2 Food Stocks to Buy on Rising Earnings Estimates

Rising earnings estimate revisions are one of the primary catalysts in the upward movement of stocks. For consumer food companies, it’s also a strong sign that consumption is increasing.

Food consumption will always be necessary, making many food-producing companies very viable investments. Here is a look at two such stocks that investors should consider buying right now.

General Mills (GIS)

With a Zacks Rank #2 (Buy) General Mills is a global manufacturer and marketer of branded foods that investors will want to consider. General Mills' Food – Miscellaneous Industry is also in the top 30% of over 250 Zacks Industries.

There will continue to be an essential need for many of General Mills’ principal product categories, which include ready-to-eat cereals, convenient meals, snacks, premium ice cream, baking mixes, and ingredients.

Following its most recent and positive fiscal second-quarter results in December, General Mills also increased its full-year outlook for organic net sales, adjusted operating profit, and adjusted diluted EPS growth.

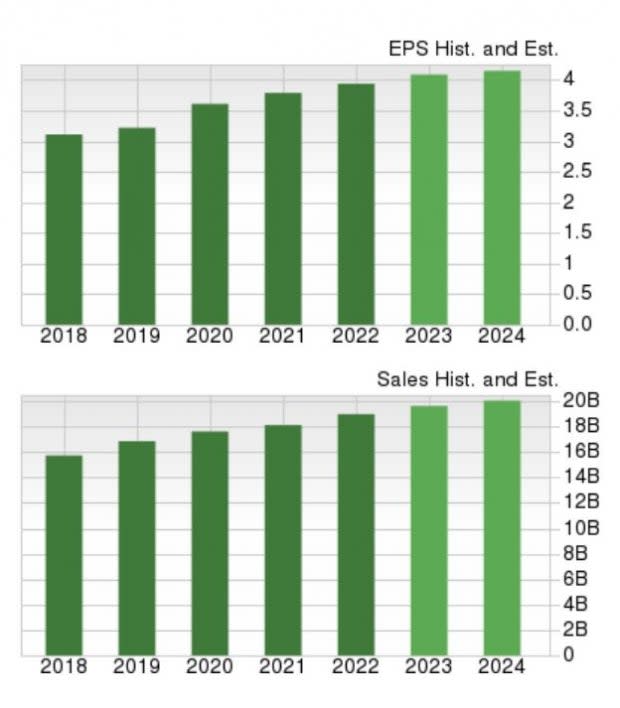

Image Source: Zacks Investment Research

To that point, earnings estimate revisions have continued to trend higher for General Mills’ fiscal 2023 and have started to go up for FY24 again. Earnings are now expected to be up 6% this year and rise another 5% in FY24 at $4.39 per share.

On the top line, sales are forecasted to rise 5% in FY23 and edge up another 3% in FY24 to $20.56 billion. More importantly, fiscal 2024 sales would represent 22% growth from pre-pandemic levels with 2019 sales at $16.86 billion.

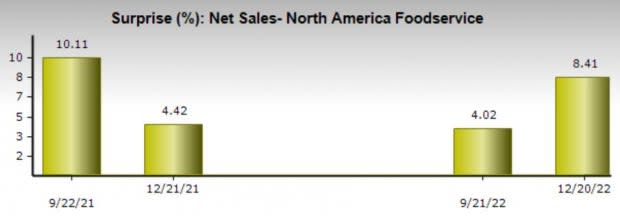

Image Source: Zacks Investment Research

General Mills’ growth has been very steady making GIS a reliable stock to keep in the portfolio. Plus, the growth of General Mills’ North America Foodservice Segment is very intriguing with net sales increasing 22% over the last six months.

The boost is largely attributed to the addition of TNT Crust, a Green Bay Wisconsin-based manufacturer of high-quality frozen pizza crusts for regional and national pizza chains that General Mills acquired last June.

Image Source: Zacks Investment Research

Last quarter, CEO Jeff Harmening stated amid ongoing volatility in the operating environment the company remains focused on driving their Accelerate strategy by investing in brand building and innovation, strengthening capabilities, and continuing to reshape its portfolio.

Notably, outside of TNT crust, General Mills also acquired Tyson Foods’ (TSN) pet treat business last year to continue diversifying into the pet food market after entering the space in 2018. As General Mills continues to widen its business breadth this year’s small drop in GIS stock is starting to look like a buying opportunity.

Year to date General Mills stock is down -6% near the Food-Miscellaneus Markets -5% and underperforming the S&P 500’s +3%. However, over the last three years, GIS stock is still up +53% to easily top the benchmark and its Zacks Subindustry’s +15% with Tyson Foods stock as a broader Consumer Staples example down -14%.

Image Source: Zacks Investment Research

Hershey (HSY)

As the largest chocolate manufacturer in North America, The Hershey Company is very attractive at the moment with its stock sporting a Zacks Rank #1 (Strong Buy).

Hershey’s Food – Confectionery Industry is currently in the top 6% of all Zacks Industries. While chocolate consumption may not seem like a necessity the earnings estimate revisions speak for themselves and indicate demand is higher.

Plus, Hershey is a leader in chocolate and non-chocolate confectionary and also manufactures important pantry items like baking ingredients, toppings, beverages, mixes, and spreads among others.

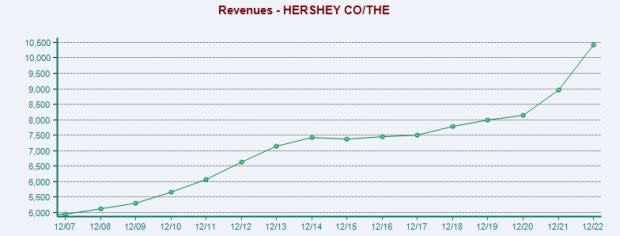

Image Source: Zacks Investment Research

Throughout the quarter, Hershey’s fiscal 2023 and FY24 EPS estimates have gone up 4% and 6% respectively. Earnings are now projected to jump 10% this year and rise another 8% in FY24 at $10.14 per share. Sales are forecasted to be up 8% in FY23 and rise another 3% in FY24 to $11.64 billion. Impressively, Fiscal 2024 would represent 45% growth from pre-pandemic levels with 2019 sales at $7.98 billion.

Image Source: Zacks Investment Research

This is on top of 2022 delivering what Hershey said was one of its strongest years in history despite inflation, supply chain disruptions, and macroeconomic uncertainty for many consumers. Hershey highlighted during its Q4 report on February 2 that it ended the year with consolidated net sales up 14% to $2.65 billion along with net income increasing 18.5% at $396.3 million.

Hershey stock is up +14% over the last year to largely outperform the S&P 500’s -11% and slightly top the Food-Confectionery Markets +13%. Even better, in the last three years Hershey’s +55% has easily beaten the benchmark and is just above its Zacks Subindustry’s +54%.

Image Source: Zacks Investment Research

Bottom Line

Both General Mills and The Hershey Company are staples of American society and are conglomerates among global food consumption as well. This looks likely to continue in the years to come. The rising earnings estimate revisions are a great sign that both General Mills and Hershey’s stock could build on their very strong performances over the last few years and be a cornerstone in investors’ portfolios.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hershey Company (The) (HSY) : Free Stock Analysis Report

General Mills, Inc. (GIS) : Free Stock Analysis Report

Tyson Foods, Inc. (TSN) : Free Stock Analysis Report