input cost environment to continue in fiscal 2022.

Stocks to Watch

We have highlighted some better-ranked stocks from the same industry, namely Guess GES, Delta Apparel DLA and Gildan Activewear GIL.

Guess currently sports a Zacks Rank #1 (Strong Buy). The company has a trailing four-quarter earnings surprise of 97%, on average. Shares of GES have surged 33.6% in the past year.

You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Guess' current financial-year sales suggests growth of 38.6% and the same for earnings per share reflects substantial growth from the year-ago period's reported figure.

Delta Apparel, a Zacks Rank #1 stock at present, has a trailing four-quarter earnings surprise of 95.5%, on average. The DLA stock has gained 38.2% in a year's time.

The Zacks Consensus Estimate for Delta Apparel's current financial-year sales and earnings per share suggests growth of 11.6% and 9.4%, respectively, from the year-ago period's reported numbers.

Gildan Activewear currently flaunts a Zacks Rank #1. The company has a trailing four-quarter earnings surprise of 85%, on average. Shares of GIL have gained 52.2% in the past year.

The Zacks Consensus Estimate for Gildan Activewear's current financial-year sales suggests growth of 43.6% and the same for earnings per share reflects substantial growth from the year-ago period. GIL has an expected long-term earnings growth rate of 9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ralph Lauren Corporation (RL) : Free Stock Analysis Report

Guess, Inc. (GES) : Free Stock Analysis Report

Gildan Activewear, Inc. (GIL) : Free Stock Analysis Report

Delta Apparel, Inc. (DLA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research