What Type Of Returns Would Western Areas'(ASX:WSA) Shareholders Have Earned If They Purchased Their Shares Three Years Ago?

For many investors, the main point of stock picking is to generate higher returns than the overall market. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. We regret to report that long term Western Areas Limited (ASX:WSA) shareholders have had that experience, with the share price dropping 34% in three years, versus a market return of about 32%. There was little comfort for shareholders in the last week as the price declined a further 1.7%.

View our latest analysis for Western Areas

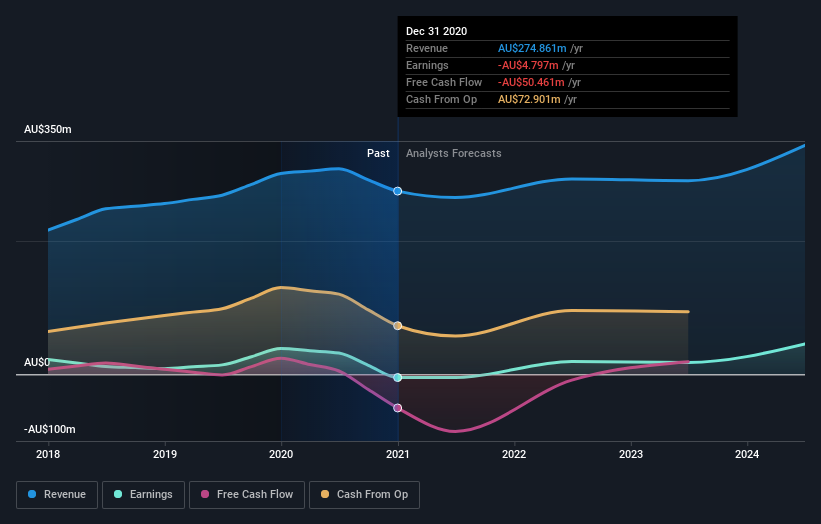

Because Western Areas made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over three years, Western Areas grew revenue at 9.4% per year. That's a fairly respectable growth rate. Shareholders have seen the share price fall at 10% per year, for three years. So the market has definitely lost some love for the stock. With revenue growing at a solid clip, now might be the time to focus on the possibility that it will have a brighter future.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Western Areas is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. You can see what analysts are predicting for Western Areas in this interactive graph of future profit estimates.

A Different Perspective

Western Areas shareholders are down 15% for the year, but the market itself is up 27%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 2% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Western Areas , and understanding them should be part of your investment process.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.